You may have wondered why, in a given year, you may be taxed on more S corporation income than was distributed to you from the S corporation in which you are a shareholder. The answers lies in the way S corporations and their shareholders are taxed. But before explaining those rules, be assured you that when you are taxed on undistributed income, you won't be taxed again if and when the income ultimately is paid to you. Unlike a regular or C corporation, an S corporation generally isn't subject to income tax (California does charge a 1.5% entity-level tax). Instead, each shareholder is taxed on the corporation's earnings, whether or not the earnings are distributed. Similarly, if an S corporation has a loss, the loss is passed...

In the fourth quarter of 2021, CEO resignations were up 16% over the prior year, according to executive outplacement firm Challenger, Gray & Christmas. Recent and announced high profile departures include Twitter’s Jack Dorsey, Amazon’s Jeff Bezos and American Airlines’ Doug Parker. This trend is expected to continue into 2022 as executives swap high-stress positions for more family time. Would your business survive if its CEO or founder suddenly jumped ship? Large public companies often have deep management structures and succession plans in place. So, they can usually recover from the loss of a C-level executive over time, except in rare instances. It’s more common for smaller businesses to depend heavily on a key person — and the actual, or even the potential, loss of that...

While some businesses have closed since the start of the COVID-19 crisis, many new ventures have launched. Entrepreneurs have cited a number of reasons why they decided to start a business in the midst of a pandemic. For example, they had more time, wanted to take advantage of new opportunities or they needed money due to being laid off. Whatever the reason, if you’ve recently started a new business, or you’re contemplating starting one, be aware of the tax implications. As you know, before you even open the doors in a start-up business, you generally have to spend a lot of money. You may have to train workers and pay for rent, utilities, marketing and more. Entrepreneurs are often unaware that many expenses incurred by start-ups can’t...

The cost (or asset-based) approach to valuing a business focuses on the balance sheet. This financial statement reports “book values” for the company’s assets and liabilities. Here’s how the cost approach works and when it might be an appropriate method of valuation. Book value vs. fair market value Amounts reported on a company’s balance sheet for its assets and liabilities may not reflect their fair market value to a potential buyer or seller. One reason is that, under U.S. Generally Accepted Accounting Principles (GAAP), assets are recorded at historic cost. Over time, historic cost may understate market value for appreciable assets, such as marketable securities and real estate. Additionally, internally generated intangible assets — such as copyrights, patents, brands and goodwill — are excluded from balance sheets prepared...

As posted to the RethinkX YouTube Channel on 11/04/2021 (Run Time 32 min, 32 sec) We are on the cusp of the fastest, deepest and most consequential transformation of civilization in history. Yet while humanity is on the brink of this existential transformation, we’re blind to the deeper processes of change. "Rethinking Humanity" takes viewers on a whirlwind tour of the rise and fall of civilizations through a powerful lens that makes sense of the past, so that we can step into the present and create our future. Throughout history, the inability to see what is going on left society looking inward and backwards. Desperate for stability and certainty. Incapable of making a different choice. The unavoidable result each time were efforts to patch up an order already in...

The value of a business interest is valid as of a specific date. The effective date is a critical cutoff point because events that occur after that date generally are not taken into account when estimating value. However, there are two key exceptions when subsequent events count. (1) When an event is foreseeable Subsequent events that were reasonably foreseeable on the effective date are usually factored into a valuation. That’s because, under the definition of fair market value, hypothetical willing buyers and sellers are presumed to have reasonable knowledge of relevant facts affecting the value of a business interest. Examples of potentially relevant subsequent events are: An offer to purchase the business, A bankruptcy filing, The emergence of new technology or government regulations, A natural or...

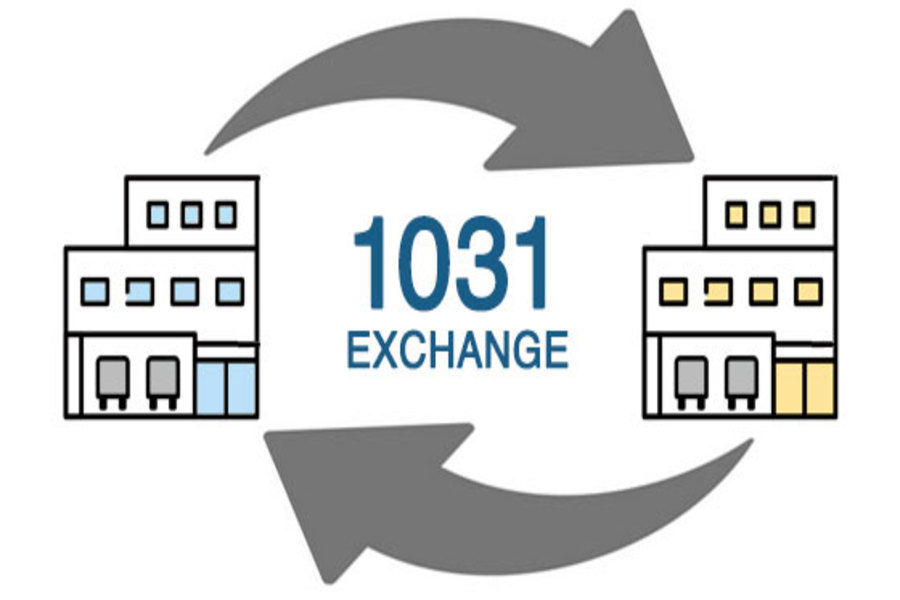

Do you want to sell commercial or investment real estate that has appreciated significantly? One way to defer a tax bill on the gain is with a §1031 “like-kind” exchange where you exchange the property rather than sell it. With real estate prices up in some markets (and higher resulting tax bills), the like-kind exchange strategy may be attractive. A like-kind exchange is any exchange of real property held for investment or for productive use in your trade or business (relinquished property) for like-kind investment, trade or business real property (replacement property). For these purposes, like-kind is broadly defined, and most real property is considered to be like-kind with other real property. However, neither the relinquished property nor the replacement property can be real property held primarily...

Valuation experts often use discounted cash flow (DCF) techniques to determine the value of a business or estimate economic losses. A critical input in a DCF model is the cost of capital. This is the rate that’s used to discount future earnings into today’s dollars. Small changes in this rate can have a major impact on the expert’s conclusion, so it’s important to get it right. Debt vs. equity The term “cost of capital” refers to the expected rate of return that the market requires to attract funds to a particular investment. The cost of capital is based on the perceived risk of the investment. Risky companies (or investments) warrant a higher discount rate and, therefore, a lower value (and vice versa). A business can be financed with...

As posted to the Munro Live YouTube Channel on 11/24/2021 (Run Time 46 min, 32 sec) Regarding the accelerating move to EVs, legendary automotive engineer Sandy Munro believes that OEMs are experiencing Scotoma, aka Paradigm Paralysis. They cannot physiologically see the data that is unfolding around them. When a paradigm shifts, success in the old paradigm will block your vision of the future. When a paradigm changes, everything goes back to zero. Your past success means nothing. GM promised 20 new EVs by 2023, yet they brought zero to the recent 2021 LA Auto Show. The EV technology disruption happening in the automotive industry is of an order of magnitude such that many OEMs simply will not survive. Who's going to win when one company (or country) is thinking...

In a business valuation context, the term “marketability” refers to the ability to quickly convert property to cash at minimal cost. While publicly traded stocks are readily marketable, interests in private companies typically require substantial time, cost and effort to sell. To the extent that public stock data is used to value private businesses, a discount may be warranted to reflect the lack of marketability. However, an important distinction must be made when applying these discounts to controlling interests. Minority vs. controlling interests Marketability discounts are well established when valuing minority interests in closely held businesses. Several empirical studies support and quantify these discounts. Restricted stock and pre-IPO studies, for example, demonstrate the spread between prices paid for freely traded shares and identical shares that are less...