Operating your small business as a Qualified Small Business Corporation (QSBC) could be a tax-wise idea. Tax-free treatment for eligible stock gains QSBCs are the same as garden-variety C corporations for tax and legal purposes — except QSBC shareholders are potentially eligible to exclude from federal income tax 100% of their stock sale gains. That translates into a 0% federal income tax rate on QSBC stock sale profits! However, you must meet several requirements set forth in Section 1202 of the Internal Revenue Code, and not all shares meet the tax-law description of QSBC stock. Finally, there are limitations on the amount of QSBC stock sale gain that you can exclude in any one tax year (but they’re unlikely to apply). Stock acquisition date is key The 100% federal...

If you’re an employer with a business where tipping is routine when providing food and beverages, you may qualify for a federal tax credit involving the Social Security and Medicare (FICA) taxes that you pay on your employees’ tip income. Credit fundamentals The FICA credit applies to tips that your staff members receive from customers when they buy food and beverages. It doesn’t matter if the food and beverages are consumed on or off the premises. Although tips are paid by customers, for FICA purposes, they’re treated as if you paid them to your employees. As you know, your employees are required to report their tips to you. You must: Withhold and remit the employee’s share of FICA taxes, and Pay the employer’s share of those taxes. How the...

If you’re interested in selling commercial or investment real estate that has appreciated significantly, one way to defer a tax bill on the gain is with a §1031 “like-kind” exchange. With this transaction, you exchange the property rather than sell it. Although the real estate market has been tough recently in some locations, there are still profitable opportunities (with high resulting tax bills) when the like-kind exchange strategy may be attractive. A like-kind exchange is any exchange of real property held for investment or for productive use in your trade or business (relinquished property) for like-kind investment, trade or business real property (replacement property). For these purposes, like-kind is broadly defined, and most real property is considered to be like-kind with other real property. However, neither the...

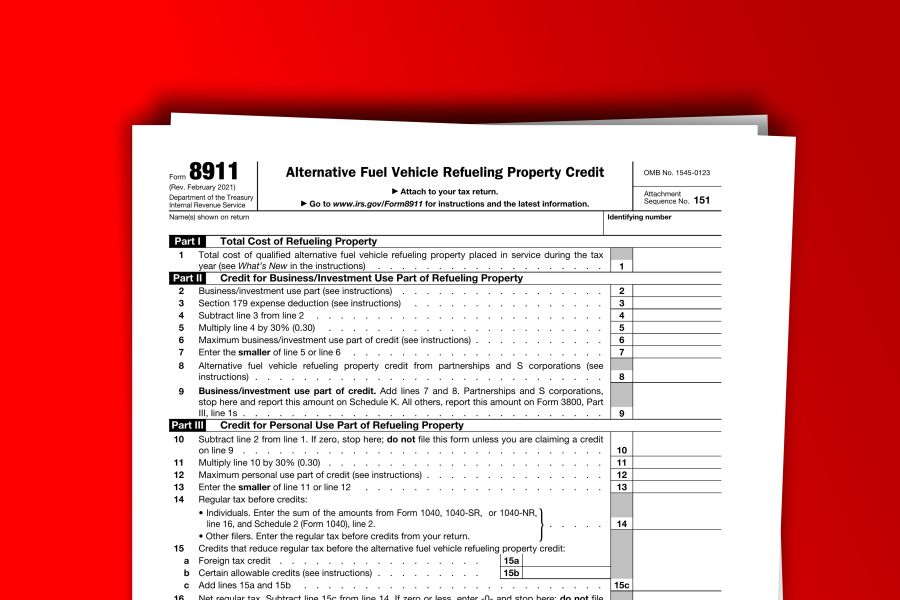

As reported via IR-2024-16 on 1/19/2024 The Internal Revenue Service and the Department of the Treasury today issued Notice 2024-20 to provide guidance on eligible census tracts for the qualified alternative fuel vehicle refueling property credit (the tax credit applicable to the installation of EV chargers) and to announce the intent to propose regulations for the credit. The Inflation Reduction Act amended the credit for qualified alternative fuel vehicle refueling property. The changes apply to qualified alternative fuel vehicle refueling property placed in service after December 31, 2022 and before January 1, 2033. Business vs Non-Business Property Property Not Subject to Depreciation The credit amount for property not subject to depreciation is 30% of the cost of the qualified property placed in service during the tax year. The credit is...

As the Financial Crimes Enforcement Network (FinCEN) opens its beneficial ownership information (BOI) reporting portal, its BOI webpage, reflects a fraud alert for individuals and entities who may be subject to beneficial ownership information (BOI) reporting. According to the FinCEN fraud alert, individuals and entities that may be subject to the beneficial ownership information (BOI) reporting requirements have been receiving fraudulent correspondence, via email or traditional mail, that appears as though it came from FinCEN. In some instances, the fraudulent correspondence may be titled "Important Compliance Notice" and ask the recipient to click on a URL or to scan a QR code. Be advised that e-mails or letters such as this are fraudulent, according to the alert. FinCEN cautions individuals that it does not send unsolicited requests for information,...

Starting in 2024 newly formed, corporations, limited liability companies (LLCs), limited partnerships, and other entities that file formation papers with a state’s Secretary of State’s office (or similar government agency) must file a report with the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) providing specified information regarding the entity’s “beneficial owners” (the so-called BOI reporting requirement under the Corporate Transparency Act). Entities in existence prior to January 1, 2024, have until January 1, 2025, to file these reports. Penalties are steep This is part of the federal government’s anti-money laundering and anti-tax evasion efforts and is an attempt to look beyond shell companies that are set up to hide money. Unfortunately, this will impose burdensome reporting requirements on most businesses, and the willful failure to report...

The IRS just put up a new webpage and released FAQs having to do with the recently announced Employee Retention Tax Credit (ERTC) Voluntary Disclosure Program. ERTC Voluntary Disclosure Program On December 21, 2023, the IRS announced a new Voluntary Disclosure Program for businesses who claimed the ERC erroneously. The program is part of the IRS' continuing efforts to combat questionable ERTC claims. This special disclosure program affords taxpayers the ability to repay only 80% of the claim received. The program runs through March 22, 2024. New webpage: The new webpage provides information on the advantages of participating in the program, who can apply, how to apply, as well as next steps. FAQs: The FAQs provide detailed information on eligibility, the program process, calculating and paying the amount...

As reported via IR-2023-247 on 12/21/2023 As part of an ongoing initiative aimed at combating dubious Employee Retention Tax Credit (ERTC) claims, the Internal Revenue Service launched a new Voluntary Disclosure Program to help businesses who want to pay back the money they received after filing ERTC claims in error. The new disclosure program, which has been in the works for several months, is part of a larger effort at the IRS to stop aggressive marketing around ERTC that misled some employers into filing claims. The special disclosure program runs through March 22, 2024, and the IRS added provisions allowing repayment of 80% of the claim received. The IRS also continues to urge employers with pending ERTC claims to consider a separate withdrawal program that allows them to...

As reported via IR-2023-230 on 12/6/2023 As part of continuing efforts to combat dubious Employee Retention Tax Credit (ERTC) claims, the Internal Revenue Service is sending an initial round of more than 20,000 letters to taxpayers notifying them of disallowed ERTC claims. IRS is disallowing claims to entities that: did not exist, or did not have paid employees during the period of eligibility to prevent improper ERTC payments from being made to ineligible entities. The letters are being sent as the IRS continues increased scrutiny of ERTC claims in response to misleading marketing campaigns that have targeted small businesses and other organizations. The IRS mailing is the latest in an expanded compliance effort that includes a special withdrawal program for those with pending claims who realize they...

The optional standard mileage rate used to calculate the deductible cost of operating an automobile for business will be going up by 1.5 cents per mile in 2024. The IRS recently announced that the cents-per-mile rate for the business use of a car, van, pickup or panel truck will be 67 cents (up from 65.5 cents for 2023). The increased tax deduction partly reflects the price of gasoline, which is about the same as it was a year ago. On December 21, 2023, the national average price of a gallon of regular gas was $3.12, compared with $3.10 a year earlier, according to AAA Gas Prices. Standard rate vs. tracking expenses Businesses can generally deduct the actual expenses attributable to business use of vehicles. These include gas, tires, oil, repairs, insurance,...