One of your New Year’s resolutions may be to pay more attention to your health. Of course, that may cost you. Can you deduct your out-of-pocket medical costs on your tax return? It depends. Many expenses are tax deductible, but there are several requirements and limitations that make it difficult for many taxpayers to actually claim a deduction. The rules Medical expenses can be claimed as a deduction only to the extent your unreimbursed costs exceed 7.5% of your adjusted gross income. Plus, medical expenses are deductible only if you itemize, which means that your itemized deductions must exceed your standard deduction. Due to changes in the Tax Cuts and Jobs Act, which generally went into effect in 2018, many taxpayers no longer itemize. Eligible medical costs include...

When you retire, you may think about moving to another state — perhaps because the weather is more temperate or because you want to be closer to family members. Don’t forget to factor state and local taxes into the equation. Establishing residency for state tax purposes may be more complex than you think. Pinpoint all applicable taxes It may seem like a smart idea to simply move to a state with no personal income tax. But, to make a wise and informed decision, you must consider all taxes that can potentially apply to a state resident. In addition to income taxes, these may include property taxes, sales taxes and estate taxes. If the state you’re considering has an income tax, look at the types of income it taxes....

Monetary awards and settlements are often provided for an array of reasons. For example, a person could receive compensatory and punitive damage payments for personal injury, discrimination or harassment. Some of this money is taxed by the federal government, and perhaps by state governments. Hopefully, you’ll never need to know how payments for personal injuries are taxed. But here are the basic rules — just in case you or a loved one does receive an award or settlement and needs to understand them. Under tax law, individuals are permitted to exclude from gross income damages that are received on account of a personal physical injury or a physical sickness. It doesn’t matter if the compensation is from a court-ordered award or an out-of-court settlement, and it...

You may have heard of the “nanny tax.” But if you don’t employ a nanny, you may think it doesn’t apply to you. Check again. Hiring a housekeeper, gardener or other household employee (who isn’t an independent contractor) may make you liable for federal income and other taxes. You may also have state tax obligations. If you employ a household worker, you aren’t required to withhold federal income taxes from pay. However, you may choose to withhold if the worker requests it. In that case, ask the worker to fill out a Form W-4. However, you may be required to withhold Social Security and Medicare (FICA) taxes and to pay federal unemployment (FUTA) tax. Threshold increasing in 2024 In 2023, you must withhold and pay FICA taxes if...

If you have a tax-saving flexible spending account (FSA) with your employer to help pay for health or dependent care expenses, there’s an important date coming up. You may have to use the money in the account by year-end or you’ll lose it (unless your employer has a grace period). As the end of 2023 gets closer, here are some rules and reminders to keep in mind. Health FSA A pre-tax contribution of $3,050 to a health FSA is permitted in 2023. This amount will be increasing to $3,200 in 2024. You save taxes in these accounts because you use pre-tax dollars to pay for medical expenses that might not be deductible. For example, expenses won’t be deductible if you don’t itemize deductions on your tax return. Even...

As reported via IRS Tax Tip 2023-51 4/17/2023 After someone with a filing requirement passes away, their surviving spouse or representative should file the deceased person's final tax return. On the final tax return, the surviving spouse or representative should note that the person has died. The IRS doesn't need a copy of the death certificate or other proof of death. Usually, the representative filing the final tax return is named in the person's will or appointed by a court. Sometimes when there isn't a surviving spouse or appointed representative, a personal representative will file the final return and attach Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer. Things to know about filing the final tax return Generally, the final individual income tax return of a deceased...

Taxpayers who make home energy improvements in 2023 may be able to benefit from tax credits for a portion of the qualifying expenses. The credit amounts have been increased, and types of qualifying expenses were expanded, by the Inflation Reduction Act of 2022. This post is intended to assist taxpayers in comparing the tax credits available for making energy home improvements. Who can claim energy credits There are two energy-related credits available to taxpayers who make qualifying improvements to their home: the Energy Efficient Home Improvement Credit,or the Residential Energy Clean Property Credit. A taxpayer may claim these credits in the year the qualifying improvement has been made to their primary home. Ordinarily, a taxpayer's primary home is where the taxpayer spends most of their time. Additionally, qualification...

As reported via IRS Tax Tip 2023-89 in October 2019 Kids are expensive. Whether someone just brought a bundle of joy home from the hospital, adopted a teen from foster care, or is raising their grandchild. There are several tax breaks that can help. Here are some tax tips for new parents Get the child a Social Security or Individual Tax Identification number To claim parental tax breaks, the taxpayer must have their child or dependent's Social Security number, Adoption Tax Identification Number or Individual Tax Identification number. Confirming a child's birth is the only way the IRS can verify that the parent is eligible for the credits and deductions they claim on their tax return. Check withholding A new family member might make taxpayers eligible for new credits...

As reported via IRS Tax Tip 2023-61 on 5/3/2023 Sometimes the line between having a hobby and running a business can be confusing, but knowing the difference is important because hobbies and businesses are treated differently when it's time to file a tax return. The biggest difference between the two is that businesses operate to make a profit while hobbies are for pleasure or recreation. Whether someone is having fun with a hobby or running a business, if they accept more than $600 for goods and services using online marketplaces or payment apps, they could receive a Form 1099-K. Profits from the sale of goods, including personal items, and services is taxable income that must be reported on tax returns. There are a few other things people should...

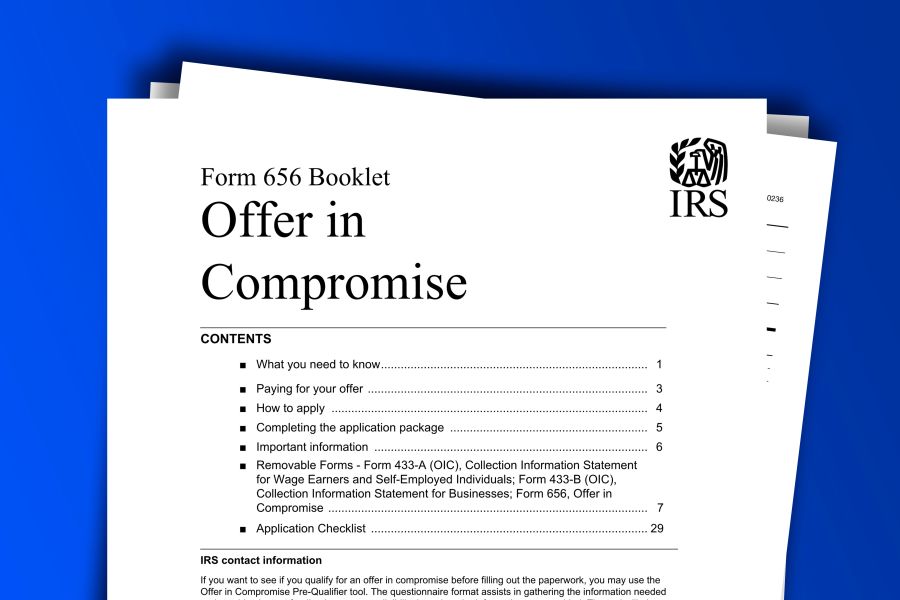

As reported via IRS Tax Tip 2023-58 on 4/27/2023 When a taxpayer can't pay their full tax liability or if paying would cause financial hardship, they may want to consider applying for an Offer in Compromise. This agreement between a taxpayer and the IRS settles a tax debt for less than the full amount owed. The goal is a compromise that's in the best interest of both the taxpayer and the agency. The application fee for an offer in compromise is $205. Low-income taxpayers don't have to pay this fee, and they should check if they meet the definition of low-income in the instructions for Form 656, Offer in Compromise. When reviewing applications, the IRS considers the taxpayer's unique set of facts and special circumstances affecting their...