If you’re paying back college loans for yourself or your children, you may wonder if you can deduct the interest you pay on the loans. The answer is yes, subject to certain limits. The maximum amount of student loan interest you can deduct each year is $2,500. Unfortunately, the deduction is phased out if your adjusted gross income (AGI) exceeds certain levels, and as explained below, the levels aren’t very high. The interest must be for a “qualified education loan,” which means a debt incurred to pay tuition, room and board, and related expenses to attend a post-high school educational institution, including certain vocational schools. Certain postgraduate programs also qualify. Therefore, an internship or residency program leading to a degree or certificate awarded by an institution...

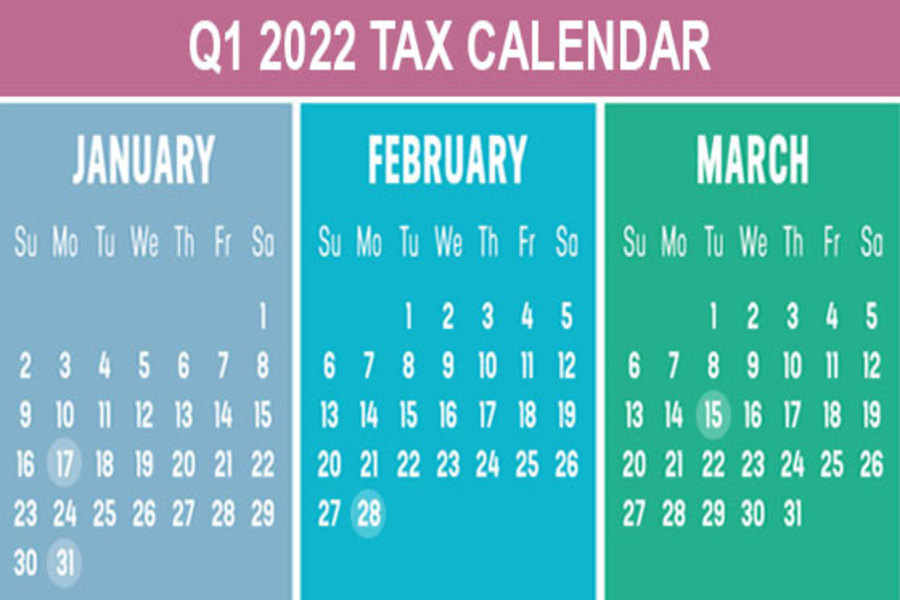

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. January 17 (The usual deadline of January 15 is a Saturday) Pay the final installment of 2021 estimated tax. Farmers and fishermen: Pay estimated tax for 2021. January 31 File 2021 Forms W-2, “Wage and Tax Statement,” with the Social Security Administration and provide copies to your employees. Provide copies of 2021 Forms 1099-MISC, “Miscellaneous Income,” to recipients of income from your business where required. File 2021 Forms 1099-MISC, reporting nonemployee compensation payments...

Companies of all sizes routinely outsource work to third-party contractors. Yet, each third-party hire comes with risk. Whether deliberate or unintentional, a third party’s actions can cost you money and harm your company’s reputation — particularly if they violate laws and regulations. Here’s how to contain possible threats. Potential problems Suppose your company employs an overseas trucking company to transport goods from a port to a customer’s warehouse. The driver could pay a kickback to customs personnel to release shipments quickly — potentially subjecting your business to bribery and corruption charges locally and in the United States. In another scenario, a third party might expose your company to excessive risk because it lacks a robust cybersecurity program and is easily hacked. This is what happened when Target Corporation...

As posted to the Munro Live YouTube Channel on 11/24/2021 (Run Time 46 min, 32 sec) Regarding the accelerating move to EVs, legendary automotive engineer Sandy Munro believes that OEMs are experiencing Scotoma, aka Paradigm Paralysis. They cannot physiologically see the data that is unfolding around them. When a paradigm shifts, success in the old paradigm will block your vision of the future. When a paradigm changes, everything goes back to zero. Your past success means nothing. GM promised 20 new EVs by 2023, yet they brought zero to the recent 2021 LA Auto Show. The EV technology disruption happening in the automotive industry is of an order of magnitude such that many OEMs simply will not survive. Who's going to win when one company (or country) is thinking...

Year-end is a good time to plan to save taxes by carefully structuring your capital gains and losses. Consider some possibilities if you have losses on certain investments to date. For example, suppose you lost money this year on some stock and have other stock that has appreciated. Consider selling appreciated assets before December 31 (if you think their value has peaked) and offsetting gains with losses. Long-term capital losses offset long-term capital gains before they offset short-term capital gains. Similarly, short-term capital losses offset short-term capital gains before they offset long-term capital gains. You may use up to $3,000 ($1,500 for married filing separately) of total capital losses in excess of total capital gains as a deduction against ordinary income in computing your adjusted gross income...

The use of a company vehicle is a valuable fringe benefit for owners and employees of small businesses. This perk results in tax deductions for the employer as well as tax breaks for the owners and employees using the cars. (And of course, they get the non-tax benefit of getting a company car.) Plus, current tax law and IRS rules make the benefit even better than it was in the past. The rules in action Let’s say you’re the owner-employee of a corporation that’s going to provide you with a company car. You need the car to visit customers, meet with vendors and check on suppliers. You expect to drive the car 8,500 miles a year for business. You also expect to use the car for about...

In a business valuation context, the term “marketability” refers to the ability to quickly convert property to cash at minimal cost. While publicly traded stocks are readily marketable, interests in private companies typically require substantial time, cost and effort to sell. To the extent that public stock data is used to value private businesses, a discount may be warranted to reflect the lack of marketability. However, an important distinction must be made when applying these discounts to controlling interests. Minority vs. controlling interests Marketability discounts are well established when valuing minority interests in closely held businesses. Several empirical studies support and quantify these discounts. Restricted stock and pre-IPO studies, for example, demonstrate the spread between prices paid for freely traded shares and identical shares that are less...

(This is Blog Post #1142)...

Awards and settlements are routinely provided for a variety of reasons. For example, a person could receive compensatory and punitive damage payments for personal injury, discrimination or harassment. Some of this money is taxed by the federal government, and perhaps state governments. Hopefully, you’ll never need to know how payments for personal injuries are taxed. But here are the basic rules — just in case you or a loved one does need to understand them. Under tax law, individuals are permitted to exclude from gross income damages that are received on account of a personal physical injury or a physical sickness. It doesn’t matter if the compensation is from a court-ordered award or an out-of-court settlement, and it makes no difference if it’s paid in a...

If your business is successful and you do a lot of business travel, you may have considered buying a corporate aircraft. Of course, there are tax and non-tax implications for aircraft ownership. Let’s look at the basic tax rules. Business travel only In most cases, if your company buys a plane used only for business, the company can deduct its entire cost in the year that it’s placed into service. The cases in which the aircraft is ineligible for this immediate write-off are: The few instances in which neither the 100% bonus depreciation rules nor the §179 small business expensing rules apply or When the taxpayer has elected out of 100% bonus depreciation and hasn’t made the election to apply §179 expensing. In those cases, the depreciation schedule...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150