Noncompete agreements can be valuable to a business, especially after a merger or acquisition. Estimating the value of these agreements has become more complicated in light of a controversial new final rule issued by the Federal Trade Commission (FTC) that will ban noncompetes for most employees and independent contractors, starting in September 2024. Types of noncompetes Noncompete agreements have been a standard business practice for decades. Some are required as a condition of employment or upon termination of employment. Here, the employer requires an employee to sign a noncompete agreement to protect the employer’s business interests, guard against disclosure of trade secrets, and prevent the employee from poaching customers or clients. These agreements generally limit employment activities in the same field for a specified period. Noncompetes also may...

As reported in IR-2024-169 IRS enters next stage of Employee Retention Tax Credit work; review indicates vast majority show risk of being improper Highest-risk claims being denied, additional processing to begin on low-risk claims; heightened scrutiny and review continues as compliance work tops $2 billion; IRS will consult with Congress on potential legislative action before making decision on future of moratorium Following a detailed review to protect taxpayers and small businesses, the Internal Revenue Service on June 20, 2024 announced plans to deny tens of thousands of improper high-risk Employee Retention Tax Credit claims while starting a new round of processing lower-risk claims to help eligible taxpayers. “The completion of this review provided the IRS with new insight into risky Employee Retention Tax Credit activity and confirmed widespread concerns...

As posted to the Munro Live YouTube Channel on 4/24/2024 (Run Time 18 min, 42 sec) Sandy Munro and Armin von Czarnowski demonstrate how steer-by-wire works and examine the components that make it possible in the Cybertruck. Steer-by-wire differs significantly from a normal steering system in that there is no mechanical linkage between the steering wheel and the front wheels. While it may appear perilous to you, it is worth noting that Tesla vehicles are equipped with numerous redundancies. (This is Blog Post #1575) Sandy Munro is an automotive engineer who specializes in machine tools and manufacturing. He joined the Ford Motor Company in 1978 and then started his own consulting company, Munro & Associates, which specializes in lean design, tearing down automotive products to study and suggest improvements and...

According to the Treasury, the US government has provided auto dealers with >$580 million in advance payments for consumer electric vehicle (EV) tax credits since 1/1/2024. Before 2024, American car purchasers were only eligible for the new electric vehicle (EV) credit of up to $7,500 or the $4,000 credit for used EVs when they submitted their tax returns in the subsequent year. Commencing on January 1, consumers have the ability to transfer the credits to a car dealer during the transaction, so reducing the purchase price. This year, the IRS has received almost 100,000 reports on the sale of electric vehicles. A total of 85,000 time of sale tax reports were filed for new electric vehicles (EVs), and more than 90% of these reports included requests for advance...

The IRS' recent declaration of a rigorous enforcement against the utilization of corporate jets has attracted widespread attention, as the Biden administration persists in intensifying its examination of affluent individuals and major corporations with intricate tax arrangements. Zeinat Zughayer, a tax controversy manager at Baker Tilly, provided information on the driving force behind the recent wave of audits and the extent of their coverage. The IRS recently declared its intention to commence several audits targeting the apportionment of corporate aircraft usage between business and personal purposes by executives, partners, shareholders, and other individuals for tax-related matters. According to the IRS, the level of personal usage has an effect on the eligibility for specific company deductions. "Utilizing the company jet for personal travel usually leads to the...

As reported in IR-2024-46 Using Inflation Reduction Act funding and as part of ongoing efforts to improve tax compliance in high-income categories, the Internal Revenue Service announced on 2/21/24 plans to begin dozens of audits on business aircraft involving personal use. The audits will be focused on aircraft usage by large corporations, large partnerships and high-income taxpayers and whether for tax purposes the use of jets is being properly allocated between business and personal reasons. The IRS will be using advanced analytics and resources from the Inflation Reduction Act to more closely examine this area, which has not been closely scrutinized during the past decade as agency resources fell sharply. The number of audits related to aircraft usage could increase in the future following initial results and as...

We are finding that, all too often, taxpayers that make Employee Retention Tax Credit (ERTC) claims by engaging a so-called “ERTC Mill” are never told of their responsibility to amend their applicable prior year federal income tax return(s), and are shocked to learn that they owe additional taxes, penalties and interest. In order to offset their wage expense for the amount of the credit claimed, taxpayers who file an amended Form 941-X to claim an ERTC refund must simultaneously file an amended income tax return(s) for the tax year(s) in which the ERTC-eligible wages were paid. Because of the resulting lower salary expense, this results in a higher tax burden for taxpayers with sizable ERTC refunds. Reasonable Cause Penalty Relief To the extent an ERTC was retroactively claimed,...

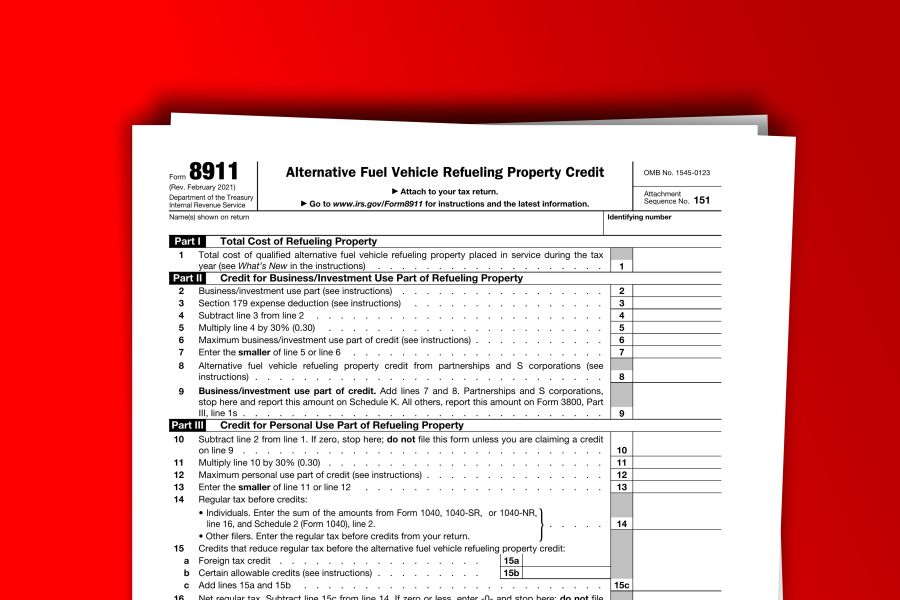

As reported via IR-2024-16 on 1/19/2024 The Internal Revenue Service and the Department of the Treasury today issued Notice 2024-20 to provide guidance on eligible census tracts for the qualified alternative fuel vehicle refueling property credit (the tax credit applicable to the installation of EV chargers) and to announce the intent to propose regulations for the credit. The Inflation Reduction Act amended the credit for qualified alternative fuel vehicle refueling property. The changes apply to qualified alternative fuel vehicle refueling property placed in service after December 31, 2022 and before January 1, 2033. Business vs Non-Business Property Property Not Subject to Depreciation The credit amount for property not subject to depreciation is 30% of the cost of the qualified property placed in service during the tax year. The credit is...

As the Financial Crimes Enforcement Network (FinCEN) opens its beneficial ownership information (BOI) reporting portal, its BOI webpage, reflects a fraud alert for individuals and entities who may be subject to beneficial ownership information (BOI) reporting. According to the FinCEN fraud alert, individuals and entities that may be subject to the beneficial ownership information (BOI) reporting requirements have been receiving fraudulent correspondence, via email or traditional mail, that appears as though it came from FinCEN. In some instances, the fraudulent correspondence may be titled "Important Compliance Notice" and ask the recipient to click on a URL or to scan a QR code. Be advised that e-mails or letters such as this are fraudulent, according to the alert. FinCEN cautions individuals that it does not send unsolicited requests for information,...

Starting in 2024 newly formed, corporations, limited liability companies (LLCs), limited partnerships, and other entities that file formation papers with a state’s Secretary of State’s office (or similar government agency) must file a report with the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) providing specified information regarding the entity’s “beneficial owners” (the so-called BOI reporting requirement under the Corporate Transparency Act). Entities in existence prior to January 1, 2024, have until January 1, 2025, to file these reports. Penalties are steep This is part of the federal government’s anti-money laundering and anti-tax evasion efforts and is an attempt to look beyond shell companies that are set up to hide money. Unfortunately, this will impose burdensome reporting requirements on most businesses, and the willful failure to report...