The COVID-19 pandemic has put unprecedented stress on private business owners. Some are now considering selling their businesses. Before putting your business on the market, it’s important to prepare it for sale. Here are six steps to consider. Clean up the financials Buyers are most interested in an acquisition target’s core competencies, and they usually prefer a clean, simple transaction. Consider buying out minority investors who could object to a deal and removing nonessential items from your balance sheet. Examples of items that could complicate a sale include underperforming segments, non-operating assets and shareholder loans. Sales are often based on multiples of earnings or earnings before interest, taxes, depreciation and amortization (EBITDA). Do what you can to maximize your bottom line. That includes cutting extraneous expenses...

Are you planning to launch a business or thinking about changing your business entity? If so, you need to determine which entity will work best for you — a C corporation or a pass-through entity such as a sole-proprietorship, partnership, limited liability company (LLC) or S corporation. There are many factors to consider and proposed federal tax law changes being considered by Congress may affect your decision. The corporate federal income tax is currently imposed at a flat 21% rate, while the current individual federal income tax rates begin at 10% and go up to 37%. The difference in rates can be mitigated by the qualified business income (QBI) deduction that’s available to eligible pass-through entity owners that are individuals, estates and trusts. Note that non-corporate taxpayers...

If your business is depreciating over a 30-year period the entire cost of constructing the building that houses your operation, you should consider a cost segregation study. It might allow you to accelerate depreciation deductions on certain items, thereby reducing taxes and boosting cash flow. And under current law, the potential benefits of a cost segregation study are now even greater than they were a few years ago due to enhancements to certain depreciation-related tax breaks. Fundamentals of depreciation Generally, business buildings have a 39-year depreciation period (27.5 years for residential rental properties). Usually, you depreciate a building’s structural components, including walls, windows, HVAC systems, elevators, plumbing and wiring, along with the building. Personal property — such as equipment, machinery, furniture and fixtures — is eligible for...

As posted to the Naomi Brockwell YouTube Channel on 6/21/21 (Run Time: 12 min, 48 sec) In this informative video from her Privacy Series, Naomi Brockwell compares the most popular e-mail options available to help you make an informed decision as to which will work best for your personal situation. The author's outline of the clip on YouTube is as follows: E-mail remains an essential backbone of internet communication, with over 4 billion users worldwide. But is it private? Actually it's inherently insecure. Furthermore, the vast majority of users rely on free online email services. Did you know that they use AI algorithms to scan your emails in order to learn more about you? Or that emails are stored in the clear, meaning in the event of a hack,...

Background Businesses are having difficulties hiring an adequate number of employees as the economy resets after the COVID-19 lockdowns and their aftermath. As such, small businesses are having to think outside the box as they work toward locating amenable workers. If your small business hires a "targeted group" member, you are afforded the ability to claim the lucrative federal Work Opportunity Tax Credit (WOTC) for a portion of wages paid to such an individual. CAA 2021 Changes Within the Consolidated Appropriations Act of 2021 (signed into law on 12/27/20) was the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (TCDTRA 2020). TCDTRA 2020 extended the WOTC to cover qualified first-year wages paid to eligible new hires who begin work by 12/31/25. This means that the hiring and paying...

Low interest rates and other factors have caused global merger and acquisition (M&A) activity to reach new highs in 2021, according to Refinitiv, a provider of financial data. It reports that 2021 is set to be the biggest in M&A history, with the United States accounting for $2.14 trillion worth of transactions already this year. If you’re considering buying or selling a business — or you’re in the process of an M&A transaction — it’s important that both parties report it to the IRS and state agencies in the same way. Otherwise, you may increase your chances of being audited. If a sale involves business assets (as opposed to stock or ownership interests), the buyer and the seller must generally report to the IRS the purchase...

If you use an automobile in your trade or business, you may wonder how depreciation tax deductions are determined. The rules are complicated, and special limitations that apply to vehicles classified as passenger autos (which include many pickups and SUVs) can result in it taking longer than expected to fully depreciate a vehicle. Cents-per-mile vs. actual expenses First, note that separate depreciation calculations for a passenger auto only come into play if you choose to use the actual expense method to calculate deductions. If, instead, you use the standard mileage rate (56 cents per business mile driven for 2021), a depreciation allowance is built into the rate. If you use the actual expense method to determine your allowable deductions for a passenger auto, you must make a separate depreciation...

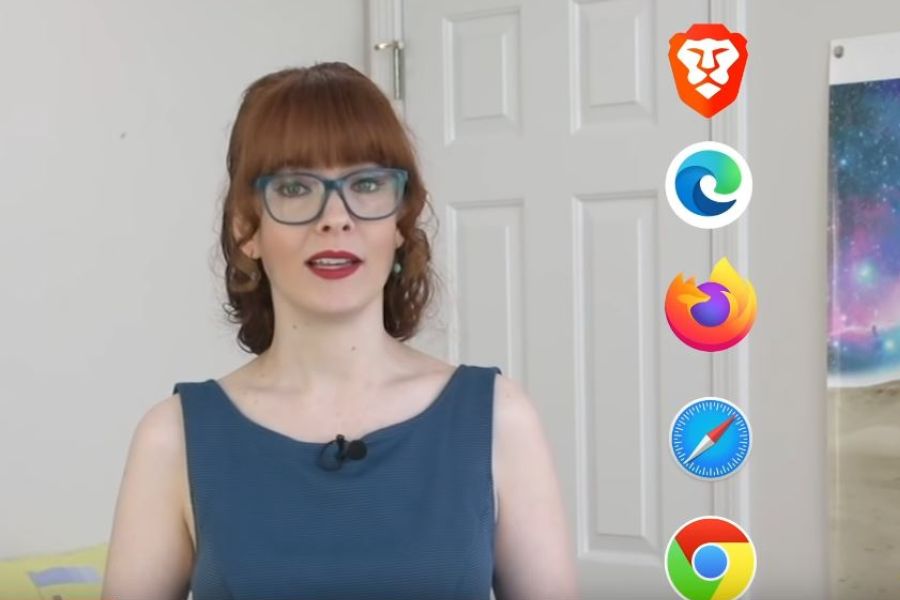

As posted to the Naomi Brockwell YouTube Channel on 4/30/21 (Run Time: 8 min, 13 sec) In this informative video from her Privacy Series, Naomi Brockwell compares the most popular browser options available to help you make an informed decision as to which will work best for your personal situation. With web browsers being your interface to the Internet, it is not surprising that they become the target of companies or hackers who want to collect information about you. In addition to websites being able to track you, browsers themselves can also send back information about you to the browser’s parent company for them to monetize. The major browsers discussed in this clip are Chrome, Safari, Mozilla Firefox, Tor Browser, Microsoft Edge, and Brave. (This is Blog Post #1096) Naomi...

California Assembly Bill No. 50 (AB-50) established the California Main Street Small Business Tax Credit II, which will provide COVID-19 financial relief to qualified small business employers. Overview Beginning 11/1/21, and ending 11/30/21, the California Department of Tax and Fee Administration (CDTFA) will be accepting applications through their online reservation system for qualified small business employers to reserve $1,000 per net increase in qualified employees, not to exceed $150,000. Tentative credit reservation amounts will generally be reduced by credit amounts reserved or received under the first Main St. Small Business Tax Credit. The credits are reserved on a first-come, first-served basis. Qualified small businesses will be able to offset either their income taxes or their sales and use taxes with the credit when filing their returns. Qualifications This credit...

A business may be able to claim a federal income tax deduction for a theft loss. But does embezzlement count as theft? In most cases it does but you’ll have to substantiate the loss. A recent U.S. Tax Court decision illustrates how that’s sometimes difficult to do. Basic rules for theft losses The tax code allows a deduction for losses sustained during the taxable year and not compensated by insurance or other means. The term “theft” is broadly defined to include larceny, embezzlement and robbery. In general, a loss is regarded as arising from theft only if there’s a criminal element to the appropriation of a taxpayer’s property. In order to claim a theft loss deduction, a taxpayer must prove: The amount of the loss, The date the...