It’s not unusual for a partner to incur expenses related to the partnership’s business. This is especially likely to occur in service partnerships such as an architecture or law firm. For example, partners in service partnerships may incur entertainment expenses in developing new client relationships. They may also incur expenses for: transportation to get to and from client meetings, professional publications, continuing education and home office. What’s the tax treatment of such expenses? Here are the answers. Reimbursable or not As long as the expenses are the type a partner is expected to pay without reimbursement under the partnership agreement or firm policy (written or unwritten), the partner can deduct the expenses on Schedule E of Form 1040. Conversely, a partner can’t deduct expenses if the partnership would have...

Businesses usually want to delay recognition of taxable income into future years and accelerate deductions into the current year. But when is it wise to do the opposite? And why would you want to? One reason might be tax law changes that raise tax rates. The Biden administration has proposed raising the corporate federal income tax rate from its current flat 21% to 28%. Another reason may be because you expect your non-corporate pass-through entity business to pay taxes at higher rates in the future and the pass-through income will be taxed on your personal return. There have also been discussions in Washington about raising individual federal income tax rates. If you believe your business income could be subject to tax rate increases, you might want to...

If your business doesn’t already have a retirement plan, it might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example, if you’re self-employed and set up a SEP-IRA, you can contribute up to 20% of your self-employment earnings, with a maximum contribution of $69,000 for 2024 (up from $66,000 for 2023). If you’re employed by your own corporation, up to 25% of your salary can be contributed to your account, with a maximum contribution of $69,000. If you’re in the 32% federal income tax bracket, making a maximum contribution could cut what you owe Uncle Sam for 2024 by a whopping $22,080 (32% × $69,000). Other possibilities There are more small business retirement plan options, including: 401(k) plans,...

If you operate a business, or you’re starting a new one, you know records of income and expenses need to be kept. Specifically, you should carefully record expenses to claim all the tax deductions to which you’re entitled. And you want to make sure you can defend the amounts reported on your tax returns in case you’re ever audited by the IRS. Be aware that there’s no one way to keep business records. On its website, the IRS states: “You can choose any recordkeeping system suited to your business that clearly shows your income and expenses.” But there are strict rules when it comes to deducting legitimate expenses for tax purposes. And certain types of expenses, such as automobile, travel, meal and home office costs, require...

The IRS' recent declaration of a rigorous enforcement against the utilization of corporate jets has attracted widespread attention, as the Biden administration persists in intensifying its examination of affluent individuals and major corporations with intricate tax arrangements. Zeinat Zughayer, a tax controversy manager at Baker Tilly, provided information on the driving force behind the recent wave of audits and the extent of their coverage. The IRS recently declared its intention to commence several audits targeting the apportionment of corporate aircraft usage between business and personal purposes by executives, partners, shareholders, and other individuals for tax-related matters. According to the IRS, the level of personal usage has an effect on the eligibility for specific company deductions. "Utilizing the company jet for personal travel usually leads to the...

As reported in IR-2024-46 Using Inflation Reduction Act funding and as part of ongoing efforts to improve tax compliance in high-income categories, the Internal Revenue Service announced on 2/21/24 plans to begin dozens of audits on business aircraft involving personal use. The audits will be focused on aircraft usage by large corporations, large partnerships and high-income taxpayers and whether for tax purposes the use of jets is being properly allocated between business and personal reasons. The IRS will be using advanced analytics and resources from the Inflation Reduction Act to more closely examine this area, which has not been closely scrutinized during the past decade as agency resources fell sharply. The number of audits related to aircraft usage could increase in the future following initial results and as...

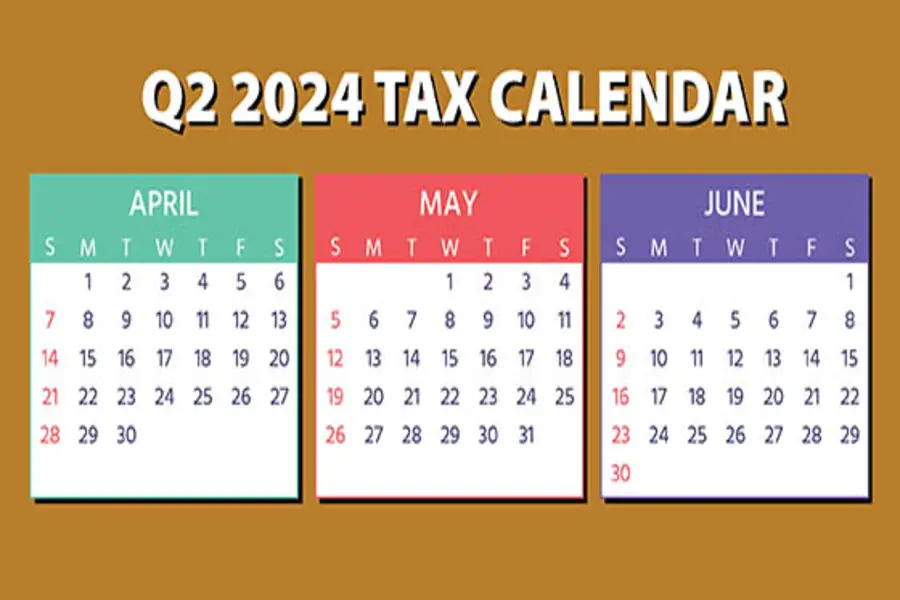

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. April 15 If you’re a calendar-year corporation, file a 2023 income tax return (Form 1120) or file for an automatic six-month extension (Form 7004) and pay any tax due. For corporations, pay the first installment of 2024 estimated income taxes. Complete and retain Form 1120-W (worksheet) for your records. For individuals, file a 2023 income tax return (Form 1040 or Form 1040-SR) or file for an automatic six-month extension (Form...

Your business should generally maximize current year depreciation write-offs for newly acquired assets. Two federal tax breaks can be a big help in achieving this goal: first-year §179 depreciation deductions and first-year bonus depreciation deductions. These two deductions can potentially allow businesses to write off some or all of their qualifying asset expenses in Year 1. However, they’re moving targets due to annual inflation adjustments and tax law changes that phase out bonus depreciation. With that in mind, here’s how to coordinate these write-offs for optimal tax-saving results. §179 deduction basics Most tangible depreciable business assets — including equipment, computer hardware, vehicles (subject to limits), furniture, most software and fixtures — qualify for the first-year Sec. 179 deduction. Depreciable real property generally doesn’t qualify unless it’s qualified improvement property...

If your small business is strapped for cash (or likes to save money), you may find it beneficial to barter or trade for goods and services. Bartering isn’t new — it’s the oldest form of trade — but the internet has made it easier to engage in with other businesses. However, if your business begins bartering, be aware that the fair market value of goods that you receive in these types of transactions is taxable income. And if you exchange services with another business, the transaction results in taxable income for both parties. Fair market value Here are some examples of an exchange of services: A computer consultant agrees to offer tech support to an advertising agency in exchange for free advertising. An electrical contractor does repair work...

The qualified business income (QBI) deduction is available to eligible businesses through 2025. After that, it’s scheduled to disappear. So if you’re eligible, you want to make the most of the deduction while it’s still on the books because it can potentially be a big tax saver. Deduction basics The QBI deduction is written off at the owner level. It can be up to 20% of: QBI earned from a sole proprietorship or single-member LLC that’s treated as a sole proprietorship for tax purposes, plus QBI from a pass-through entity, meaning a partnership, LLC that’s treated as a partnership for tax purposes or S corporation. How is QBI defined? It’s qualified income and gains from an eligible business, reduced by related deductions. QBI is reduced by: 1) deductible...