(This is Blog Post #689) ...

If your company faces the need to “remediate” or clean up environmental contamination, the money you spend can be deductible on your tax return as ordinary and necessary business expenses. There are however "timing difference" types of tax implications of environmental cleanup. You want to claim the maximum immediate income tax benefits possible for the expenses you incur but that may not always be possible. These expenses may include the actual cleanup costs, as well as expenses for environmental studies, surveys and investigations, fees for consulting and environmental engineering, legal and professional fees, environmental “audit” and monitoring costs, and other expenses. Current deductions vs. capitalized costs Unfortunately, every type of environmental cleanup expense cannot be currently deducted. Some cleanup costs must be capitalized. But, generally, cleanup costs are...

(This is Blog Post #687)...

By temporarily doubling the gift and estate tax exemption, the Tax Cuts and Jobs Act (TCJA) opened a window of opportunity for affluent families to transfer assets tax-free. To take advantage of the higher exemption amount, many families that own businesses or other assets worth more than the pre-TCJA exemption amount are planning substantial gifts to their children before 2026. Traditionally, parents use trust-based gifting strategies to transfer assets to their children. Even though these strategies offer significant tax-planning benefits, they also have a major drawback: They require you to relinquish much of your control over the assets, including the right to direct the ultimate disposition of the trust assets. One strategy for avoiding this drawback is to use beneficiary defective inheritors trusts (BDIT). It’s better to...

If you devote all your business’s security resources to fending off hackers and other cybercriminals, you may be unlocking the door, literally, to more basic types of theft. “Creepers” are criminals who gain access to offices or other physical facilities via unlocked doors and social engineering tactics. Once in, they steal proprietary information, inventory, computers and personal property, or gather information that makes it easier to hack your network. As such, creepers are a threat to your business. Creepers in action A major energy company’s Houston office was infiltrated by a creeper who’s believed to have stolen sensitive information, possibly to sell to a rival company or foreign government. Surveillance footage released by the FBI shows a man walking through an unlocked door in the middle of...

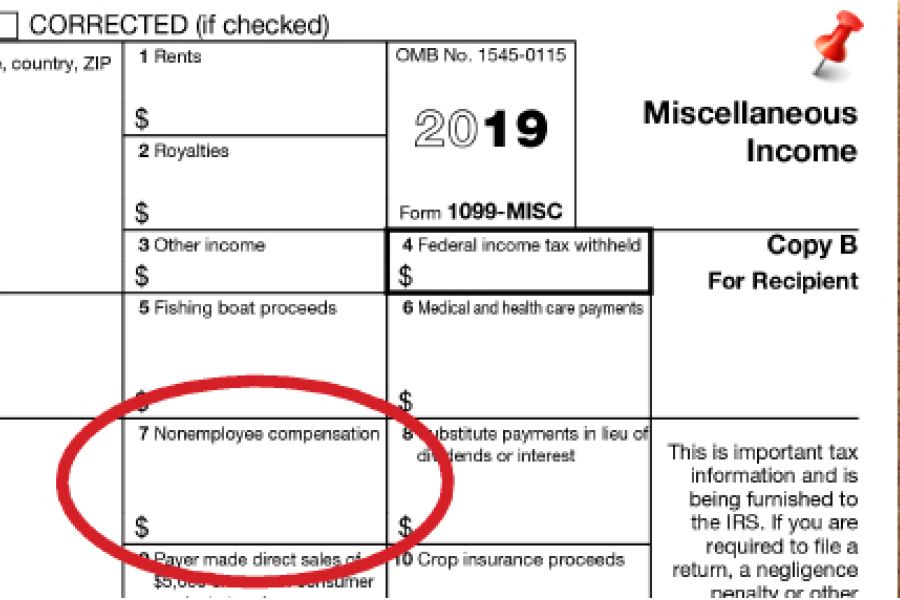

It's 2020, and with it your business may be required to comply with rules to report amounts paid to independent contractors, vendors and others. 1099-MISC reporting requirements may mean you have to send 1099-MISC forms to those whom you pay nonemployee compensation, as well as file copies with the IRS. This task can be time consuming and there are penalties for not complying, so it’s a good idea to begin gathering information early to help ensure smooth filing. Deadline There are many types of 1099 forms. For example, 1099-INT is sent out to report interest income and 1099-B is used to report broker transactions and barter exchanges. Employers must provide a Form 1099-MISC for nonemployee compensation by January 31, 2020, to each noncorporate service provider who was...

Here's a 2020 Q1 tax calendar with some of the key tax-related deadlines affecting businesses and other employers. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact me to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. January 31 File 2019 Forms W-2, “Wage and Tax Statement,” with the Social Security Administration and provide copies to your employees. Provide copies of 2019 Forms 1099-MISC, “Miscellaneous Income,” to recipients of income from your business where required. File 2019 Forms 1099-MISC reporting nonemployee compensation payments in Box 7 with the IRS. File Form 940, “Employer’s Annual Federal Unemployment (FUTA) Tax Return,” for 2019. If your undeposited tax is $500 or less, you...

Given the escalating cost of employee health care benefits, your business may be interested in providing some of these benefits through an employer-sponsored Health Savings Account (HSA). For eligible individuals, setting up a Health Savings Account offers a tax-advantaged way to set aside funds (or have their employers do so) to meet future medical needs. Here are the key tax benefits: Contributions that participants make to an HSA are deductible, within limits. Contributions that employers make aren’t taxed to participants. Earnings on the funds within an HSA aren’t taxed, so the money can accumulate year after year tax free. HSA distributions to cover qualified medical expenses aren’t taxed. Employers don’t have to pay payroll taxes on HSA contributions made by employees through payroll deductions. Who is...

One of the most laborious tasks for small businesses is managing payroll. But it’s critical that you not only withhold the right amount of taxes from employees’ paychecks but also that you pay them over to the federal government on time. If you willfully fail to do so, you could personally be hit with Trust Fund Recovery Penalties, also known as the 100% penalty. The penalty applies to the Social Security and income taxes required to be withheld by a business from its employees’ wages. Since the taxes are considered property of the government, the employer holds them in “trust” on the government’s behalf until they’re paid over. The reason the penalty is sometimes called the “100% penalty” is because the person liable for the taxes (called...

At this time of year, many business owners ask if there’s any year end tax saving tools they can implement. Under current tax law, there are two valuable depreciation-related tax breaks that may help your business reduce its 2019 tax liability. To benefit from these deductions, you must buy eligible machinery, equipment, furniture or other assets and place them into service by the end of the tax year. In other words, you can claim a full deduction for 2019 even if you acquire assets and place them in service during the last days of the year. The §179 deduction Under §179, you can deduct (or expense) up to 100% of the cost of qualifying assets in Year 1 instead of depreciating the cost over a number of...