As Reported via IR-2024-263 on 10/10/2024 The Internal Revenue Service announced on 10/10/2024 continued progress on Employee Retention Tax Credit claims, with processing underway on about 400,000 claims, representing about $10 billion of eligible claims. Work on the claims for small businesses and others is ongoing as the agency continues to navigate a large volume of claims from the complex pandemic-era credit. A significant number of the Employee Retention Tax Credit (ERTC) claims came in during a period of aggressive marketing by promoters, leading to a large percentage of improper, ineligible claims. “The IRS understands the vital importance of Employee Retention Tax Credits payments for struggling small businesses, and we are continuing to make important progress on one of the most complex tax administration provisions we’ve...

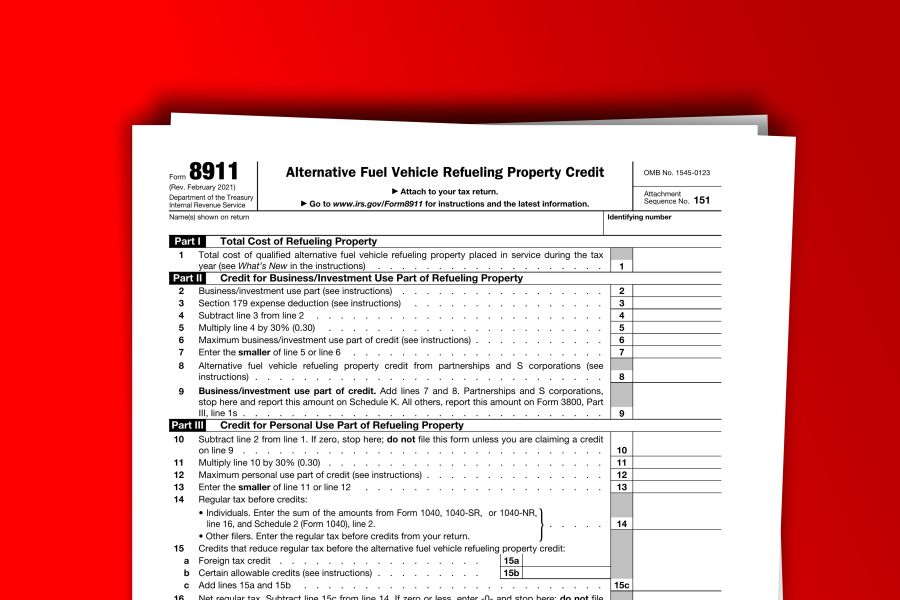

As reported via IR-2024-240 on 9/18/2024 The Department of Treasury and Internal Revenue Service issued proposed regulations to provide guidance for the Alternative Fuel Vehicle Refueling Property Credit (the tax credit related to the installation of EV chargers). The Inflation Reduction Act amended the credit for qualified alternative fuel vehicle refueling property. The changes apply to qualified alternative fuel vehicle refueling property placed in service after 12/31/2022, and before 01/01/2033. Business vs Non-Business Property Property Subject to Depreciation The credit amount for property not subject to depreciation is 30% of the cost of the qualified property placed in service during the tax year. The credit is limited to $1,000 per item of non-depreciable property Property Not Subject to Depreciation The credit amount for depreciable property is 6% of the cost of the...

As appearing in IR-2024-198 Businesses urged to proactively resolve erroneous claims to avoid penalties, interest, audits As the Internal Revenue Service intensifies work on the Employee Retention Tax Credit (ERTC), the agency today shared five new warning signs being seen on incorrect claims by businesses. The new list comes from common issues the IRS compliance teams have seen while analyzing and processing ERTC claims. The new items are in addition to seven problem areas the IRS previously highlighted. The IRS urged businesses with pending claims to carefully review their filings to confirm their eligibility and ensure credits claimed don’t include any of these 12 warning signs or other mistakes. Businesses with these indicators should talk to a trusted tax professional and consider using special ERTC Withdrawal Program that remains available. Business considering...

As appearing in IR-2024-203 Agency accelerates work on complex credit as more payments move into processing. Vigilance, monitoring continues on potentially improper claims On 8/8/24, the Internal Revenue Service announced additional actions to help small businesses and prevent improper payments in the Employee Retention Tax Credit (ERTC) program, including accelerating more payments and continuing compliance work on the complex pandemic-era credit that was flooded with claims following misleading marketing. The IRS is continuing to work denials of improper ERTC claims, intensifying audits and pursuing civil and criminal investigations of potential fraud and abuse. The findings of the IRS review, announced in June, confirmed concerns raised by tax professionals and others that there was an extremely high rate of improper ERTC claims in the current inventory of ERTC claims. In...

As reported in IR-2024-169 IRS enters next stage of Employee Retention Tax Credit work; review indicates vast majority show risk of being improper Highest-risk claims being denied, additional processing to begin on low-risk claims; heightened scrutiny and review continues as compliance work tops $2 billion; IRS will consult with Congress on potential legislative action before making decision on future of moratorium Following a detailed review to protect taxpayers and small businesses, the Internal Revenue Service on June 20, 2024 announced plans to deny tens of thousands of improper high-risk Employee Retention Tax Credit claims while starting a new round of processing lower-risk claims to help eligible taxpayers. “The completion of this review provided the IRS with new insight into risky Employee Retention Tax Credit activity and confirmed widespread concerns...

As reported via IR-2024-16 on 1/19/2024 The Internal Revenue Service and the Department of the Treasury today issued Notice 2024-20 to provide guidance on eligible census tracts for the qualified alternative fuel vehicle refueling property credit (the tax credit applicable to the installation of EV chargers) and to announce the intent to propose regulations for the credit. The Inflation Reduction Act amended the credit for qualified alternative fuel vehicle refueling property. The changes apply to qualified alternative fuel vehicle refueling property placed in service after December 31, 2022 and before January 1, 2033. Business vs Non-Business Property Property Not Subject to Depreciation The credit amount for property not subject to depreciation is 30% of the cost of the qualified property placed in service during the tax year. The credit is...

As the Financial Crimes Enforcement Network (FinCEN) opens its beneficial ownership information (BOI) reporting portal, its BOI webpage, reflects a fraud alert for individuals and entities who may be subject to beneficial ownership information (BOI) reporting. According to the FinCEN fraud alert, individuals and entities that may be subject to the beneficial ownership information (BOI) reporting requirements have been receiving fraudulent correspondence, via email or traditional mail, that appears as though it came from FinCEN. In some instances, the fraudulent correspondence may be titled "Important Compliance Notice" and ask the recipient to click on a URL or to scan a QR code. Be advised that e-mails or letters such as this are fraudulent, according to the alert. FinCEN cautions individuals that it does not send unsolicited requests for information,...

Starting in 2024 newly formed, corporations, limited liability companies (LLCs), limited partnerships, and other entities that file formation papers with a state’s Secretary of State’s office (or similar government agency) must file a report with the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) providing specified information regarding the entity’s “beneficial owners” (the so-called BOI reporting requirement under the Corporate Transparency Act). Entities in existence prior to January 1, 2024, have until January 1, 2025, to file these reports. Penalties are steep This is part of the federal government’s anti-money laundering and anti-tax evasion efforts and is an attempt to look beyond shell companies that are set up to hide money. Unfortunately, this will impose burdensome reporting requirements on most businesses, and the willful failure to report...

The IRS just put up a new webpage and released FAQs having to do with the recently announced Employee Retention Tax Credit (ERTC) Voluntary Disclosure Program. ERTC Voluntary Disclosure Program On December 21, 2023, the IRS announced a new Voluntary Disclosure Program for businesses who claimed the ERC erroneously. The program is part of the IRS' continuing efforts to combat questionable ERTC claims. This special disclosure program affords taxpayers the ability to repay only 80% of the claim received. The program runs through March 22, 2024. New webpage: The new webpage provides information on the advantages of participating in the program, who can apply, how to apply, as well as next steps. FAQs: The FAQs provide detailed information on eligibility, the program process, calculating and paying the amount...

As reported via IR-2023-247 on 12/21/2023 As part of an ongoing initiative aimed at combating dubious Employee Retention Tax Credit (ERTC) claims, the Internal Revenue Service launched a new Voluntary Disclosure Program to help businesses who want to pay back the money they received after filing ERTC claims in error. The new disclosure program, which has been in the works for several months, is part of a larger effort at the IRS to stop aggressive marketing around ERTC that misled some employers into filing claims. The special disclosure program runs through March 22, 2024, and the IRS added provisions allowing repayment of 80% of the claim received. The IRS also continues to urge employers with pending ERTC claims to consider a separate withdrawal program that allows them to...