(This is Blog Post #743)...

As posted to the Peak Prosperity YouTube Channel on February 12, 2020 (Run time 10 min 27 sec) In Update #20, on the Wuhan New Coronavirus (now officially "Covid-19"), Chris Martenson reports: "The Coronavirus continues its spread through China and surrounding Asian countries. The data increasingly show that this virus is wickedly contagious, especially in crowded environments where population density is high -- like the densely-packed buildings in cities. As a frightening example: in Japan, a health worker was infected while inspecting a quarantined cruise ship, despite wearing a hazmat suit and taking standard precautions. On the more positive side, we are hearing "success" stories from those who have now recovered from the virus. These are mostly folks who had less serious cases, which is around 80% of those...

As you’ve probably heard, a new law was recently passed with a wide range of retirement plan changes for employers and individuals. One of the provisions of the SECURE Act involves a new requirement for employers that sponsor tax-favored defined contribution retirement plans that are subject to ERISA. Soon, employers must disclose retirement income to employees. Specifically, the law will require that the benefit statements sent to plan participants include a lifetime income disclosure at least once during any 12-month period. The disclosure will need to illustrate the monthly payments that an employee would receive if the total account balance were used to provide lifetime income streams, including a single life annuity and a qualified joint and survivor annuity for the participant and the participant’s surviving...

As posted to the Peak Prosperity YouTube Channel on February 11, 2020 (Run time 22 min 57 sec) In Update #19, on the Wuhan New Coronavirus (now officially "Covid-19"), Chris Martenson reports: "After updating on the latest case information, this video explains what a cytokine storm is, how that actually is the cause of harm, and additional troubling information that nCoV (now "Covid-19") spreads through the air. Can a vaccine be developed soon? Well, a prior attempt to create one for SARS ended up doing more harm than good in animal models. This means we may need to temper our hopes for a quick vaccine and allow the process to run. It may take a while - a year or more? Which means people need to be ready to hunker...

If you reside in a high-tax state, you may want to want to use nongrantor trusts to bypass the SALT deduction limit (the $10,000 federal limit on State And Local Tax deductions. The limit can significantly reduce itemized deductions if your state income and property taxes are well over $10,000. A potential strategy for avoiding the limit is to transfer interests in real estate to several nongrantor trusts, each of which enjoys its own $10,000 SALT deduction. Grantor vs. nongrantor trusts The main difference between a grantor and nongrantor trust is that a grantor trust is treated as your alter ego for tax purposes, while a nongrantor trust is treated as a separate entity. Traditionally, grantor trusts have been the vehicle of choice for estate planning purposes...

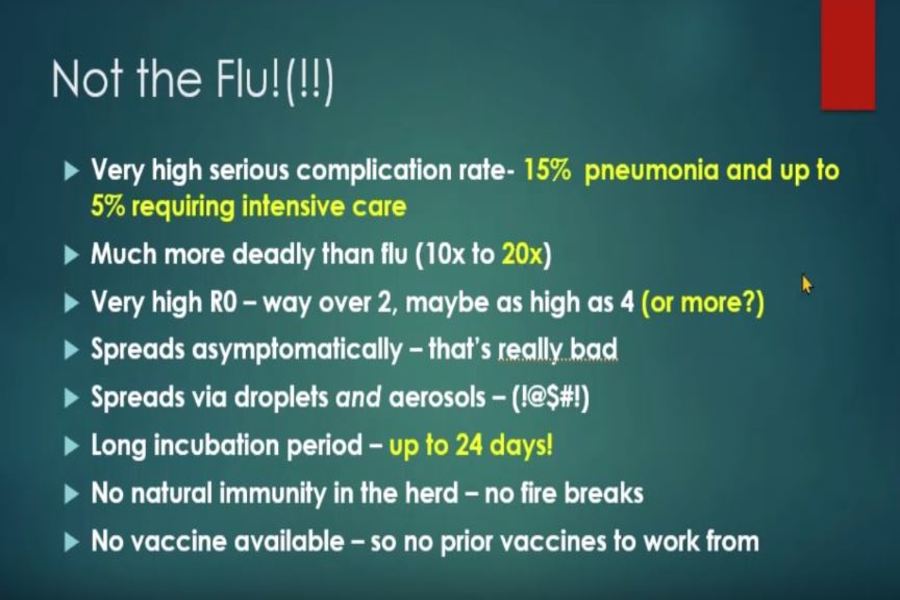

As posted to the Peak Prosperity YouTube Channel on February 10, 2020 (Run time 20 min 44 sec) In Update #18, on the Wuhan New Coronavirus (officially "2019-ncov"), Chris Martenson reports: "A new report finds that the incubation period for the Coronavirus may be as long as 24 days, 10 days longer than previous expected. That means that the potential size of "infected & contagious yet unaware" masses walking around (outside of China's quarantine borders) could be substantially larger than feared. On top of that, additional data from China's hospitals in Wuhan show that once a patient is hospitalized, meaning their condition has become severe, the death rate is very high (~20%). More reinforcement that you want to avoid this virus if at all possible. And yet, the stock market...

If you save for retirement with an IRA or other plan, you’ll be interested to know that Congress recently passed a law that makes significant modifications to these accounts. The SECURE Act, which was signed into law on December 20, 2019, made these four changes which may affect your retirement plan. Change #1: The maximum age for making traditional IRA contributions is repealed Before 2020, traditional IRA contributions weren’t allowed once you reached age 70½. Starting in 2020, an individual of any age can make contributions to a traditional IRA, as long he or she has compensation, which generally means earned income from wages or self-employment. Change #2: The required minimum distribution (RMD) age was raised from 70½ to 72 Before 2020, retirement plan participants and IRA owners were...

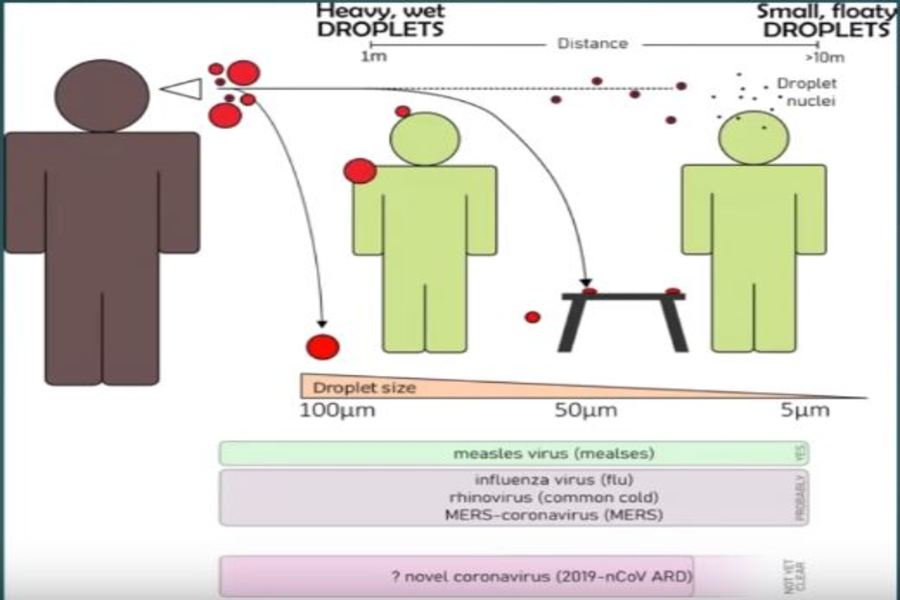

As posted to the Peak Prosperity YouTube Channel on February 9, 2020 (Run time 27 min 35 sec) In Update #17, on the Wuhan New Coronavirus (officially "2019-ncov"), Chris Martenson reports: Is the Coronavirus far worse than we thought? New research suggest that is the case. "Chinese officials are now warning the Wuhan Coronavirus may spread by aerosol transmission. We have known it spreads via fomites contained within mucus-based globules, spread by coughing, sneezing, etc. But if it also transmits from human to human via aerosol means, it's likely FAR more contagious than previously feared. Many of the most contagious diseases, like measles, spread as aerosols -- tiny particles that hang in the air for a protracted time. If confirmed, this makes a very bad situation substantially worse. And adding...

A significant law was recently passed that adds tax breaks and makes changes to employer-provided retirement plans. If your small business has a current plan for employees or if you’re thinking about adding one, you should familiarize yourself with the new rules. The Setting Every Community Up for Retirement Enhancement Act (SECURE Act) was signed into law on December 20, 2019 as part of a larger spending bill. Here are three provisions of interest to small businesses which helps secure employees retirement. Employers that are unrelated will be able to join together to create one retirement plan Beginning in 2021, new rules will make it easier to create and maintain a multiple employer plan (MEP). A MEP is a single plan operated by two or more unrelated employers....

You may already know how CPAs can help businesses uncover and prevent fraud. But what about when a fraud incident leads to civil litigation? Don't contemplate fraud litigation without an experienced CPA that can help your legal team collect and summarize complex financial documents and reconstruct lost or stolen records. CPAs can also serve as expert witnesses in court. From investigator to expert witness As a fraud investigation becomes a fraud case, CPAs can help identify critical evidence. They may also be enlisted to analyze and translate financial data for attorneys, insurers and other parties. These financial experts can be equally valuable with depositions by helping to frame questions that attorneys ask witnesses. They also are skilled at spotting inconsistencies and flaws in witness testimony. Once a case...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150