The Coronavirus Aid, Relief, and Economic Security (CARES) Act signed by President Trump on 3/27/2020 provides a variety of tax and financial relief measures to help Americans during the Coronavirus (COVID-19) pandemic. This post explains some of the CARES Act tax relief for individuals. Individual cash payments Under the new law, an eligible individual will receive a cash payment equal to the sum of: $1,200 ($2,400 for eligible married couples filing jointly) plus $500 for each qualifying child. Eligibility is based on adjusted gross income (AGI). Individuals who have no income, as well as those whose income comes entirely from Social Security benefits, are also eligible for the payment. The AGI thresholds will be based on 2019 tax returns, or 2018 returns if you haven’t yet filed your 2019...

On 3/27/20, President Trump signed into law another coronavirus (COVID-19) law. The CARES Act provides more tax relief for businesses employers. Here are some of the tax-related provisions in the Coronavirus Aid, Relief, and Economic Security Act. Employee retention credit The new law provides a refundable payroll tax credit for 50% of wages paid by eligible employers to certain employees during the COVID-19 crisis. Employer eligibility. The credit is available to employers with operations that have been fully or partially suspended as a result of a government order limiting commerce, travel or group meetings. The credit is also provided to employers that have experienced a greater than 50% reduction in quarterly receipts, measured on a year-over-year basis. The credit isn’t available to employers receiving Small Business Interruption Loans under...

As governments around the globe mobilize to defend their populations from the novel coronavirus, criminals are also mobilizing — using COVID-19 to fleece Americans. These opportunists have already found ways to use the fear and chaos associated with the pandemic to enrich themselves. But you can protect yourself and your business. Ripe opportunity Phishing emails that promise valuable information about the virus have been circulating for weeks. Fake COVID-19 websites loaded with malware have also popped up everywhere. And as many Americans start working from home, often on vulnerable home networks and devices that lack the latest security updates, hacking incidents are becoming more common. The federal government’s plan to send checks to Americans to help boost the economy will almost certainly bring scammers out in force. The...

The IRS and Congress have responded with some Coronavirus tax relief for individuals. Taxpayers now have more time to file their tax returns and pay any tax owed because of the coronavirus (COVID-19) pandemic. The Treasury Department and IRS announced that the federal income tax filing due date is automatically extended from April 15, 2020, to July 15, 2020. Taxpayers can also defer making federal income tax payments, which are due on April 15, 2020, until July 15, 2020, without penalties and interest, regardless of the amount they owe. This deferment applies to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate tax filers as well as those who pay self-employment tax. They can also defer their initial quarterly estimated federal income tax payments...

Businesses across the country are being affected by the worldwide pandemic. Fortunately, Congress recently passed Coronavirus tax relief for small businesses. In a separate development, the IRS has issued guidance allowing taxpayers to defer any amount of federal income tax payments due on April 15, 2020, until July 15, 2020, without penalties or interest. New law On March 18, the Senate passed the House's Coronavirus bill, the Families First Coronavirus Response Act. President Trump signed the bill that day. It includes: Paid leave benefits to employees, Tax credits for employers and self-employed taxpayers, and FICA tax relief for employers. Tax filing and payment extension In Notice 2020-18, the IRS provides relief for taxpayers with a federal income tax payment due April 15, 2020. The due date for making federal income...

As posted to the Peak Prosperity YouTube Channel on March 15, 2020 (Run time: 45 min 07 sec) In today's update, on the Wuhan New Coronavirus (aka "Covid-19"), Chris Martenson reports: "As the number of Covid-19 infections outside China now exceed those within, the masses across the world are starting to panic. Empty grocery store shelves. Fights over toilet paper. Schools closing and sending students home en mass. Desperate pleas from health workers to stay home when sick unless in truly dire condition. And this with just 170,000 total worldwide cases (that we know of). Now, just imagine what the fear factor will be like when that number is 1.7 million. Or 17 million. Or 170 million. Or (and this is possible) 1.7 billion. Chris predicts that more national...

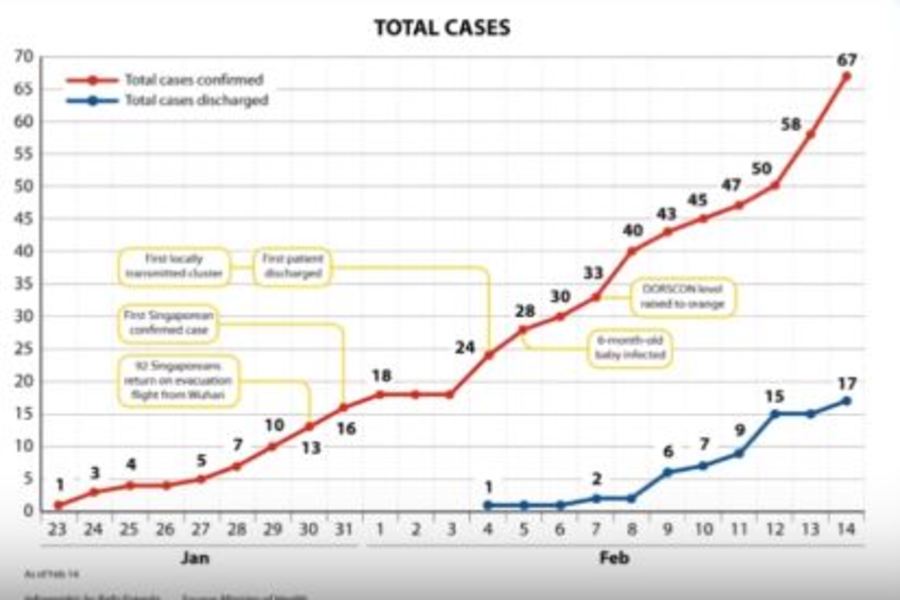

As posted to the Peak Prosperity YouTube Channel on February 19, 2020 (Run time: 35 min 32 sec) In Update #26, on the Wuhan New Coronavirus (now officially "Covid-19"), Chris Martenson reports: "The world is now watching closely to see if the Coronavirus is indeed poised to accelerate outside of China. In yesterday's video, we warned that the coming two weeks will be crucial in determining how bad the pandemic will be. The early results are not encouraging. New cases continue to climb in the rest of Asia -- Japan, Korea and Singapore are being hit hardest. And now we have the first two cases (and two deaths!) reported in Iran. That's on top of last week's confirmed case in Africa. So now the virus is on every continent...

As posted to the Peak Prosperity YouTube Channel on February 18, 2020 (Run time 25 min 53 sec) In Update #25, on the Wuhan New Coronavirus (now officially "Covid-19"), Chris Martenson reports: "While China remains largely in lock down, Covid-19 cases in the rest of the world are at a key juncture. To-date, confirmed cases have been lower than feared. Though increasingly, we're suspecting that's due to inadequate testing & reporting. And the cases we *do* know of (now at ~1,000) appear to be growing at an exponential rate. So the next two weeks will be critical in telling the tale. We'll soon know whether the spread is indeed slower than initially feared, or we'll start to see huge increases in the number of infected ex-China. Meanwhile, the authorities around...

As posted to the Peak Prosperity YouTube Channel on February 17, 2020 (Run time 39 min 33 sec) In Update #24, on the Wuhan New Coronavirus (now officially "Covid-19"), Chris Martenson reports: "Good updates on the Wuhan Coronavirus pandemic (aka Covid-19) are becoming harder to obtain as governments tighten their grip on news sources. The data being shared, particularly by the Chinese are increasingly hard to believe, as they don't match the massive response the government is undertaking. Likewise, outside of China, reported cases remain lower than we would expect given the powerful R0 (i.e., infectiousness) of the virus, as well as its long asymptomatic incubation period. Are we being intentionally kept in the dark? Quite possibly. Chris walks through the possible reasons why, and points to the stock markets...

As posted to the Peak Prosperity YouTube Channel on February 15, 2020 (Run time 19 min 39 sec) In Update #23, on the Wuhan New Coronavirus (now officially "Covid-19"), Chris Martenson reports: "Finally, some good news? While the Coronavirus continues its spread throughout China and elsewhere in the world (we now have the first confirmed case in Africa), we are hearing about an encouraging development on the treatment front. Chinese hospitals are reporting success treating severely sick patients with the blood plasma of those who have recently recovered. At least 11 patients treated this way went from 'critically ill' to much improved in just 24 hours. This is not an uncommon form of treatment, so it's a process the medical establishment knows how to successfully replicate. The big questions now...