As you’re aware, certain employers are required to report information related to their employees’ health coverage. Does your business have to comply, and if so, what must be done? Basic rules Certain employers with 50 or more full-time employees (called “applicable large employers” or ALEs) must use Forms 1094-C and 1095-C to report the information about offers of health coverage and enrollment in health coverage for their employees. Specifically, an ALE uses Form 1094-C to report summary information for each employee and to transmit Forms 1095-C to the IRS. A separate Form 1095-C is used to report information about each employee. In addition, Forms 1094-C and 1095-C are used to determine whether an employer owes payments under the employer shared responsibility provisions (sometimes referred to as the...

Sometimes, bigger isn’t better: Your small- or medium-sized business may be eligible for some tax breaks that aren’t available to larger businesses. Here are some examples. QBI deduction For 2018 through 2025, the qualified business income (QBI) deduction is available to eligible individuals, trusts and estates. But it’s not available to C corporations or their shareholders. The QBI deduction can be up to 20% of: QBI earned from a sole proprietorship or single-member limited liability company (LLC) that’s treated as a sole proprietorship for federal income tax purposes, plus QBI passed through from a pass-through business entity, meaning a partnership, LLC classified as a partnership for federal income tax purposes or S corporation. Pass-through business entities report tax items to their owners, who then take them into...

These days, most businesses have websites. But surprisingly, the IRS hasn’t issued formal guidance on when website costs can be deducted. Fortunately, established rules that generally apply to the deductibility of business costs provide business taxpayers launching a website with some guidance as to the proper treatment of the costs. Plus, businesses can turn to IRS guidance that applies to software costs. Hardware versus software Let’s start with the hardware you may need to operate a website. The costs fall under the standard rules for depreciable equipment. Specifically, once these assets are operating, you can deduct 100% of the cost in the first year they’re placed in service (before 2023). This favorable treatment is allowed under the 100% first-year bonus depreciation break. Note: The bonus depreciation rate will begin...

On its website, the IRS has issued guidance on accessing the Inflation Reduction Act of 2022's tax credits for electric vehicles ("Plug-in Electric Drive Vehicle Credit at a Glance"), while the Energy Department listed credit-eligible cars, trucks, and SUVs ("List of Vehicles with Final Assembly in North America") on 8/16/22, just hours after President Biden signed the law. Credit Amounts The Act introduces a $4,000 tax credit for the purchase of used electric vehicles (EVs), and updates the $7,500 credit for new EVs . . . Vehicle Price Caps A major change however is the introduction of caps on the price of new vehicles, based on the buyer's income, that qualify for that credit. The caps imposed are: $55,000 for electric cars, and $80,000 for SUVs and pickup trucks. Final Assembly...

A business or individual might be able to dispose of appreciated real property without being taxed on the gain by exchanging it rather than selling it. You can defer tax on your gain through a “like-kind” or Section 1031 exchange. A like-kind exchange is a swap of real property held for investment or for productive use in your trade or business for like-kind investment real property or business real property. For these purposes, “like-kind” is very broadly defined, and most real property is considered to be like-kind with other real property. However, neither the relinquished property nor the replacement property can be real property held primarily for sale. If you’re unsure whether the property involved in your exchange is eligible for a like-kind exchange, contact us...

Sadly, many businesses have been forced to shut down recently due to the pandemic and the economy. If this is your situation, we can assist you, including taking care of the various tax responsibilities that must be met. Of course, a business must file a final income tax return and some other related forms for the year it closes its doors. The type of return to be filed depends on the type of business you have. Here’s a rundown of the basic requirements. Sole proprietorships. You’ll need to file the usual Schedule C, “Profit or Loss from Business,” with your individual return for the year you close the business. You may also need to report self-employment tax. Partnerships. A partnership must file Form 1065, “U.S. Return of Partnership...

On 8/16/22, President Biden signed into law the so-called Inflation Reduction Act of 2022 (H.R. 5376). In a statement earlier, the White House said, "President Biden and Congressional Democrats have worked together to deliver a historic legislative achievement that defeats special interests, delivers for American families, and grows the economy from the bottom up and middle out". The White House is also planning an event on 9/6/22 to celebrate the enactment of the bill. The $740 billion Act is projected to raise revenue via a new 15% minimum tax on large, profitable corporations and a 1% excise tax on stock buybacks, to achieve the Democrats goal of using the budget reconciliation measure to reduce the U.S. annual deficit (i.e. not the National Debt) by approximately $300...

Although merger and acquisition activity has been down in 2022, there are still companies being bought and sold. If your business is considering merging with or acquiring another business, it’s important to understand how the transaction will be taxed under current law. Stocks vs. assets From a tax standpoint, a transaction can basically be structured in two ways: 1. Stock (or ownership interest). A buyer can directly purchase a seller’s ownership interest if the target business is operated as a C or S corporation, a partnership, or a limited liability company (LLC) that’s treated as a partnership for tax purposes. The current 21% corporate federal income tax rate makes buying the stock of a C corporation somewhat more attractive. Reasons: The corporation will pay less tax and generate more...

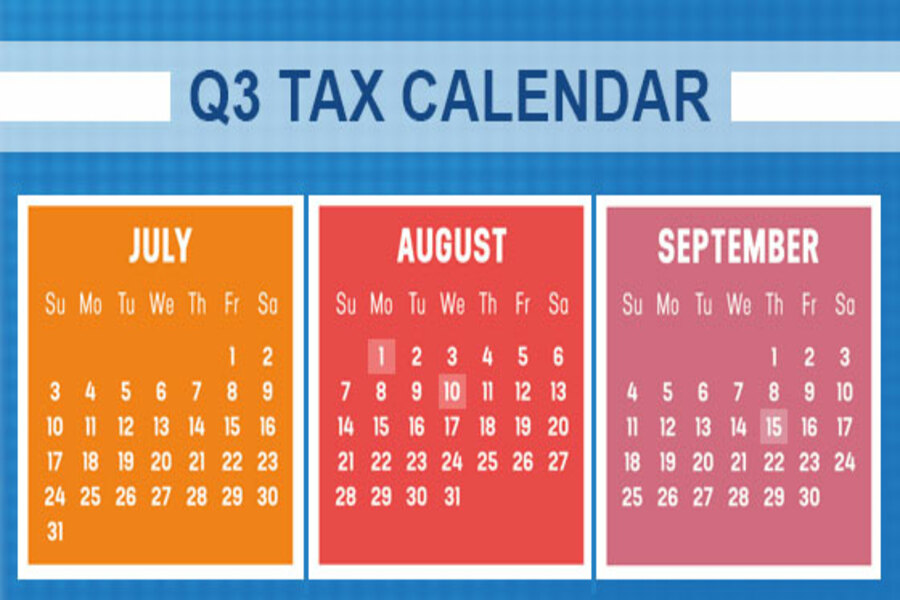

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. August 1 Report income tax withholding and FICA taxes for second quarter 2022 (Form 941), and pay any tax due. (See the exception below, under “August 10.”) File a 2021 calendar-year retirement plan report (Form 5500 or Form 5500-EZ) or request an extension. August 10 Report income tax withholding and FICA taxes for second quarter 2022 (Form 941), if you deposited on time and in full all of the associated taxes due. September 15 ...

Business owners are aware that the price of gas is historically high, which has made their vehicle costs soar. The average nationwide price of a gallon of unleaded regular gas on June 17 was $5, compared with $3.08 a year earlier, according to the AAA Gas Prices website. A gallon of diesel averaged $5.78 a gallon, compared with $3.21 a year earlier. Fortunately, the IRS is providing some relief. The tax agency announced an increase in the optional standard mileage rate for the last six months of 2022. Taxpayers may use the optional cents-per-mile rate to calculate the deductible costs of operating a vehicle for business. For the second half of 2022 (July 1–December 31), the standard mileage rate for business travel will be 62.5 cents per...