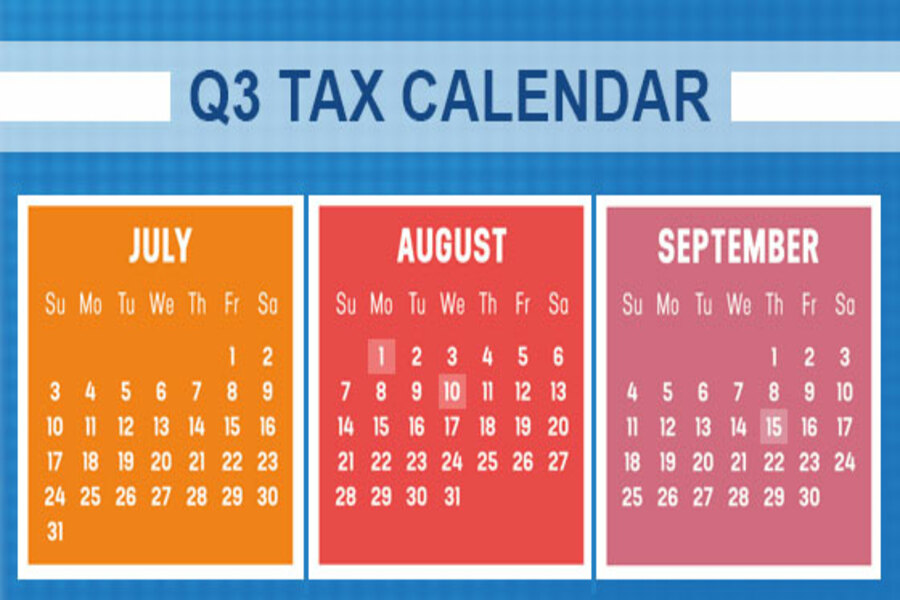

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. August 1 Report income tax withholding and FICA taxes for second quarter 2022 (Form 941), and pay any tax due. (See the exception below, under “August 10.”) File a 2021 calendar-year retirement plan report (Form 5500 or Form 5500-EZ) or request an extension. August 10 Report income tax withholding and FICA taxes for second quarter 2022 (Form 941), if you deposited on time and in full all of the associated taxes due. September 15 ...

Business owners are aware that the price of gas is historically high, which has made their vehicle costs soar. The average nationwide price of a gallon of unleaded regular gas on June 17 was $5, compared with $3.08 a year earlier, according to the AAA Gas Prices website. A gallon of diesel averaged $5.78 a gallon, compared with $3.21 a year earlier. Fortunately, the IRS is providing some relief. The tax agency announced an increase in the optional standard mileage rate for the last six months of 2022. Taxpayers may use the optional cents-per-mile rate to calculate the deductible costs of operating a vehicle for business. For the second half of 2022 (July 1–December 31), the standard mileage rate for business travel will be 62.5 cents per...

There’s a valuable tax deduction available to a C corporation when it receives dividends. The “dividends-received deduction” is designed to reduce or eliminate an extra level of tax on dividends received by a corporation. As a result, a corporation will typically be taxed at a lower rate on dividends than on capital gains. Ordinarily, the deduction is 50% of the dividend, with the result that only 50% of the dividend received is effectively subject to tax. For example, if your corporation receives a $1,000 dividend, it includes $1,000 in income, but after the $500 dividends-received deduction, its taxable income from the dividend is only $500. The deductible percentage of a dividend will increase to 65% of the dividend if your corporation owns 20% or more (by vote...

Here’s an interesting option if your small company or start-up business is planning to claim the research tax credit. Subject to limits, you can elect to apply all or some of any research tax credits that you earn against your payroll taxes instead of your income tax. This payroll tax election may influence some businesses to undertake or increase their research activities. On the other hand, if you’re engaged in or are planning to engage in research activities without regard to tax consequences, be aware that some tax relief could be in your future. Here are some answers to questions about the option. Why is the election important? Many new businesses, even if they have some cash flow, or even net positive cash flow and/or a book profit,...

On 6/1/22, the IRS made available an update to the "Cost Segregation Audit Techniques Guide" (Publication 5653). Originally issued in 2004, the purpose of the Audit Techniques Guide (ATG) was to offer guidance to IRS auditors auditing cost segregation studies. Because the ATG is an interpretation of the law, as opposed to the law itself, it cannot be cited as precedent. It does however provide an inside look at how the IRS views this subject. The IRS maintains a library of Audit Techniques Guides (ATGs) intended to help IRS examiners during audits by providing insight into issues and accounting methods unique to specific industries. While ATGs are designed to provide guidance for IRS employees, they’re also useful to small business owners and tax professionals who prepare...

Are you a partner in a business? You may have come across a situation that’s puzzling. In a given year, you may be taxed on more partnership income than was distributed to you from the partnership in which you’re a partner. Why does this happen? It’s due to the way partnerships and partners are taxed. Unlike C corporations, partnerships aren’t subject to income tax. Instead, each partner is taxed on the partnership’s earnings — whether or not they’re distributed. Similarly, if a partnership has a loss, the loss is passed through to the partners. (However, various rules may prevent a partner from currently using his or her share of a partnership’s loss to offset other income.) Pass through your share While a partnership isn’t subject to income tax,...

Businesses should be aware that they may be responsible for issuing more information reporting forms for 2022 because more workers may fall into the required range of income to be reported. Beginning this year, the threshold has dropped significantly for the filing of Form 1099-K, “Payment Card and Third-Party Network Transactions.” Businesses and workers in certain industries may receive more of these forms and some people may even get them based on personal transactions. Background of the change Banks and online payment networks — payment settlement entities (PSEs) or third-party settlement organizations (TPSOs) — must report payments in a trade or business to the IRS and recipients. This is done on Form 1099-K. These entities include Venmo and CashApp, as well as gig economy facilitators such as...

The IRS recently released guidance providing the 2023 inflation-adjusted amounts for Health Savings Accounts (HSAs). High inflation rates will result in next year’s amounts being increased more than they have been in recent years. HSA basics An HSA is a trust created or organized exclusively for the purpose of paying the “qualified medical expenses” of an “account beneficiary.” An HSA can only be established for the benefit of an “eligible individual” who is covered under a “high deductible health plan.” In addition, a participant can’t be enrolled in Medicare or have other health coverage (exceptions include dental, vision, long-term care, accident and specific disease insurance). A high deductible health plan (HDHP) is generally a plan with an annual deductible that isn’t less than $1,000 for self-only coverage and...

The next quarterly estimated tax payment deadline is June 15 for individuals and businesses so it’s a good time to review the rules for computing corporate federal estimated payments. You want your business to pay the minimum amount of estimated taxes without triggering the penalty for underpayment of estimated tax. Four methods The required installment of estimated tax that a corporation must pay to avoid a penalty is the lowest amount determined under each of the following four methods: Under the current year method, a corporation can avoid the estimated tax underpayment penalty by paying 25% of the tax shown on the current tax year’s return (or, if no return is filed, 25% of the tax for the current year) by each of four installment due dates. The...

The IRS has begun mailing notices to businesses, financial institutions and other payers that filed certain returns with information that doesn’t match the agency’s records. These CP2100 and CP2100A notices are sent by the IRS twice a year to payers who filed information returns that are missing a Taxpayer Identification Number (TIN), have an incorrect name or have a combination of both. Each notice has a list of persons who received payments from the business with identified TIN issues. If you receive one of these notices, you need to compare the accounts listed on the notice with your records and correct or update your records, if necessary. This can also include correcting backup withholding on payments made to payees. Which returns are involved? Businesses, financial institutions and other payers are...