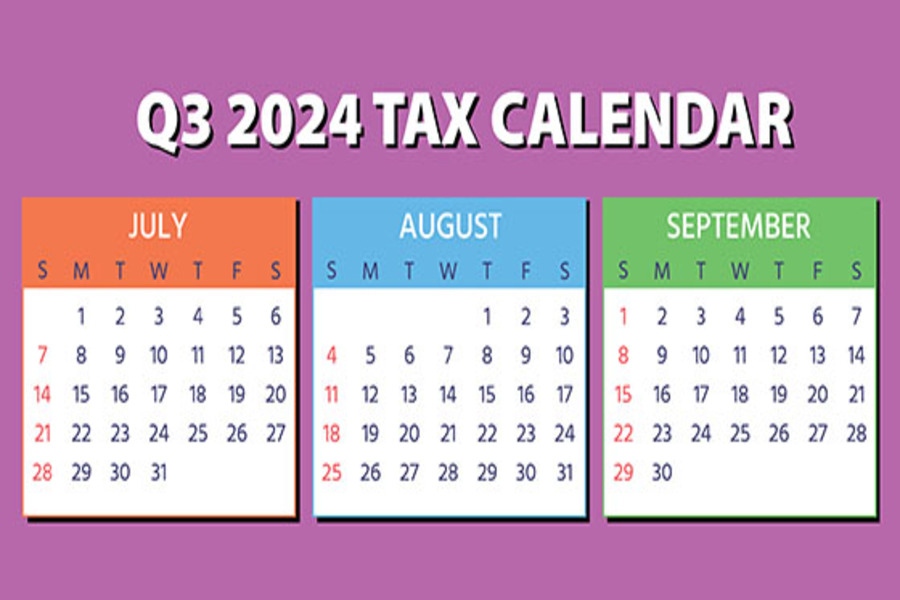

July 15 Employers should deposit Social Security, Medicare and withheld income taxes for June if the monthly deposit rule applies. They should also deposit non-payroll withheld income tax for June if the monthly deposit rule applies. July 31 Report income tax withholding and FICA taxes for second quarter 2024 (Form 941) and pay any tax due. (See the exception below, under “August 12.”) File a 2023 calendar-year retirement plan report (Form 5500 or Form 5500-EZ) or request an extension. August 12 Report income tax withholding and FICA taxes for second quarter 2024 (Form 941), if you deposited on time and in full all the associated taxes due. September 16 If a calendar-year C corporation, pay the third installment of 2024 estimated income taxes. If a calendar-year S corporation or partnership that...

With school out, you might be hiring your child to work at your company. In addition to giving your son or daughter some business knowledge, you and your child could reap some tax advantages. Benefits for your child There are special tax breaks for hiring your offspring if you operate your business as one of the following: A sole proprietorship, A partnership owned by both spouses, A single-member LLC that’s treated as a sole proprietorship for tax purposes, or An LLC that’s treated as a partnership owned by both spouses. These entities can hire an owner’s under-age-18 children as full- or part-time employees. The children’s wages then will be exempt from the following federal payroll taxes: Social Security tax, Medicare tax, and Federal unemployment (FUTA) tax (until an...

The next quarterly estimated tax payment deadline is September 16 for individuals and businesses, so it’s a good time to review the rules for computing corporate federal estimated payments. You want your business to pay the minimum amount of estimated tax without triggering the penalty for underpayment of estimated tax. Four possible options The required installment of estimated tax that a corporation must pay to avoid a penalty is the lowest amount determined under one of the following four methods: Current year method. Under this option, a corporation can avoid the estimated tax underpayment penalty by paying 25% of the tax shown on the current tax year’s return (or, if no return is filed, 25% of the tax for the current year) by each of four installment...

As reported in IR-2024-169 IRS enters next stage of Employee Retention Tax Credit work; review indicates vast majority show risk of being improper Highest-risk claims being denied, additional processing to begin on low-risk claims; heightened scrutiny and review continues as compliance work tops $2 billion; IRS will consult with Congress on potential legislative action before making decision on future of moratorium Following a detailed review to protect taxpayers and small businesses, the Internal Revenue Service on June 20, 2024 announced plans to deny tens of thousands of improper high-risk Employee Retention Tax Credit claims while starting a new round of processing lower-risk claims to help eligible taxpayers. “The completion of this review provided the IRS with new insight into risky Employee Retention Tax Credit activity and confirmed widespread concerns...

The IRS recently released guidance providing the 2025 inflation-adjusted amounts for Health Savings Accounts (HSAs). These amounts are adjusted each year, based on inflation, and the adjustments are announced earlier in the year than other inflation-adjusted amounts, which allows employers to get ready for the next year. Fundamentals of HSAs An HSA is a trust created or organized exclusively for the purpose of paying the qualified medical expenses of an account beneficiary. An HSA can only be established for the benefit of an eligible individual who is covered under a high-deductible health plan (HDHP). In addition, a participant can’t be enrolled in Medicare or have other health coverage (exceptions include dental, vision, long-term care, accident and specific disease insurance). Within specified dollar limits, an above-the-line tax deduction is...

Choosing the right business entity has many implications, including the amount of your tax bill. The most common business structures are sole proprietorships, partnerships, limited liability companies, C corporations and S corporations. In some cases, a business may decide to switch from one entity type to another. Although S corporations can provide substantial tax benefits over C corporations in some circumstances, there are potentially costly tax issues that you should assess before making the decision to convert from a C corporation to an S corporation. Here are four considerations: 1. LIFO inventories. C corporations that use last-in, first-out (LIFO) inventories must pay tax on the benefits they derived by using LIFO if they convert to S corporations. The tax can be spread over four years. This cost must be weighed against the potential tax gains from...

After experiencing a downturn in 2023, merger and acquisition activity in several sectors is rebounding in 2024. If you’re buying a business, you want the best results possible after taxes. You can potentially structure the purchase in two ways: Buy the assets of the business, or Buy the seller’s entity ownership interest if the target business is operated as a corporation, partnership or LLC. In this post, we’re going to focus on buying assets. Asset purchase tax basics You must allocate the total purchase price to the specific assets acquired. The amount allocated to each asset becomes the initial tax basis of that asset. For depreciable and amortizable assets (such as furniture, fixtures, equipment, buildings, software and intangibles such as customer lists and goodwill), the initial tax basis determines...

Commencing in 2024, individuals who possess short-term rentals (such as rentals facilitated by platforms like Airbnb) will be required to fill out the newly introduced Form BOE-571-STR, known as the Short Term Rental Property Statement, in order to disclose their business personal property. Business personal property is typically subject to annual reappraisal, unlike real property. Every year, business owners are required to provide a business property statement that provides a comprehensive breakdown of the expenses associated with supplies, equipment, and fixtures at each of their locations. Form BOE-571-STR can be found here: www.boe.ca.gov/proptaxes/pdf/sample-boe571str.pdf When a property owner rents out all or part of their property, such as a residential unit, they are required to pay business property tax on the items used for the rental, such as furniture,...

Let’s say you plan to use a C corporation to operate a newly acquired business or you have an existing C corporation that needs more capital. You should know that the federal tax code treats corporate debt more favorably than corporate equity. So for shareholders of closely held C corporations, it can be a tax-smart move to include in the corporation’s capital structure: Some third-party debt (owed to outside lenders), and/or Some owner debt. Tax rate considerations Let’s review some basics. The top individual federal income tax rate is currently 37%. The top individual federal rate on net long-term capital gains and qualified dividends is currently 20%. On top of this, higher-income individuals may also owe the 3.8% net investment income tax on all or part of their investment income,...

There are several financial and legal implications when adding a new partner to a partnership. Here’s an example to illustrate: You and your partners are planning to admit a new partner. The new partner will acquire a one-third interest in the partnership by making a cash contribution to the business. Assume that your basis in your partnership interests is sufficient so that the decrease in your portions of the partnership’s liabilities because of the new partner’s entry won’t reduce your basis to zero. More complex than it seems Although adding a new partner may appear to be simple, it’s important to plan the new person’s entry properly to avoid various tax problems. Here are two issues to consider: If there’s a change in the partners’ interests in...