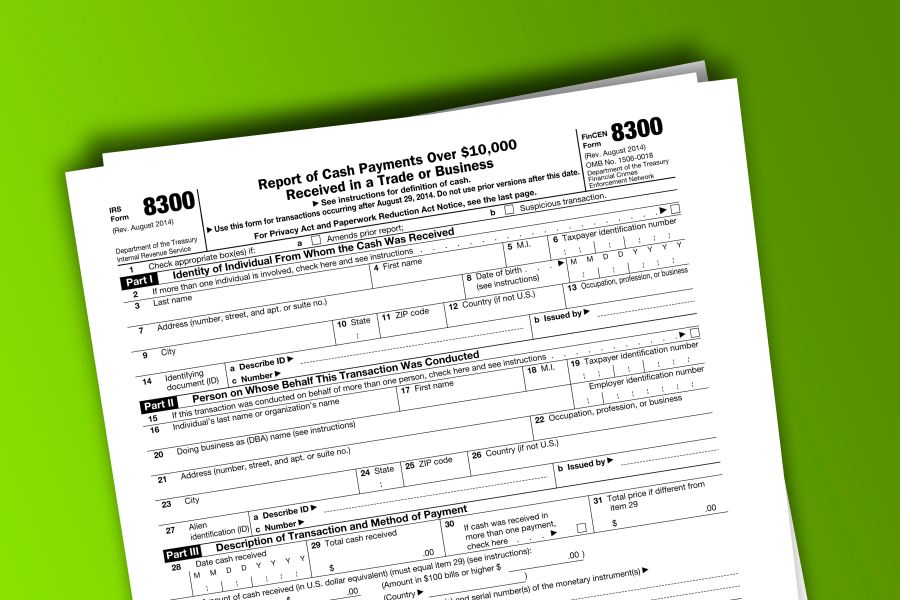

Does your business receive large amounts of cash or cash equivalents? If so, you’re generally required to report these transactions to the IRS — and not just on your tax return. The requirements Each person who, in the course of operating a trade or business, receives more than $10,000 in cash in one transaction (or two or more related transactions), must file Form 8300. Who is a “person”? It can be an individual, company, corporation, partnership, association, trust or estate. What are considered “related transactions”? Any transactions conducted in a 24-hour period. Transactions can also be considered related even if they occur over a period of more than 24 hours if the recipient knows, or has reason to know, that each transaction is one of a series...

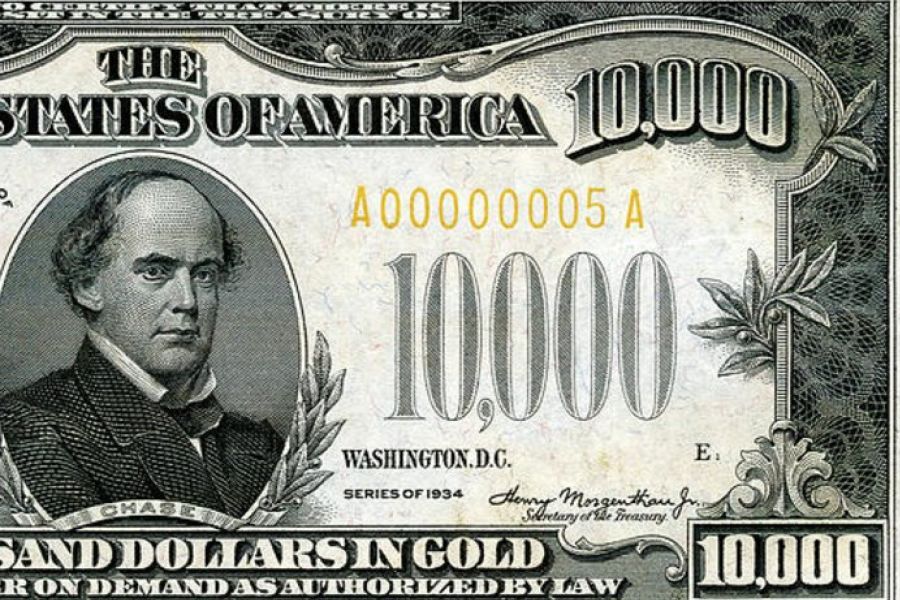

As reported in IRS News Release IR-2023-157 The Internal Revenue Service announced that starting 1/1/2024, businesses are required to electronically file (e-file) Form 8300, Report of Cash Payments Over $10,000, instead of filing a paper return. This new requirement follows final regulations amending e-filing rules for information returns, including Forms 8300. Businesses that receive more than $10,000 in cash must report transactions to the U.S. government. Although many cash transactions are legitimate, information reported on Forms 8300 can help combat those who evade taxes, profit from the drug trade, engage in terrorist financing or conduct other criminal activities. The government can often trace money from these illegal activities through payments reported on Forms 8300 that are timely filed, complete and accurate. The new requirement for e-filing Forms 8300...

If your business receives large amounts of cash or cash equivalents, you may be required to report these transactions to the IRS. What are the requirements? Each person who, in the course of operating a trade or business, receives more than $10,000 in cash in one transaction (or two or more related transactions), must file Form 8300. What is considered a “related transaction?” Any transactions conducted in a 24-hour period. Transactions can also be considered related even if they occur over a period of more than 24 hours if the recipient knows, or has reason to know, that each transaction is one of a series of connected transactions. To complete a Form 8300, you’ll need personal information about the person making the cash payment, including a Social Security...

The Internal Revenue Service recently reminded businesses (in News Release 2021-47) of their responsibility to report large cash transactions via the filing of Form 8300, Report of Cash Payments Over $10,000, and encourages e-filing to help them file accurate, complete forms. Although many cash transactions are legitimate, information reported on Form 8300 can help stop those who evade taxes, profit from drug trading, engage in terrorist financing and conduct other criminal activities. The government can often trace money from these illegal activities through payments reported on complete, accurate forms. To help businesses prepare and file reports, the IRS created a video on How to Complete Form 8300 – Part I, Part II. The short video points out sections of Form 8300 for which the IRS commonly finds...

Does your business receive large amounts of cash or cash equivalents? You may be required to begin filing cash transaction reports with the IRS to report these transactions. Filing requirements Each person engaged in a trade or business who, in the course of operating, receives more than $10,000 in cash in one transaction, or in two or more related transactions, must file Form 8300. Any transactions conducted in a 24-hour period are considered related transactions. Transactions are also considered related even if they occur over a period of more than 24 hours if the recipient knows, or has reason to know, that each transaction is one of a series of connected transactions. To complete a Form 8300, you will need personal information about the person making the cash...

(Image copyright belongs to Serge Averbukh) In Fact Sheet 2020-11, the IRS has presented a series of examples where a person might have to file Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. Background Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file a Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. A "person" is an individual, company, corporation, partnership, association, trust or estate. A person must file Form 8300 if they receive cash of more than $10,000 from the same payer or agent: in one lump sum; in two or more related payments within 24 hours, e.g., a 24-hour period is...

(This is Blog Post #743)...