On August 8, 2020, President Trump signed four executive actions, including a Presidential Memorandum to defer the employee’s portion of Social Security taxes for some people. These actions were taken in an effort to offer more relief due to the COVID-19 pandemic. The action only defers the taxes, which means they’ll have to be paid in the future. However, the action directs the U.S. Treasury Secretary to “explore avenues, including legislation, to eliminate the obligation to pay the taxes deferred pursuant to the implementation of this memorandum.” Legislative history On March 18, 2020, President Trump signed into law the Families First Coronavirus Response Act. A short time later, President Trump signed into law the Coronavirus, Aid, Relief and Economic Security (CARES) Act. Both laws contain economic relief provisions for employers...

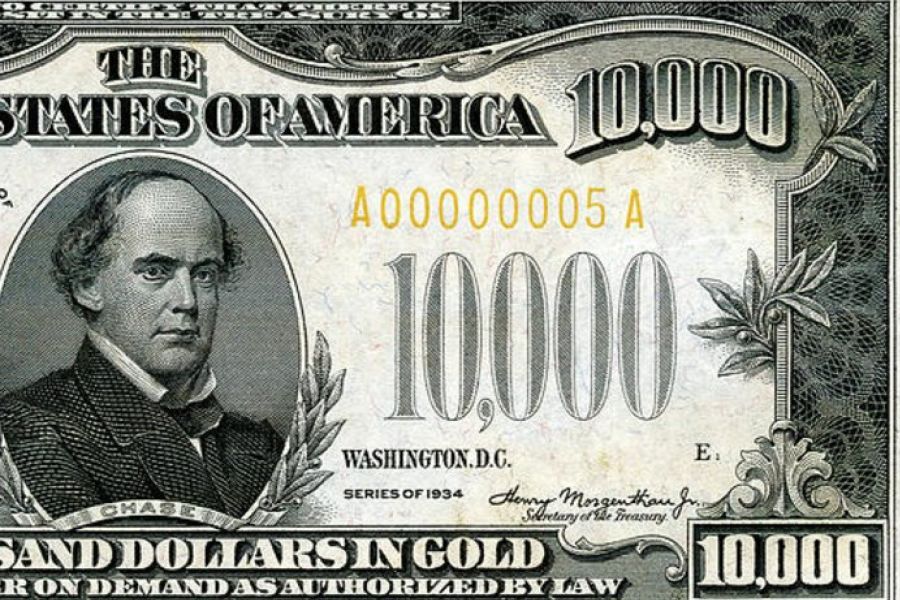

(Image copyright belongs to Serge Averbukh) In Fact Sheet 2020-11, the IRS has presented a series of examples where a person might have to file Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. Background Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file a Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. A "person" is an individual, company, corporation, partnership, association, trust or estate. A person must file Form 8300 if they receive cash of more than $10,000 from the same payer or agent: in one lump sum; in two or more related payments within 24 hours, e.g., a 24-hour period is...

The U.S. Small Business Administration (SBA), in consultation with the Department of the Treasury, released guidance on 8/4/2020 answering 23 frequently asked questions (FAQs) regarding the forgiveness of Paycheck Protection Program (PPP) loans. The PPP Loan Forgiveness FAQs, published in a new 10-page document, are divided into the following four sections addressing different aspects of the process and on calculations PPP borrowers should use to determine how much of their loan is forgivable. General Loan Forgiveness FAQs Loan Forgiveness Payroll Costs FAQs Loan Forgiveness Non-Payroll Costs FAQs Loan Forgiveness Reductions FAQs Borrowers and lenders may rely on the guidance provided in this document as SBA’s interpretation, in consultation with the Department of the Treasury, of the CARES Act, the Flexibility Act, and the Paycheck Protection Program Interim...

(As posted to IRS.gov on 7/16/20) Via IR-2020-160, the Internal Revenue Service today announced its annual "Dirty Dozen" list of tax scams for 2020 with a special emphasis on aggressive and evolving schemes related to coronavirus tax relief, including Economic Impact Payments. This year, the Dirty Dozen focuses on scams that target taxpayers. The criminals behind these bogus schemes view everyone as potentially easy prey. The IRS urges everyone to be on guard all the time and look out for others in their lives. "Tax scams tend to rise during tax season or during times of crisis, and scam artists are using pandemic to try stealing money and information from honest taxpayers," said IRS Commissioner Chuck Rettig. "The IRS provides the Dirty Dozen list to help raise awareness...

Skimming isn’t the biggest fraud threat for most businesses. The theft of cash receipts represents only 11% of asset appropriation schemes, according to the Association of Certified Fraud Examiners’ 2020 Report to the Nations. But with a median loss of $47,000, your business will likely feel the pain if it becomes a victim of skimming. That said, skimming losses can be significant. Here’s what you need to know to prevent it. Usual tactics Skimming occurs when an employee steals an incoming payment before it’s recorded. In the most basic skimming scheme, a worker sells goods or services to a customer, collects payment and pockets the money without recording the sale. If the customer receives goods but no sale is recorded, skimming will cause a discrepancy between physical...

If you own or manage a business with employees, you may be at risk for a severe tax penalty. It’s called the “Trust Fund Recovery Penalty” because it applies to the Social Security and income taxes required to be withheld by a business from its employees’ wages. Because the taxes are considered property of the government, the employer holds them in “trust” on the government’s behalf until they’re paid over. The penalty is also sometimes called the “100% penalty” because the person liable and responsible for the taxes will be penalized 100% of the taxes due. Accordingly, the amounts IRS seeks when the penalty is applied are usually substantial, and IRS is very aggressive in enforcing the penalty. Far-reaching penalty The Trust Fund Recovery Penalty is among the...

There’s a new IRS form for business taxpayers that pay or receive nonemployee compensation. IRS Form 1099-NEC debuts in 2020 and payers must use it to report any payment of $600 or more to a payee. Why the new form? Prior to 2020, Form 1099-MISC was filed to report payments totaling at least $600 in a calendar year for services performed in a trade or business by someone who isn’t treated as an employee. These payments are referred to as nonemployee compensation (NEC) and the payment amount was reported in box 7. Form 1099-NEC was reintroduced to alleviate the confusion caused by separate deadlines for Form 1099-MISC that report NEC in box 7 and all other Form 1099-MISC for paper filers and electronic filers. The IRS announced in July...

As Posted to the Kitco News YouTube Channel on 8/3/2020 Part 3 of 3 (Run Time 7:19) Quantitative easing by the Federal Reserve has undoubtedly expanded the Fed balance sheet to record levels, but the outcome on consumer and asset prices is yet to be seen according to best-selling author Jim Rickards and Peter Schiff, CEO of Euro Pacific Capital. In this final segment of the three-part Kitco News interview, Rickards and Schiff argue that inflation of asset prices is the likely outcome. Other parts of this interview can be found here: Part 1: Rickards and Schiff Give Gold Forecasts Part 2: Rickards and Schiff Discuss Coming Monetary Collapse (This is Blog Post #863) James G. Rickards is an American lawyer. He is a regular commentator on finance, and is the author of The...

As Posted to the Kitco News YouTube Channel on 7/31/2020 Part 2 of 3 (Run Time 9:15) The Federal Reserve has gone past the point of no return and is unlikely to be able to unwind their balance sheet in the foreseeable future, according to best-selling author Jim Rickards and Peter Schiff, CEO of Euro Pacific Capital. In this second segment of the three-part Kitco News interview, Rickards and Schiff discuss the consequences of the Federal Reserve paying for the nation’s expenses, or as Schiff called it, “free money.” Part 1 of this interview can be found here: Part 1: Rickards and Schiff Give Gold Forecasts Part 3: Rickards and Schiff on Deflation vs Inflation (This is Blog Post #862) James G. Rickards is an American lawyer. He is a regular commentator on...

As Posted to the Kitco News YouTube Channel on 7/30/2020 Part 1 of 3 (Run Time 14:35) Gold prices have hit all-time highs, but in this Kitco News interview, industry heavyweights Jim Rickards, best-selling author, and Peter Schiff, CEO of Euro Pacific Capital, both think that the rally is far from over. Rickards’ analysis gives a five-year gold price target of $15,000 an ounce. Schiff, too, sees this as just the start of the bull cycle, adding that an imminent U.S. dollar collapse will be a major catalyst in sending gold prices much higher. Other parts of this interview can be found here: Part 2: Rickards and Schiff Discuss Coming Monetary Collapse Part 3: Rickards and Schiff on Deflation vs Inflation (This is Blog Post #861) James G. Rickards is an American...