As reported via IR-2023-193 on 10/19/2023 Special initiative aimed at helping businesses concerned about an ineligible claim amid aggressive marketing, scams As part of a larger effort to protect small businesses and organizations from scams, the Internal Revenue Service announced the details of a special withdrawal process to help those who filed an Employee Retention Tax Credit (ERTC) claim and are concerned about its accuracy. This new withdrawal option allows certain employers that filed an ERTC claim but have not yet received a refund to withdraw their submission and avoid future repayment, interest and penalties. Employers that submitted an ERTC claim that's still being processed can withdraw their claim and avoid the possibility of getting a refund for which they're ineligible. The IRS created the withdrawal option to help...

Is your business depreciating over 30 years the entire cost of constructing the building that houses your enterprise? If so, you should consider a cost segregation study. It may allow you to accelerate depreciation deductions on certain items, thereby reducing taxes and boosting cash flow. Depreciation basics Business buildings generally have a 39-year depreciation period (27.5 years for residential rental properties). In most cases, a business depreciates a building’s structural components, including walls, windows, HVAC systems, elevators, plumbing and wiring, along with the building. Personal property — including equipment, machinery, furniture and fixtures — is eligible for accelerated depreciation, usually over five or seven years. And land improvements, such as fences, outdoor lighting and parking lots, are depreciable over 15 years. Frequently, businesses allocate all or most of...

If you’re planning to start a business or thinking about changing your business entity, you need to determine what will work best for you. Should you operate as a C corporation or a pass-through entity such as a sole-proprietorship, partnership, limited liability company (LLC) or S corporation? There are many issues to consider. Currently, the corporate federal income tax is imposed at a flat 21% rate, while individual federal income tax rates currently begin at 10% and go up to 37%. The difference in rates can be alleviated by the qualified business income (QBI) deduction that’s available to eligible pass-through entity owners that are individuals, and some estates and trusts. Individual rate caveats: The QBI deduction is scheduled to end in 2026, unless Congress acts to extend it, while...

The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $168,600 for 2024 (up from $160,200 for 2023). Wages and self-employment income above this threshold aren’t subject to Social Security tax. Basic details The Federal Insurance Contributions Act (FICA) imposes two taxes on employers, employees and self-employed workers — one for Old Age, Survivors and Disability Insurance, which is commonly known as the Social Security tax, and the other for Hospital Insurance, which is commonly known as the Medicare tax. There’s a maximum amount of compensation subject to the Social Security tax, but no maximum for Medicare tax. For 2024, the FICA tax rate for employers will be 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same...

Do you use an automobile in your trade or business? If so, you may question how depreciation tax deductions are determined. The rules are complicated, and special limitations that apply to vehicles classified as passenger autos (which include many pickups and SUVs) can result in it taking longer than expected to fully depreciate a vehicle. Depreciation is built into the cents-per-mile rate First, be aware that separate depreciation calculations for a passenger auto only come into play if you choose to use the actual expense method to calculate deductions. If, instead, you use the standard mileage rate (65.5 cents per business mile driven for 2023), a depreciation allowance is built into the rate. If you use the actual expense method to determine your allowable deductions for a passenger...

Ever wonder how IRS examiners know about different industries so they can audit various businesses? They generally do research about specific industries and issues on tax returns by using IRS Audit Techniques Guides (ATGs). A little-known fact is that these guides are available to the public on the IRS website. In other words, your business can use the same guides to gain insight into what the IRS is looking for in terms of compliance with tax laws and regulations. Many ATGs target specific industries, such as construction, aerospace, art galleries, architecture and veterinary medicine. Other guides address issues that frequently arise in audits, such as executive compensation, passive activity losses and capitalization of tangible property. Issues unique to certain taxpayers IRS auditors need to examine all different types...

If you read the Internal Revenue Code (and you probably don’t want to!), you may be surprised to find that most business deductions aren’t specifically listed. For example, the tax law doesn’t explicitly state that you can deduct office supplies and certain other expenses. Some expenses are detailed in the tax code, but the general rule is contained in the first sentence of §162, which states you can write off “all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business.” Basic definitions In general, an expense is ordinary if it’s considered common or customary in the particular trade or business. For example, insurance premiums to protect a store would be an ordinary business expense in the retail...

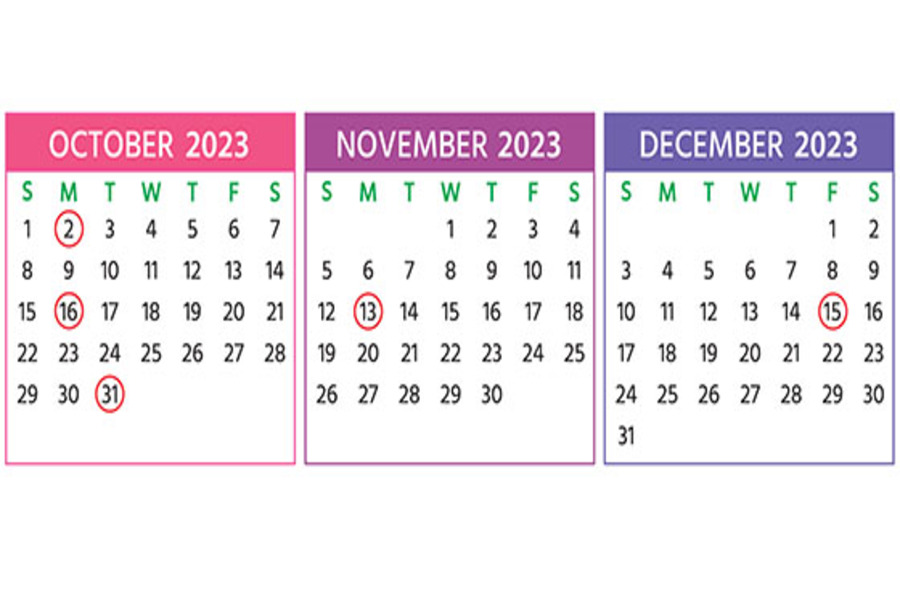

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: Certain tax-filing and tax-payment deadlines may be postponed for taxpayers who reside in or have businesses in federally declared disaster areas. Monday, October 2 The last day you can initially set up a SIMPLE IRA plan, provided you (or any predecessor employer) didn’t previously maintain a SIMPLE IRA plan. If you’re a new employer that comes into existence after October 1 of the year, you can establish a SIMPLE IRA plan as...

In recent years, merger and acquisition activity has been strong in many industries. If your business is considering merging with or acquiring another business, it’s important to understand how the transaction will be taxed under current law. Stocks vs. assets From a tax standpoint, a transaction can basically be structured in two ways: 1. Stock (or ownership interest) sale. A buyer can directly purchase a seller’s ownership interest if the target business is operated as a C or S corporation, a partnership, or a limited liability company (LLC) that’s treated as a partnership for tax purposes. The now-permanent 21% corporate federal income tax rate under the Tax Cuts and Jobs Act (TCJA) makes buying the stock of a C corporation somewhat more attractive. Reasons: The corporation will pay less tax and...

Do you and your spouse together operate a profitable unincorporated small business? If so, you face some challenging tax issues. The partnership issue An unincorporated business with your spouse is classified as a partnership for federal income tax purposes, unless you can avoid that treatment. Otherwise, you must file an annual partnership return, on Form 1065. In addition, you and your spouse must be issued separate Schedule K-1s, which allocate the partnership’s taxable income, deductions and credits between the two of you. This is only the beginning of the unwelcome tax compliance tasks. The self-employment (SE) tax problem The SE tax is how the government collects Social Security and Medicare taxes from self-employed individuals. For 2023, the SE tax consists of 12.4% Social Security tax on the first $160,200...