Limited liability companies (LLCs) sometimes award employees and contractors a unique form of equity-based compensation known as “profits interests.” These interests aren’t actively sold on a public market, so a customized valuation approach is required. Here’s an overview of how business valuation pros determine what these awards are worth for tax and financial reporting purposes. The basics Finding skilled workers is one of the top challenges reported by private businesses today. Employers may award various forms of equity-based compensation to help attract, retain and reward workers for their contributions to the company. LLCs aren’t allowed to issue traditional corporate forms of equity compensation, such as common and preferred shares, stock options, restricted shares and phantom stock. Instead, they can award profits interests to certain employees and contractors for...

Do you own a successful small business with no employees and want to set up a retirement plan? Or do you want to upgrade from a SIMPLE IRA or Simplified Employee Pension (SEP) plan? Consider a solo 401(k) if you have healthy self-employment income and want to contribute substantial amounts to a retirement nest egg. This strategy is geared toward self-employed individuals including sole proprietors, owners of single-member limited liability companies and other one-person businesses. Go it alone With a solo 401(k) plan, you can potentially make large annual deductible contributions to a retirement account. For 2022, you can make an “elective deferral contribution” of up to $20,500 of your net self-employment (SE) income to a solo 401(k). The elective deferral contribution limit increases to $27,000 if you’ll be...

When a married couple files a joint tax return, each spouse is “jointly and severally” liable for the full amount of tax on the couple’s combined income. Therefore, the IRS can come after either spouse to collect the entire tax — not just the part that’s attributed to one spouse or the other. This includes any tax deficiency that the IRS assesses after an audit, as well as any penalties and interest. (However, the civil fraud penalty can be imposed only on spouses who’ve actually committed fraud.) Innocent spouse relief In some cases, spouses are eligible for “innocent spouse relief.” This generally involves individuals who were unaware of a tax understatement that was attributable to the other spouse. To qualify, you must show not only that you didn’t...

Many financial companies search for negative news, also known as “adverse media,” as part of their due diligence process for potential customers. But this type of screening isn’t only effective for banks. Any company can use adverse media to scrutinize customers, vendors and business partners. Screening these subjects can help uncover issues — such as accusations of fraud or litigation for nonpayment — that could negatively affect a business relationship. 4 steps Given the vast amount of data available online, conducting adverse media screening requires a methodical approach. Consider taking these steps: Develop a policy. To ensure that your organization’s use of adverse media screening meets your needs without creating legal risk, draft a policy governing its usage. Make sure that your legal team reviews the policy,...

The business entity you choose can affect your taxes, your personal liability and other issues. A limited liability company (LLC) is somewhat of a hybrid entity in that it can be structured to resemble a corporation for owner liability purposes and a partnership for federal tax purposes. This duality may provide you with the best of both worlds. Like the shareholders of a corporation, the owners of an LLC (called “members” rather than shareholders or partners) generally aren’t liable for business debts except to the extent of their investment. Thus, they can operate the business with the security of knowing that their personal assets are protected from the entity’s creditors. This protection is far greater than that afforded by partnerships. In a partnership, the general partners...

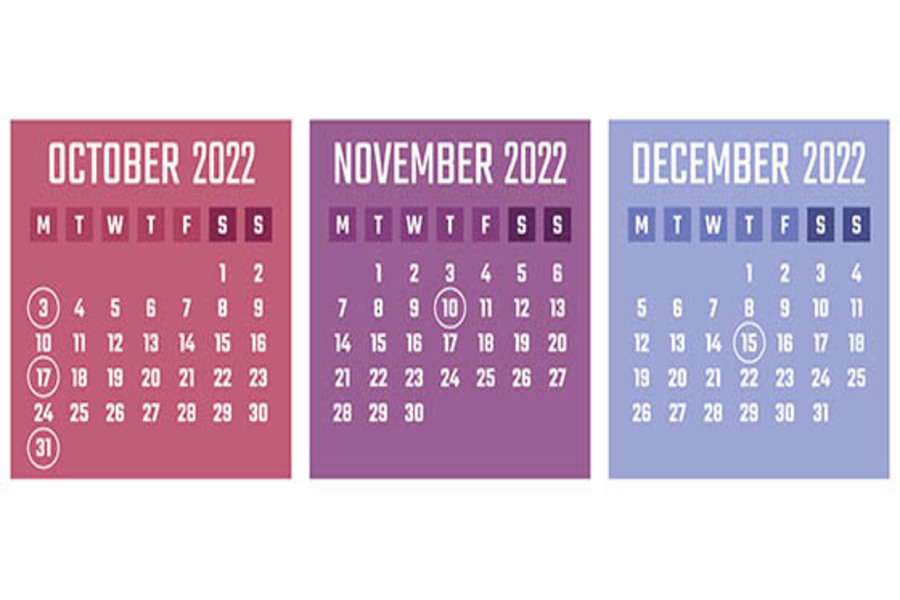

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: Certain tax-filing and tax-payment deadlines may be postponed for taxpayers who reside in or have businesses in federally declared disaster areas. Monday, October 3 The last day you can initially set up a SIMPLE IRA plan, provided you (or any predecessor employer) didn’t previously maintain a SIMPLE IRA plan. If you’re a new employer that comes into existence after October 1 of the year, you can establish a SIMPLE IRA plan as soon...

If you don’t have enough federal tax withheld from your paychecks and other payments, you may have to make estimated tax payments. This is the case if you receive interest, dividends, self-employment income, capital gains or other income. Here are the applicable rules for paying estimated tax without triggering the penalty for underpayment. When are the payments due? Individuals must pay 25% of a “required annual payment” by April 15, June 15, September 15, and January 15 of the following year, to avoid an underpayment penalty. If one of those dates falls on a weekend or holiday, the payment is due on the next business day. So the fourth installment for 2022 is due on Monday, January 16, 2023. Payments are made using Form 1040-ES. How much should you...

Summer can bring extreme weather, including floods, droughts, wildfires, tornadoes and hurricanes. These natural disasters and other crises can interrupt normal business operations, causing significant financial losses. If disaster strikes, a business interruption insurance policy can allow you to recoup lost profits, repair damaged assets and cover other incremental expenses. When a covered event has occurred, a business valuation professional can help explain what’s covered and calculate how much you’re entitled to recover. Coverage basics Business interruption insurance is arguably one of the most complicated insurance products on the market today. And most policies require claims to be filed in a relatively short period of time (often within 30 days). In addition to replacing any damaged assets, such as inventory or machinery, a business interruption policy typically covers lost...

You may have heard that the Inflation Reduction Act (IRA) was signed into law recently. While experts have varying opinions about whether it will reduce inflation in the near future, it contains, extends and modifies many climate and energy-related tax credits that may be of interest to individuals. Non-business energy property Before the IRA was enacted, you were allowed a personal tax credit for certain non-business energy property expenses. The credit applied only to property placed in service before January 1, 2022. The credit is now extended for energy-efficient property placed in service before January 1, 2033. The new law also increases the credit for a tax year to an amount equal to 30% of: The amount paid or incurred by you for qualified energy efficiency improvements installed...

The Inflation Reduction Act (IRA), signed into law by President Biden on August 16, contains many provisions related to climate, energy and taxes. There has been a lot of media coverage about the law’s impact on large corporations. For example, the IRA contains a new 15% alternative minimum tax on large, profitable corporations. And the law adds a 1% excise tax on stock buybacks of more than $1 million by publicly traded U.S. corporations. But there are also provisions that provide tax relief for small businesses. Here are two: A payroll tax credit for research Under current law, qualified small businesses can elect to claim a portion of their research credit as a payroll tax credit against their employer Social Security tax liability, rather than against their income tax...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151