(Run Time 1 min, 44 sec) When working with an existing dealer for the first time, the first step is to break everything down to the lowest common denominator, so-to-say. Each entity, and how these related companies interact with each other. Consider whether the interactions are arranged in a tax-wise manner. This has become even more important now in light of the recent Tax Cuts and Jobs Act. Heralded as containing the most sweeping changes in decades, new rules such as the 30% Business Interest Limitation and the 20% Qualified Business Income deduction have turned tax planning on it’s ear. Looking at everything with a new set of eyes can be very . . . well, eye-opening. The same goes for the dealership returns. At the end...

As posted to the Tony Seba YouTube Channel on 10/30/2019 (Run Time 31 min, 17 sec) Based on Tony Seba's #1 Amazon bestselling book "Clean Disruption of Energy and Transportation" and "Rethinking Transportation 2020-2030", this presentation lays out the key technologies (batteries, electric vehicles, autonomous vehicles), business model innovations (ride-hailing, transportation-as-a-service), how the technology disruption will affect existing companies and sectors (market trauma) and how it will unfold over the next decade, as well as key implications for society, finance, industry, cities, and infrastructure. (This is Blog Post #907) Tony Seba is the author of "Clean Disruption of Energy and Transportation - How Silicon Valley Will Make Oil, Nuclear, Natural Gas, Coal, Electric Utilities and Conventional Cars Obsolete by 2030" and "Rethinking Transportation 2020-2030". He is the creator of...

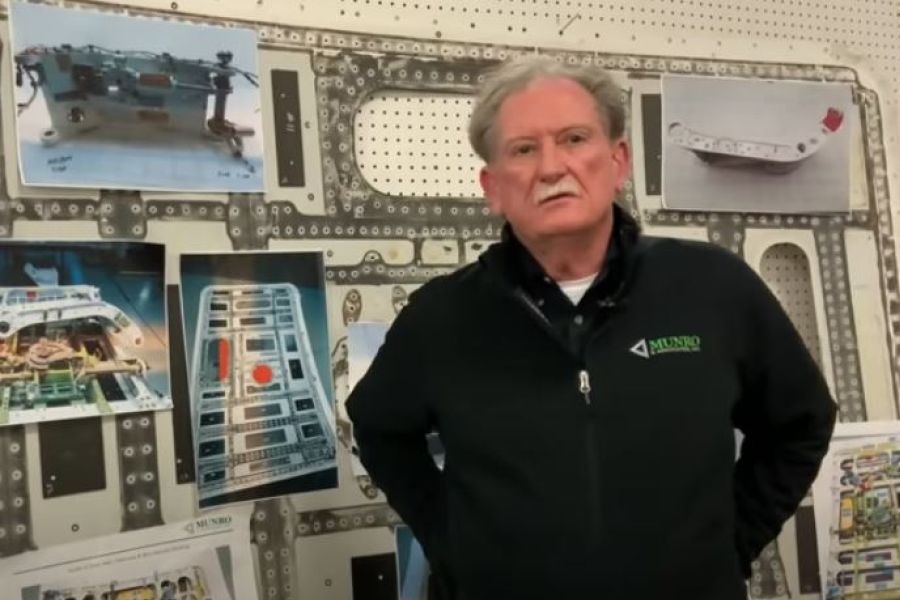

As posted to the Munro Live YouTube Channel on 10/9/2020 (Run Time 22 min, 38 sec) This video is an "abridged" version of a presentation given by legendary automotive engineer Sandy Munro in September, 2020. On Testa's growing lead in technology, Sandy comments, "It is not the big that eat the small, but rather the fast that eat the slow". (This is Blog Post #905) Sandy Munro is an automotive engineer who specializes in machine tools and manufacturing. He joined the Ford Motor Company in 1978 and then started his own consulting company, Munro & Associates, which specializes in lean design, tearing down automotive products to study and suggest improvements and innovations....

I'm happy to report that my second ad has now been published in 2020 Issue 3 of the California New Car Dealers Association quarterly magazine, "California New Car Dealer Quarterly". (Run time 2 min, 0 sec) Whether you’re a successful General Manager that now finds him or herself a newly minted Dealer Principal seeking an Automobile Dealership CPA Firm . . . or a seasoned automotive veteran looking to make a change to an Automotive CPA that understands your business . . . we need to talk. I’m Roger Rossmeisl, a senior partner with Kho & Patel CPAs with offices in Southern California. For the past 35+ years my practice has been serving franchise new vehicle dealerships with their tax, attest and consulting needs. Today, an automotive-centric CPA is...

Preventing fraud from costing your company can sometimes seem like a game of whack-a-mole: Squash one scheme and another one pops up. Business service scams are particularly abundant. Fraud perpetrators know that business owners don’t always have time to verify the identities of salespeople or service reps and the legitimacy of their claims. Your best defense is to refuse to pay anyone anything until you’ve ascertained the facts. It also helps to know what schemes are popular with criminals. Here are 5 business service scams to watch out for. (1) Utility Bill Fraudsters Someone claiming to be from your gas, electric or water company may call and say services are about to be cut off for non-payment. However, you can stop the discontinuation if you immediately pay the...

If your company faces the need to “remediate” or clean up environmental contamination, the money you spend can be deductible on your tax return as ordinary and necessary business expenses. There are however "timing difference" types of tax implications of environmental cleanup. You want to claim the maximum immediate income tax benefits possible for the expenses you incur but that may not always be possible. These expenses may include the actual cleanup costs, as well as expenses for environmental studies, surveys and investigations, fees for consulting and environmental engineering, legal and professional fees, environmental “audit” and monitoring costs, and other expenses. Current deductions vs. capitalized costs Unfortunately, every type of environmental cleanup expense cannot be currently deducted. Some cleanup costs must be capitalized. But, generally, cleanup costs are...

Do you want to withdraw cash from your closely held corporation at a low tax cost? The easiest way is to distribute cash as a dividend. However, a dividend distribution isn’t tax-efficient, since it’s taxable to you to the extent of your corporation’s “earnings and profits.” But it’s not deductible by the corporation. Fortunately, there are several alternative methods that may allow you to withdraw cash from a corporation while avoiding dividend treatment. Here are five ideas: (1) Capital repayments To the extent that you’ve capitalized the corporation with debt, including amounts that you’ve advanced to the business, the corporation can repay the debt without the repayment being treated as a dividend. Additionally, interest paid on the debt can be deducted by the corporation. This assumes that the...

As posted to the Chris Fix YouTube Channel on 10/15/19 (Run Time: 16 min, 10 sec) What is the best fuel to use in your vehicle? Chris Fix explains the octane rating system and other related matters in this informative clip. (This is Blog Post #635) Chris Fix creates and posts easy-to-follow, step-by-step how-to style videos for both beginners and experts that want to save money by fixing their own car. With new content every 10 days or so, Chris takes pride in helping others at the Chris Fix YouTube Channel. ...