The Coronavirus Aid, Relief and Economic Security (CARES) Act made changes to excess business losses. This includes some changes that are retroactive and there may be opportunities for some businesses to file amended tax returns. If you hold an interest in a business, or may do so in the future, here is more information about the changes. Deferral of the excess business loss limits The Tax Cuts and Jobs Act (TCJA) provided that net tax losses from active businesses in excess of an inflation-adjusted $500,000 for joint filers, or an inflation-adjusted $250,000 for other covered taxpayers, are to be treated as net operating loss (NOL) carryforwards in the following tax year. The covered taxpayers are individuals, estates and trusts that own businesses directly or as partners in a...

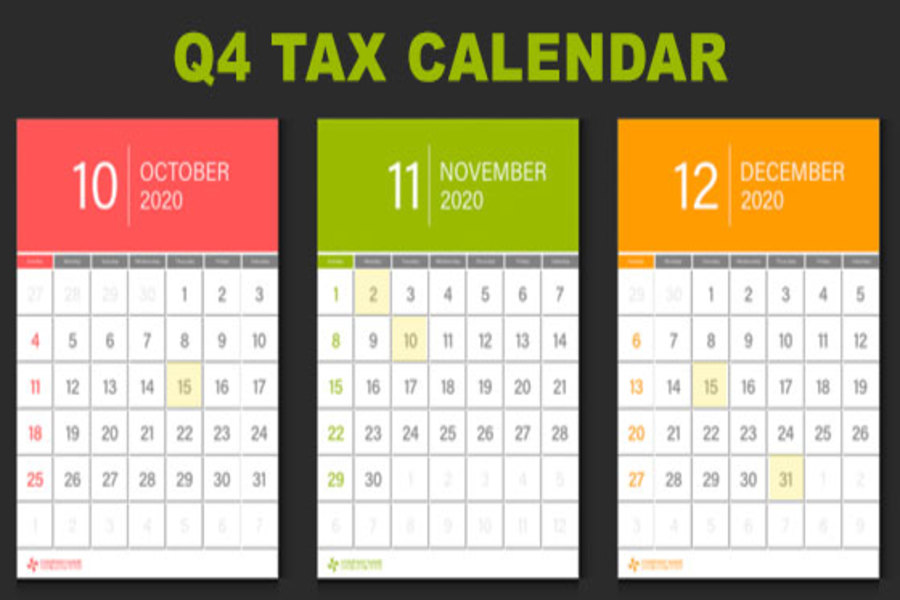

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2020. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Thursday, October 15 If a calendar-year C corporation that filed an automatic six-month extension: File a 2019 income tax return (Form 1120) and pay any tax, interest and penalties due. Make contributions for 2019 to certain employer-sponsored retirement plans. Monday, November 2 Report income tax withholding and FICA taxes for third quarter 2020 (Form 941) and pay any tax due. (See exception below under “November 10.”) Tuesday, November 10 Report income tax withholding and FICA taxes for third quarter 2020 (Form 941), if you deposited on time (and in full) all of the associated...

The IRS has provided guidance to employers regarding the recent presidential action to allow employers to defer the withholding, deposit and payment of certain payroll tax obligations. The three-page guidance in Notice 2020-65 was issued to implement President Trump’s executive memorandum signed on August 8. Even with the guidance, employers have questions about FICA deferral, specifically whether, and how, to implement the optional deferral. The President’s action only defers the employee’s share of Social Security taxes; it doesn’t forgive them, meaning employees will still have to pay the taxes later unless Congress acts to eliminate the liability. (The payroll services provider for federal employers announced that federal employees will have their taxes deferred.) Deferral basics President Trump issued the memorandum in light of the COVID-19 crisis. He directed the...

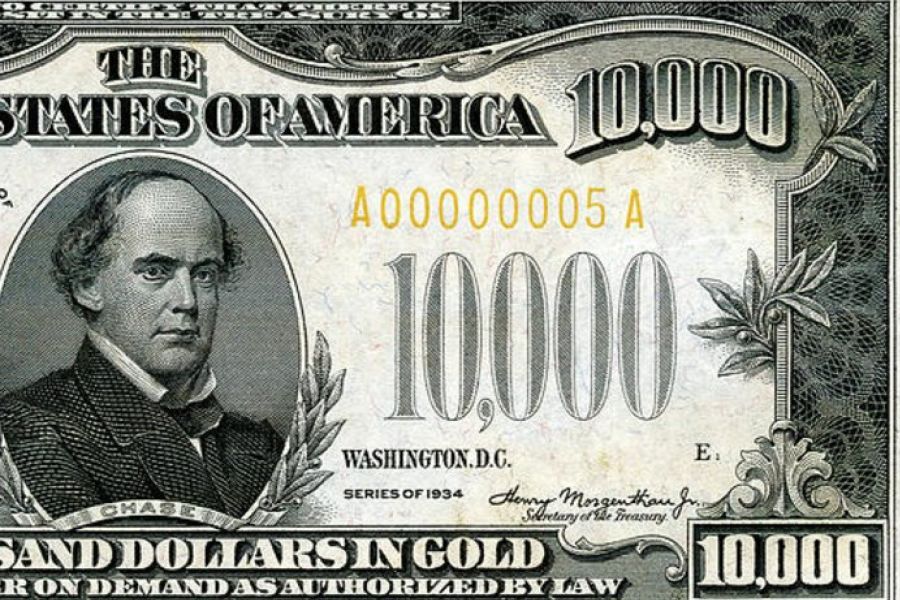

Does your business receive large amounts of cash or cash equivalents? You may be required to begin filing cash transaction reports with the IRS to report these transactions. Filing requirements Each person engaged in a trade or business who, in the course of operating, receives more than $10,000 in cash in one transaction, or in two or more related transactions, must file Form 8300. Any transactions conducted in a 24-hour period are considered related transactions. Transactions are also considered related even if they occur over a period of more than 24 hours if the recipient knows, or has reason to know, that each transaction is one of a series of connected transactions. To complete a Form 8300, you will need personal information about the person making the cash...

If you’re a partner in a business, you may have come across a situation that gave you pause. In a given year, you may be taxed on more partnership income than was distributed to you from the partnership in which you’re a partner. Why is partner taxable income different than cash received? The answer lies in the way partnerships and partners are taxed. Unlike regular corporations, partnerships aren’t subject to income tax. Instead, each partner is taxed on the partnership’s earnings — whether or not they’re distributed. Similarly, if a partnership has a loss, the loss is passed through to the partners. (However, various rules may prevent a partner from currently using his share of a partnership’s loss to offset other income.) Separate entity While a partnership isn’t...

During the COVID-19 pandemic, many small businesses are strapped for cash. They may find it beneficial to barter for goods and services instead of paying cash for them. If your business gets involved in bartering, remember that the fair market value of goods that you receive in bartering is taxable income. And if you exchange services with another business, the bartering is a taxable transaction for both parties. For example, if a computer consultant agrees to exchange services with an advertising agency, both parties are taxed on the fair market value of the services received. This is the amount they would normally charge for the same services. If the parties agree to the value of the services in advance, that will be considered the fair market...

If your business was fortunate enough to have applied for, and received a loan under the Paycheck Protection Program (PPP) in connection with the COVID-19 crisis, you should be aware of the possible tax consequences of PPP loans. PPP basics The Coronavirus Aid, Relief and Economic Security (CARES) Act, which was enacted on March 27, 2020, is designed to provide financial assistance to Americans suffering during the COVID-19 pandemic. The CARES Act authorized up to $349 billion in forgivable loans to small businesses for job retention and certain other expenses through the PPP. In April, Congress authorized additional PPP funding and it’s possible more relief could be part of another stimulus law. The PPP allows qualifying small businesses and other organizations to receive loans with an interest rate...

On August 8, 2020, President Trump signed four executive actions, including a Presidential Memorandum to defer the employee’s portion of Social Security taxes for some people. These actions were taken in an effort to offer more relief due to the COVID-19 pandemic. The action only defers the taxes, which means they’ll have to be paid in the future. However, the action directs the U.S. Treasury Secretary to “explore avenues, including legislation, to eliminate the obligation to pay the taxes deferred pursuant to the implementation of this memorandum.” Legislative history On March 18, 2020, President Trump signed into law the Families First Coronavirus Response Act. A short time later, President Trump signed into law the Coronavirus, Aid, Relief and Economic Security (CARES) Act. Both laws contain economic relief provisions for employers...

(Image copyright belongs to Serge Averbukh) In Fact Sheet 2020-11, the IRS has presented a series of examples where a person might have to file Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. Background Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file a Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. A "person" is an individual, company, corporation, partnership, association, trust or estate. A person must file Form 8300 if they receive cash of more than $10,000 from the same payer or agent: in one lump sum; in two or more related payments within 24 hours, e.g., a 24-hour period is...

The U.S. Small Business Administration (SBA), in consultation with the Department of the Treasury, released guidance on 8/4/2020 answering 23 frequently asked questions (FAQs) regarding the forgiveness of Paycheck Protection Program (PPP) loans. The PPP Loan Forgiveness FAQs, published in a new 10-page document, are divided into the following four sections addressing different aspects of the process and on calculations PPP borrowers should use to determine how much of their loan is forgivable. General Loan Forgiveness FAQs Loan Forgiveness Payroll Costs FAQs Loan Forgiveness Non-Payroll Costs FAQs Loan Forgiveness Reductions FAQs Borrowers and lenders may rely on the guidance provided in this document as SBA’s interpretation, in consultation with the Department of the Treasury, of the CARES Act, the Flexibility Act, and the Paycheck Protection Program Interim...