The Coronavirus Aid, Relief and Economic Security (CARES) Act made changes to excess business losses. This includes some changes that are retroactive and there may be opportunities for some businesses to file amended tax returns. If you hold an interest in a business, or may do so in the future, here is more information about the changes. Deferral of the excess business loss limits The Tax Cuts and Jobs Act (TCJA) provided that net tax losses from active businesses in excess of an inflation-adjusted $500,000 for joint filers, or an inflation-adjusted $250,000 for other covered taxpayers, are to be treated as net operating loss (NOL) carryforwards in the following tax year. The covered taxpayers are individuals, estates and trusts that own businesses directly or as partners in a...

Fraud tends to flourish during periods of prosperity. The reason is simple: When companies experience fast-growing revenues and rising net profits, they may lack a strong incentive to divert resources to preventing and detecting fraud. Fraud schemes can go undetected for months, even years. Furthermore, the sheer volume of legitimate transactions during thriving economic times makes it harder to detect fraudulent transactions. Normally, an economic slowdown correlates with increased fraud detection. But the COVID-19 pandemic has upended normal expectations. Companies may need to find new methods of unmasking fraud. Fraud continues … and even grows With millions of employees working from their homes, there are fewer people in the office to notice and report irregularities. And many managers are too distracted with crisis-related activities to perform the proper...

COVID-19 has changed our lives in many ways, and some of the changes have tax implications. Here is basic information about two common situations . . . tax implications of working from home, and collecting unemployment. 1. Working from home Many employees have been told not to come into their workplaces due to the pandemic. If you’re an employee who “telecommutes” — that is, you work at home, and communicate with your employer mainly by telephone, videoconferencing, email, etc. — you should know about the strict rules that govern whether you can deduct your home office expenses. Unfortunately, employee home office expenses aren’t currently deductible, even if your employer requires you to work from home. Employee business expense deductions (including the expenses an employee incurs to maintain a...

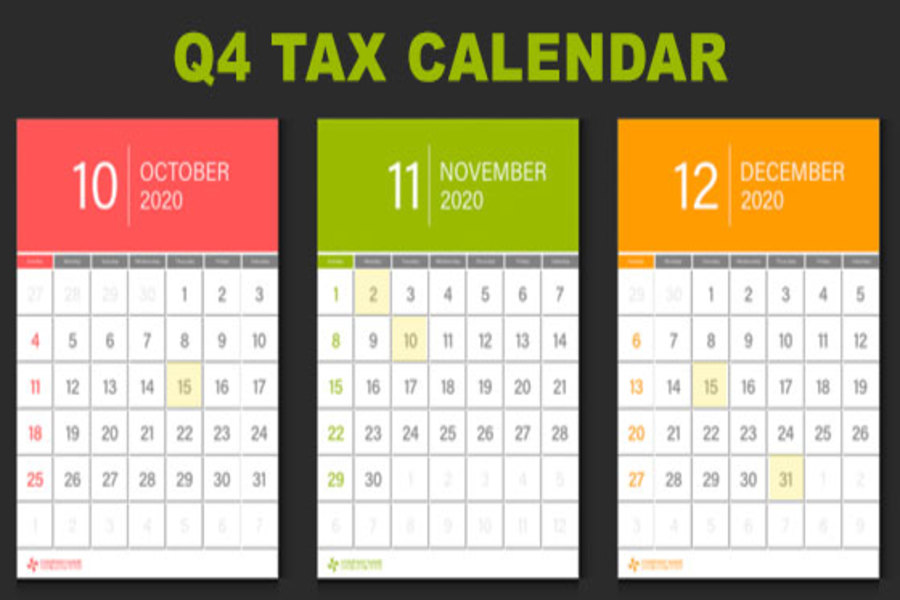

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2020. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Thursday, October 15 If a calendar-year C corporation that filed an automatic six-month extension: File a 2019 income tax return (Form 1120) and pay any tax, interest and penalties due. Make contributions for 2019 to certain employer-sponsored retirement plans. Monday, November 2 Report income tax withholding and FICA taxes for third quarter 2020 (Form 941) and pay any tax due. (See exception below under “November 10.”) Tuesday, November 10 Report income tax withholding and FICA taxes for third quarter 2020 (Form 941), if you deposited on time (and in full) all of the associated...

If you’re getting close to retirement, you may wonder: Are my Social Security benefits going to be taxed? And if so, how much will you have to pay? It depends on your other income. If you’re taxed, between 50% and 85% of your benefits could be taxed. (This doesn’t mean you pay 85% of your benefits back to the government in taxes. It merely that you’d include 85% of them in your income subject to your regular tax rates.) Crunch the numbers To determine how much of your benefits are taxed, first determine your other income, including certain items otherwise excluded for tax purposes (for example, tax-exempt interest). Add to that the income of your spouse, if you file joint tax returns. To this, add half of the...

In the COVID-19 era, many parents are hiring nannies and babysitters because their daycare centers and summer camps have closed. This means that more parents may owe "nanny tax" this year. Keep in mind that the nanny tax may apply to all household workers, including housekeepers, babysitters, gardeners or others who aren’t independent contractors. If you employ someone who’s subject to the nanny tax, you aren’t required to withhold federal income taxes from the individual’s pay. You only must withhold if the worker asks you to and you agree. (In that case, ask the nanny to fill out a Form W-4.) However, you may have other withholding and payment obligations. Withholding FICA and FUTA You must withhold and pay Social Security and Medicare taxes (FICA) if your nanny earns...

With a median loss of $954,000, financial statement fraud is the costliest type of white-collar crime, according to the Association of Certified Fraud Examiners. Fortunately, auditors and forensic accountants may be able to detect inflated income and other financial manipulation by testing journal entries. Unearthing suspicious entries Financial statement frauds come in many forms. For example, out-of-period revenue can be recorded to inflate revenue. Repair costs can be improperly capitalized as fixed assets to boost earnings. Accounts payable can be understated by recording post-closing journal entries to income. Or expenses can be reclassified to reserves and intercompany accounts, thereby increasing earnings. To detect these types of scams, auditors: Learn about the company’s financial reporting process and controls over journal entries, Identify and select journal entries and other adjustments...

Does your employer provide you with group term life insurance? If so, and if the coverage is higher than $50,000, this employee benefit may create undesirable income tax consequences for you. “Phantom income” The first $50,000 of group term life insurance coverage that your employer provides is excluded from taxable income and doesn’t add anything to your income tax bill. But the employer-paid cost of group term coverage in excess of $50,000 is taxable income to you. It’s included in the taxable wages reported on your Form W-2 — even though you never actually receive it. In other words, it’s “phantom income.” What’s worse, the cost of group term insurance must be determined under a table prepared by IRS even if the employer’s actual cost is less than...

The IRS has provided guidance to employers regarding the recent presidential action to allow employers to defer the withholding, deposit and payment of certain payroll tax obligations. The three-page guidance in Notice 2020-65 was issued to implement President Trump’s executive memorandum signed on August 8. Even with the guidance, employers have questions about FICA deferral, specifically whether, and how, to implement the optional deferral. The President’s action only defers the employee’s share of Social Security taxes; it doesn’t forgive them, meaning employees will still have to pay the taxes later unless Congress acts to eliminate the liability. (The payroll services provider for federal employers announced that federal employees will have their taxes deferred.) Deferral basics President Trump issued the memorandum in light of the COVID-19 crisis. He directed the...

While you probably don’t have any problems paying your tax bills, you may wonder: What happens in the event you can’t pay your taxes on time? Here’s a look at the options. Most importantly, don’t let the inability to pay your tax liability in full keep you from filing a tax return properly and on time. In addition, taking certain steps can keep the IRS from instituting punitive collection processes. Common penalties The “failure to file” penalty accrues at 5% per month or part of a month (to a maximum of 25%) on the amount of tax your return shows you owe. The “failure to pay” penalty accrues at only 0.5% per month or part of a month (to 25% maximum) on the amount due on the...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150