The COVID-19 pandemic has put enormous pressure on medical practices and healthcare workers. The last thing they need right now is to worry about financial losses and other negative repercussions of occupational fraud. So that physicians and their employees can focus on patient care, they should take a little time now to ensure strong internal controls are in place. Elements of embezzlement According to the Association of Certified Fraud Examiners, embezzlement is the most common form of occupational fraud in medical practices. For example, crooked employees might: Steal receipts or cash on hand, Alter or forge checks, Submit fictitious invoices, Pay personal expenses with practice funds, or Cheat on their expense reimbursement requests. Unfortunately, the complexity of medical practice paperwork discourages many physicians from involvement in the administrative...

As a result of the current estate tax exemption amount ($11.58 million in 2020), many estates no longer need to be concerned with federal estate tax. Before 2011, a much smaller amount resulted in estate plans attempting to avoid it. Now, because many estates won’t be subject to estate tax, more planning can be devoted to saving income taxes for your heirs. While saving both income and transfer taxes has always been a goal of estate planning, it was more difficult to succeed at both when the estate and gift tax exemption level was much lower. Here are some strategies to consider. Plan gifts that use the annual gift tax exclusion One of the benefits of using the gift tax annual exclusion to make transfers during life is...

(Run Time: 1 min, 40 sec) Working with a first-time auto dealer is an important job. One reason is because everything is new. Everything must be set up from scratch. I always say that it’s easier to do something right the first time than to have to fix it later. But you have to let me help . . . keep me in the loop. I had a dealership client once that was on the grow . . . purchasing a new dealership every year. The problem was that his attorney didn’t know dealerships, and I never heard about the transaction until it was consummated. The result? Every year, I spent a good amount of time figuring out how to undo errors in the business entity formations,...

(Run Time 1 min, 44 sec) When working with an existing dealer for the first time, the first step is to break everything down to the lowest common denominator, so-to-say. Each entity, and how these related companies interact with each other. Consider whether the interactions are arranged in a tax-wise manner. This has become even more important now in light of the recent Tax Cuts and Jobs Act. Heralded as containing the most sweeping changes in decades, new rules such as the 30% Business Interest Limitation and the 20% Qualified Business Income deduction have turned tax planning on it’s ear. Looking at everything with a new set of eyes can be very . . . well, eye-opening. The same goes for the dealership returns. At the end...

Do you buy or lease computer software to use in your business? Do you develop computer software for use in your business, or for sale or lease to others? Then you should be aware of the complex rules that apply to determine the tax rules for deducting software, whether you're buying, leasing or developing. Purchased software Some software costs are deemed to be costs of “purchased” software, meaning software that’s either: Non-customized software available to the general public under a non-exclusive license or Acquired from a contractor who is at economic risk should the software not perform. The entire cost of purchased software can be deducted in the year that it’s placed into service. The cases in which the costs are ineligible for this immediate write-off are the...

Management consulting company McKinsey reports that synthetic identity theft is growing fast. In fact, it's the fastest growing financial crime in the United States. And a LexisNexis Risk Solutions study has found that 20% of ID theft losses by banks can be attributed to synthetic versions of the scheme. If you’re unfamiliar with synthetic ID theft, you should know that it’s not — as its name might imply — a weaker, less “real” form of fraud. In fact, it tends to be much harder to prevent and detect. That’s because all a perpetrator needs to create an identity for criminal purposes is a Social Security number (SSN). Frankenstein monsters Traditionally, identity theft occurs when a thief gets hold of someone’s personal information and uses it to assume his...

As posted to the Tony Seba YouTube Channel on 10/30/2019 (Run Time 31 min, 17 sec) Based on Tony Seba's #1 Amazon bestselling book "Clean Disruption of Energy and Transportation" and "Rethinking Transportation 2020-2030", this presentation lays out the key technologies (batteries, electric vehicles, autonomous vehicles), business model innovations (ride-hailing, transportation-as-a-service), how the technology disruption will affect existing companies and sectors (market trauma) and how it will unfold over the next decade, as well as key implications for society, finance, industry, cities, and infrastructure. (This is Blog Post #907) Tony Seba is the author of "Clean Disruption of Energy and Transportation - How Silicon Valley Will Make Oil, Nuclear, Natural Gas, Coal, Electric Utilities and Conventional Cars Obsolete by 2030" and "Rethinking Transportation 2020-2030". He is the creator of...

In some cases, investors have significant related expenses, such as the cost of subscriptions to financial periodicals and clerical expenses. Are they tax deductible? Under the Tax Cut and Jobs Act, these expenses aren’t deductible through 2025 if they’re considered expenses for the production of income. But they are deductible if they’re considered trade or business expenses. (For tax years before 2018, production-of-income expenses were deductible, but were included in miscellaneous itemized deductions, which were subject to a 2%-of-adjusted-gross-income floor.) The deductibility of portfolio management and related invesmtnet expenses requires determining if you’re an investor or a trader — and be aware that it’s more advantageous (and difficult) to qualify for trader status. Engaged in a Trade or Business To qualify, you must be engaged in a...

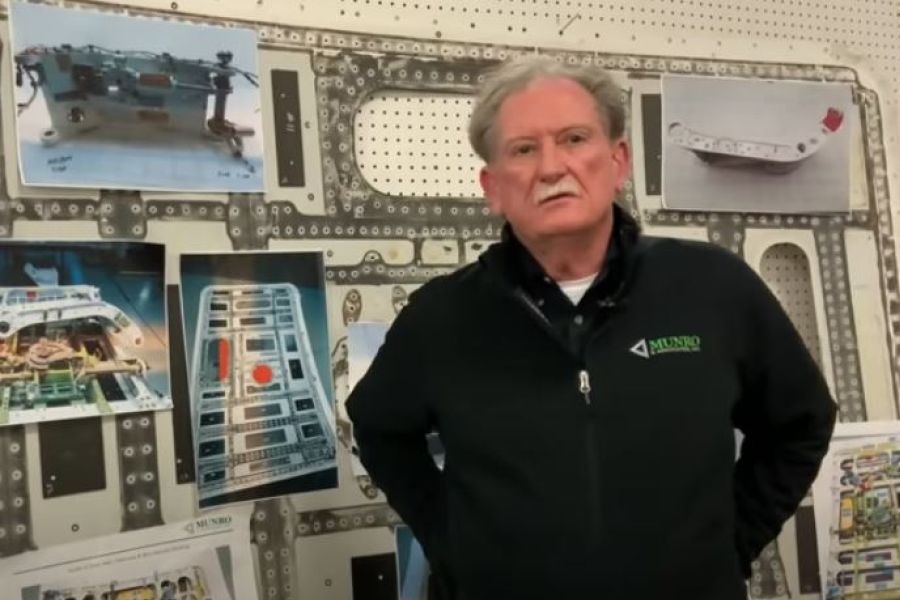

As posted to the Munro Live YouTube Channel on 10/9/2020 (Run Time 22 min, 38 sec) This video is an "abridged" version of a presentation given by legendary automotive engineer Sandy Munro in September, 2020. On Testa's growing lead in technology, Sandy comments, "It is not the big that eat the small, but rather the fast that eat the slow". (This is Blog Post #905) Sandy Munro is an automotive engineer who specializes in machine tools and manufacturing. He joined the Ford Motor Company in 1978 and then started his own consulting company, Munro & Associates, which specializes in lean design, tearing down automotive products to study and suggest improvements and innovations....

Forensic accountants have many tools to help them find evidence of hidden assets or fraud. But one of the most effective, particularly in divorce matters or legal disputes with former business partners, is using lifestyle analysis to find hidden income and assets. This method involves developing a financial profile of a subject and then examining mismatches between the person’s known resources and lifestyle. Financial profiling Forensic accountants develop a financial profile of a subject by examining: Bank deposits. The expert reconstructs the subject’s income by analyzing bank deposits, canceled checks and currency transactions, as well as accounts for cash payments from undeposited receipts and non-income cash sources, such as gifts and insurance proceeds. Expenditures. Here, the expert analyzes the subject’s personal income sources and uses of cash during a...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153