The federal government is helping to pick up the tab for certain business meals. Under a provision that’s part of one of the COVID-19 relief laws, the usual deduction for 50% of the cost of business meals is doubled to 100% for food and beverages provided by restaurants in 2022 (and 2021). So, you can take a customer out for a business meal or order take-out for your team and temporarily write off the entire cost — including the tip, sales tax and any delivery charges. Basic rules Despite eliminating deductions for business entertainment expenses in the Tax Cuts and Jobs Act (TCJA), a business taxpayer could still deduct 50% of the cost of qualified business meals, including meals incurred while traveling away from home on business. (The...

Valuation discounts for lack of control and marketability are major points of contention when companies or controlling shareholders are required to buy out shareholders who own minority interests. What’s appropriate depends on the facts of the case — and there’s an important distinction between statutory and contractual buyouts. Statutory buyouts In many jurisdictions, minority shareholders who are oppressed by controlling shareholders or who dissent to major business decisions are entitled to receive the “fair value” of their shares. Statutory appraisal rights provisions protect investors from being shortchanged in minority shareholder squeeze-outs, privatizations and leveraged buyouts, especially when the deal involves company insiders who may have a potential conflict of interest. It’s up to the court to determine a fair buyout price in these cases, but both sides usually...

When banks detect suspicious activity in a customer’s account, they often call account holders to discuss the transactions. Time is of the essence when it comes to preventing fraud, especially in the case of wire and automated clearing house transactions. In most cases, if a caller claims to work for the fraud department of your or your business’s bank, the call is likely legitimate. However, in a currently active scam, criminals pretend to be bank fraud investigators and try to extract account information from consumers or employees. Here’s how to identify criminals and prevent account breaches: Don’t trust caller ID. A fraudster might “spoof” or fake a phone number, which means your caller ID could display a bank’s fraud department name and number. Even if caller...

Traditional IRAs and Roth IRAs have been around for decades and the rules surrounding them have changed many times. What hasn’t changed is that they can help you save for retirement on a tax-favored basis. Here’s an overview. Traditional IRAs You can make an annual deductible contribution to a traditional IRA if: You (and your spouse) aren’t active participants in employer-sponsored retirement plans, or You (or your spouse) are active participants in an employer plan, and your modified adjusted gross income (MAGI) doesn’t exceed certain levels that vary annually by filing status. For example, in 2022, if you’re a joint return filer covered by an employer plan, your deductible IRA contribution phases out over $109,000 to $129,000 of MAGI ($68,000 to $78,000 for singles). Deductible IRA contributions reduce your...

If you operate a business, or you’re starting a new one, you know you need to keep records of your income and expenses. Specifically, you should carefully record your expenses in order to claim all of the tax deductions to which you’re entitled. And you want to make sure you can defend the amounts reported on your tax returns in case you’re ever audited by the IRS. Be aware that there’s no one way to keep business records. But there are strict rules when it comes to keeping records and proving expenses are legitimate for tax purposes. Certain types of expenses, such as automobile, travel, meals and home office costs, require special attention because they’re subject to special recordkeeping requirements or limitations. Here are two recent court...

Many fraud investigations focus on financial statements. Because cash is the most commonly stolen business asset, fraud experts regularly scrutinize statements of cash flow for signs of misappropriation and fraudulent disbursements. If you suspect occupational fraud and request an investigation, here’s what the experts might find. Unusual changes Your statement of cash flows shows how cash changed during the year. Forensic accountants generally look for amounts that seem unreasonable and for increases or decreases in accounts that seem to contradict trends in operating cash flows or other financial information. The statement of cash flows is typically broken down into three categories: Cash from operations, Cash from investing activities, and Cash from financing activities. Fraud experts often apply ratio analysis to detect unusual changes that might indicate fraud — for...

Summer is just around the corner. If you’re fortunate enough to own a vacation home, you may wonder about the tax consequences of renting it out for part of the year. The tax treatment depends on how many days it’s rented and your level of personal use. Personal use includes vacation use by your relatives (even if you charge them market rate rent) and use by non-relatives if a market rate rent isn’t charged. If you rent the property out for less than 15 days during the year, it’s not treated as “rental property” at all. In the right circumstances, this can produce significant tax benefits. Any rent you receive isn’t included in your income for tax purposes (no matter how substantial). On the other hand, you...

An experienced business valuation professional considers more than just a company’s financial statements when quantifying its value. The professional conducts detailed interviews and asks for a variety of documents when gathering information to use to value the business — and some of this information may provide objective insight into how much the owners believe the business is worth. Here are some key examples. Buy-sell agreements Shareholders often protect their business interests with buy-sell agreements that contain valuation formulas to be used on a shareholder’s death or termination. Some detailed buy-sell agreements may even specify whether valuation discounts apply and, if so, how much. But if a buy-sell agreement has been superseded or is otherwise outdated, it may not be as relevant to current market values. Life insurance policies Life...

Typically, businesses want to delay recognition of taxable income into future years and accelerate deductions into the current year. But when is it prudent to do the opposite? And why would you want to? One reason might be tax law changes that raise tax rates. There have been discussions in Washington about raising the corporate federal income tax rate from its current flat 21%. Another reason may be because you expect your non-corporate pass-through entity business to pay taxes at higher rates in the future, because the pass-through income will be taxed on your personal return. There have also been discussions in Washington about raising individual federal income tax rates. If you believe your business income could be subject to tax rate increases, you might want to accelerate...

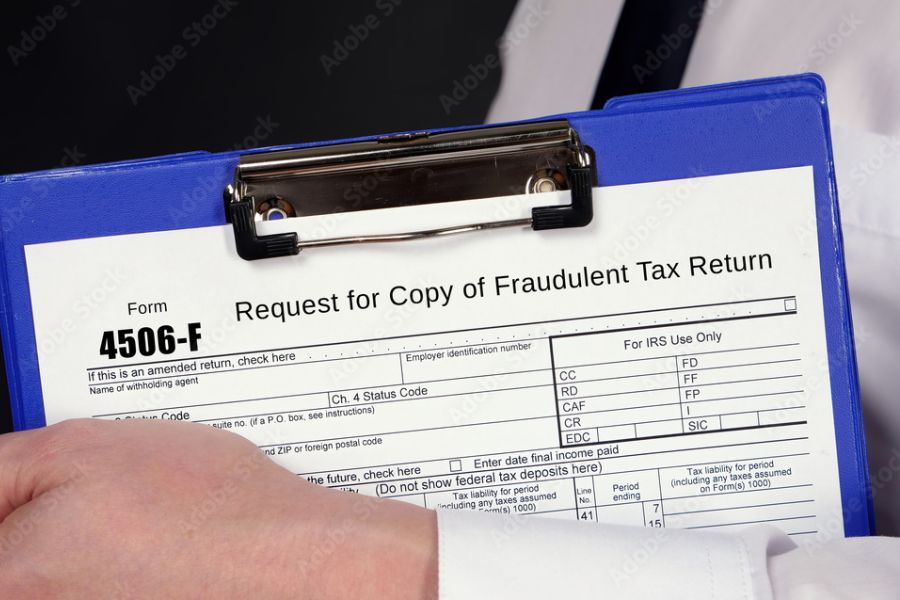

In Fact Sheet 2022-25, the IRS has provided information about how taxpayers should handle non-tax and tax-related identity theft. When a taxpayer believes their personal information is being used to file fraudulent tax returns, they should submit a Form 14039, Identity Theft Affidavit, to the IRS. But in most cases, taxpayers do not need to complete this form. Only victims of tax-related identity theft should submit the Form 14039, and only if they haven't received certain letters from the IRS. All taxpayers can request an Identity Protection Personal Identification Number (IP PIN) using the Get An Identity Protection PIN (IP PIN) tool on IRS.gov to protect themselves from becoming a victim of tax-related identity theft. What is tax-related identity theft? Tax-related identity theft occurs when someone uses a taxpayer's...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150