Business valuation professionals often use public stock market data to value private businesses — even though there are critical differences between closely held and publicly traded companies. Here’s an overview of how valuators modify their analyses to take advantage of objective, market-based indicators of value. Recognizing key differences Public companies differ from private ones in the following five critical ways: Level of oversight, differing goals. The Securities and Exchange Commission requires public companies to file paperwork (such as annual 10-K forms) and comply with its rules and regulations (such as the Sarbanes-Oxley Act). Private businesses are generally exempt from these requirements, freeing them to focus less on earnings per share (a short-term performance metric) and more on long-term or non-financial goals. Additionally, private businesses commonly downplay...

When one spouse in a married couple is not earning compensation, the couple may not be able to save as much as they need for a comfortable retirement. In general, an IRA contribution is allowed only if a taxpayer earns compensation. However, there’s an exception involving a “spousal” IRA. It allows contributions to be made for a spouse who is out of work or who stays home to care for children, elderly parents or for other reasons, as long as the couple files a joint tax return. For 2023, the amount that an eligible married couple can contribute to an IRA for a nonworking spouse is $6,500, which is the same limit that applies for the working spouse. Benefits of an IRA As you may know, IRAs offer...

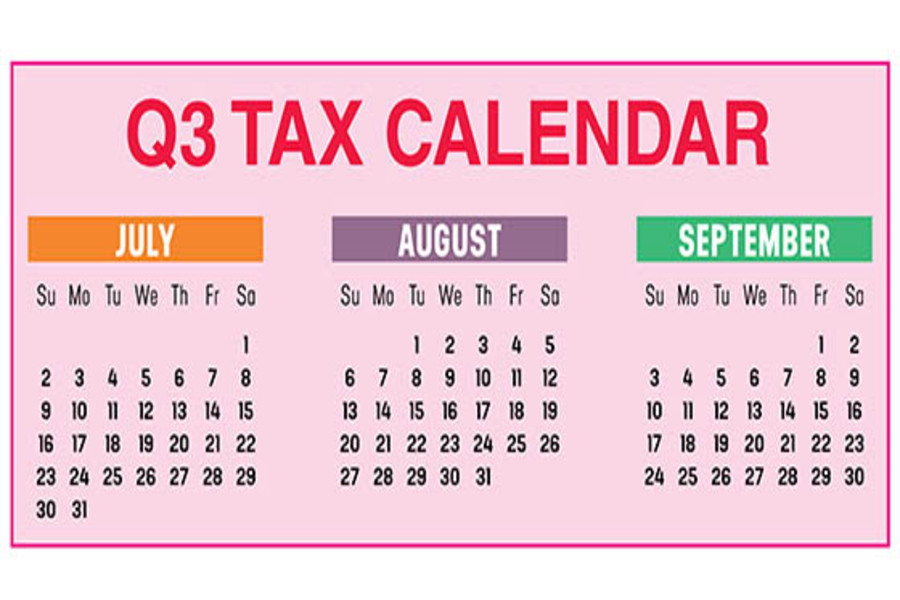

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. July 31 Report income tax withholding and FICA taxes for second quarter 2023 (Form 941) and pay any tax due. (See the exception below, under “August 10.”) File a 2022 calendar-year retirement plan report (Form 5500 or Form 5500-EZ) or request an extension. August 10 Report income tax withholding and FICA taxes for second quarter 2023 (Form 941), if you deposited on time and in full all of the associated taxes due. September 15 If a...

Expanding operations into foreign countries can help U.S. businesses reduce labor and operating costs. It can also provide them with access to new markets and potentially higher profits. You may be attracted to a country by a plentiful labor supply, significant tax benefits or government incentives. But, beware: Some foreign business environments present serious fraud risks. Before you make the decision to cross borders, familiarize yourself with the country’s culture and laws. Threats everywhere Corruption is a business risk in every country, but in some countries, it’s omnipresent. For example, if you want to build a factory, you could encounter officials who expect gifts to “grease the wheels” or local politicians who are accustomed to excessive wining and dining in exchange for their cooperation. If you import...

If you’re age 65 and older and have basic Medicare insurance, you may need to pay additional premiums to get the level of coverage you want. The premiums can be costly, especially for married couples with both spouses paying them. But there may be an advantage: You may qualify for a tax break for paying the premiums. Premiums count as medical expenses For purposes of claiming an itemized deduction for medical expenses on your tax return, you can combine premiums for Medicare health insurance with other qualifying medical expenses. These includes amounts for “Medigap” insurance and Medicare Advantage plans. Some people buy Medigap policies because Medicare Parts A and B don’t cover all their health care expenses. Coverage gaps include co-payments, coinsurance, deductibles and other costs. Medigap...

Your business may be able to claim big first-year depreciation tax deductions for eligible real estate expenditures rather than depreciate them over several years. But should you? It’s not as simple as it may seem. Qualified improvement property For qualifying assets placed in service in tax years beginning in 2023, the maximum allowable first-year Section 179 depreciation deduction is $1.16 million. Importantly, the Sec. 179 deduction can be claimed for real estate qualified improvement property (QIP), up to the maximum annual allowance. QIP includes any improvement to an interior portion of a nonresidential building that’s placed in service after the date the building is placed in service. For Sec. 179 deduction purposes, QIP also includes HVAC systems, nonresidential building roofs, fire protection and alarm systems and security systems...

There are many types of professional practices. Examples include medical, architecture, engineering, accounting, advertising, design and law. From a business valuation perspective, it’s important to recognize the common denominators these businesses share. Reliance on intangible assets Professional practices provide services rather than sell products (at least primarily). In addition, education, licensing and continuing education requirements may limit the individuals who can own and operate a professional practice. So, they tend to rely heavily on intangible assets, such as: Business and owner reputations, Client lists, Trained, assembled workforces, Procedural manuals, Noncompete agreements, and Professional licenses. Professional practices rarely report these intangibles on their balance sheets. Some valuation engagements — such as those related to a divorce or a business combination — may require valuators to identify and assign value...

As posted to the Climate One YouTube page on 7/17/23 Run Time 58 minutes, 47 seconds (when beginning at Time Stamp 21:33) Climate One clip description: Demand for lithium ion batteries is expected to grow 500% by 2030, and the race for raw materials is on. Lithium mines around the world are opening or expanding, while children as young as six in the Congo carry sacks of cobalt-laced rocks on their backs for less than $2 a day. Recycling presents promising opportunities, yet before millions of batteries can be recycled, they have to be made in the first place. At the same time, advances in battery chemistry continue to be made, and it’s not hard to imagine a near future when batteries don’t require lithium or cobalt at...

High-income taxpayers face a regular income tax rate of 35% or 37%. And they may also have to pay a 3.8% net investment income tax (NIIT) that’s imposed in addition to regular income tax. Fortunately, there are some ways you may be able to reduce its impact. Affected taxpayers The NIIT applies to you only if modified adjusted gross income (MAGI) exceeds: $250,000 for married taxpayers filing jointly and surviving spouses, $125,000 for married taxpayers filing separately, $200,000 for unmarried taxpayers and heads of household. The amount subject to the tax is the lesser of your net investment income or the amount by which your MAGI exceeds the threshold ($250,000, $200,000, or $125,000) that applies to you. Net investment income includes interest, dividend, annuity, royalty and rental income, unless...

If you and your employees are traveling for business this summer, there are a number of considerations to keep in mind. Under tax law, in order to claim deductions, you must meet certain requirements for out-of-town business travel within the United States. The rules apply if the business conducted reasonably requires an overnight stay. Note: Under the Tax Cuts and Jobs Act, employees can’t deduct their unreimbursed travel expenses on their own tax returns through 2025. That’s because unreimbursed employee business expenses are “miscellaneous itemized deductions” that aren’t deductible through 2025. However, self-employed individuals can continue to deduct business expenses, including away-from-home travel expenses. Rules that come into play The actual costs of travel (for example, plane fare and cabs to the airport) are deductible for out-of-town business trips....

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151