If you’re claiming deductions for business meals or auto expenses, expect the IRS to closely review them. In some cases, taxpayers have incomplete documentation or try to create records months (or years) later. In doing so, they fail to meet the strict substantiation requirements set forth under tax law. Tax auditors are adept at rooting out inconsistencies, omissions and errors in taxpayers’ records, as illustrated by one recent U.S. Tax Court case. Facts of the case In the case, the taxpayer ran a notary and paralegal business. She deducted business meals and vehicle expenses that she allegedly incurred in connection with her business. The deductions were denied by the IRS and the court. Tax law “establishes higher substantiation requirements” for these and certain other expenses, the court noted....

Compiled annually, the “Dirty Dozen” lists a variety of common scams that taxpayers may encounter anytime but many of these schemes peak during filing season as people prepare their returns or hire someone to help with their taxes. This year's "Dirty Dozen" is separated into four separate categories: Pandemic-related scams like Economic Impact Payment theft (See Blog Post 1049) Personal information cons including phishing, ransomware and phone "vishing" (See Blog Post 1050) Ruses focusing on unsuspecting victims like fake charities and senior/immigrant fraud (See Blog Post 1051) Schemes that persuade taxpayers into unscrupulous actions such as Offer In Compromise mills and syndicated conservation easements (This Blog Post) The Internal Revenue Service, in IR 2021-144, concluded the "Dirty Dozen" list of tax scams with a warning to taxpayers...

Compiled annually, the “Dirty Dozen” lists a variety of common scams that taxpayers may encounter anytime but many of these schemes peak during filing season as people prepare their returns or hire someone to help with their taxes. This year's "Dirty Dozen" is separated into four separate categories: Pandemic-related scams like Economic Impact Payment theft (See Blog Post 1049) Personal information cons including phishing, ransomware and phone "vishing" (See Blog Post 1050) Ruses focusing on unsuspecting victims like fake charities and senior/immigrant fraud (This Blog Post) Schemes that persuade taxpayers into unscrupulous actions such as Offer In Compromise mills and syndicated conservation easements (See Blog Post 1052) The Internal Revenue Service, via IR 2021-141, continued its "Dirty Dozen" tax scams with a warning for people to watch...

Compiled annually, the “Dirty Dozen” lists a variety of common scams that taxpayers may encounter anytime but many of these schemes peak during filing season as people prepare their returns or hire someone to help with their taxes. This year's "Dirty Dozen" is separated into four separate categories: Pandemic-related scams like Economic Impact Payment theft (See Blog Post 1049) Personal information cons including phishing, ransomware and phone "vishing" (This Blog Post) Ruses focusing on unsuspecting victims like fake charities and senior/immigrant fraud (See Blog Post 1051) Schemes that persuade taxpayers into unscrupulous actions such as Offer In Compromise mills and syndicated conservation easements (See Blog Post 1052) The Internal Revenue Service, via IR 2021-137, continues its "Dirty Dozen" scam series with a warning to taxpayers to watch...

Compiled annually, the “Dirty Dozen” lists a variety of common scams that taxpayers may encounter anytime but many of these schemes peak during filing season as people prepare their returns or hire someone to help with their taxes. This year's "Dirty Dozen" will be separated into four separate categories: Pandemic-related scams like Economic Impact Payment theft (This Blog Post) Personal information cons including phishing, ransomware and phone "vishing" (See Blog Post 1050) Ruses focusing on unsuspecting victims like fake charities and senior/immigrant fraud (See Blog Post 1051) Schemes that persuade taxpayers into unscrupulous actions such as Offer In Compromise mills and syndicated conservation easements (See Blog Post 1052) Economic Impact Payment theft A continuing threat to individuals is from identity thieves who try to steal Economic Impact Payments...

Compiled annually, the “Dirty Dozen” lists a variety of common scams that taxpayers may encounter anytime but many of these schemes peak during filing season as people prepare their returns or hire someone to help with their taxes. On 6/28/21 the Internal Revenue Service, via IR 2021-135, began its "Dirty Dozen" list for 2021 with a warning for taxpayers, tax professionals and financial institutions to be on the lookout for these 12 nefarious schemes and scams. This year's "Dirty Dozen" will be separated into four separate categories: Pandemic-related scams like Economic Impact Payment theft (See Blog Post 1049) Personal information cons including phishing, ransomware and phone "vishing" (See Blog Post 1050) Ruses focusing on unsuspecting victims like fake charities and senior/immigrant fraud (See Blog Post 1051) Schemes...

The Employee Retention Tax Credit (ERTC) is a valuable tax break that was extended and modified by the American Rescue Plan Act (ARPA), enacted in March of 2021. Here’s a rundown of the rules for businesses that have considered revisiting the Employee Retention Tax Credit. Background Back in March of 2020, Congress originally enacted the ERTC in the CARES Act to encourage employers to hire and retain employees during the pandemic. At that time, the ERTC applied to wages paid after March 12, 2020, and before January 1, 2021. However, Congress later modified and extended the ERTC to apply to wages paid before July 1, 2021. The ARPA again extended and modified the ERTC to apply to wages paid after June 30, 2021, and before January 1, 2022. Thus, an eligible employer can...

If your business is organized as a sole proprietorship or as a wholly owned limited liability company (LLC), you’re subject to both income tax and self-employment tax. There may be a way to cut your tax bill by conducting business as an S corporation. Fundamentals of self-employment tax The self-employment tax is imposed on 92.35% of self-employment income at a 12.4% rate for Social Security up to a certain maximum ($142,800 for 2021) and at a 2.9% rate for Medicare. No maximum tax limit applies to the Medicare tax. An additional 0.9% Medicare tax is imposed on income exceeding $250,000 for married couples ($125,000 for married persons filing separately) and $200,000 in all other cases. What if you conduct your business as a partnership in which you’re a...

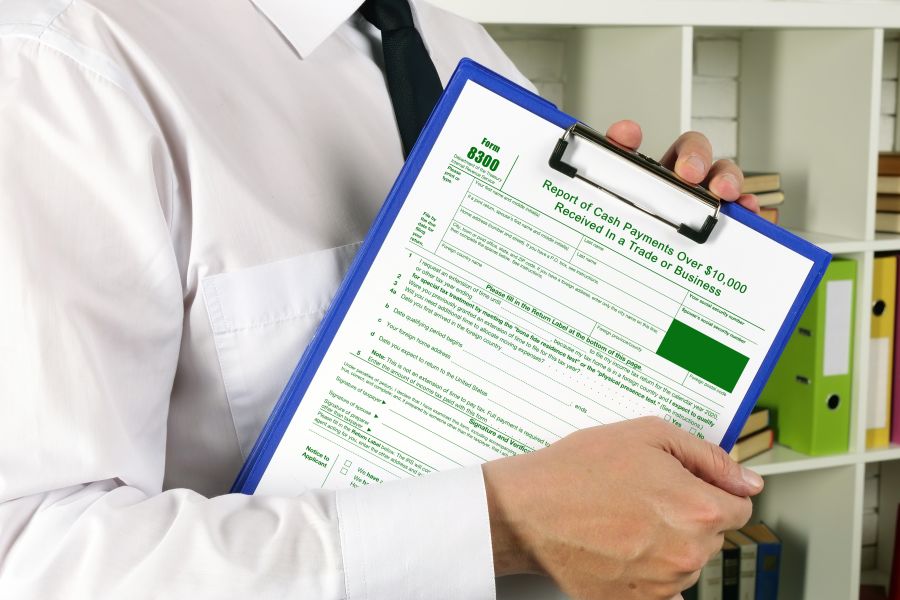

The Internal Revenue Service recently reminded businesses (in News Release 2021-47) of their responsibility to report large cash transactions via the filing of Form 8300, Report of Cash Payments Over $10,000, and encourages e-filing to help them file accurate, complete forms. Although many cash transactions are legitimate, information reported on Form 8300 can help stop those who evade taxes, profit from drug trading, engage in terrorist financing and conduct other criminal activities. The government can often trace money from these illegal activities through payments reported on complete, accurate forms. To help businesses prepare and file reports, the IRS created a video on How to Complete Form 8300 – Part I, Part II. The short video points out sections of Form 8300 for which the IRS commonly finds...

High-income taxpayers face a 3.8% net investment income tax (NIIT) that’s imposed in addition to regular income tax. Fortunately, there are some steps you may be able to take to reduce its impact. The NIIT applies to you only if modified adjusted gross income (MAGI) exceeds: $250,000 for married taxpayers filing jointly and surviving spouses, $125,000 for married taxpayers filing separately, $200,000 for unmarried taxpayers and heads of household. The amount subject to the tax is the lesser of your net investment income or the amount by which your MAGI exceeds the threshold ($250,000, $200,000, or $125,000) that applies to you. Net investment income includes interest, dividend, annuity, royalty, and rental income, unless those items were derived in the ordinary course of an active trade or business. In...