The SECURE 2.0 law, which was enacted last year, contains wide-ranging changes to retirement plans. One provision in the law is that eligible employers will soon be able to provide more help to staff members facing emergencies. This will be done through what the law calls “pension-linked emergency savings accounts.” Effective for plan years beginning January 1, 2024, SECURE 2.0 permits a plan sponsor to amend its 401(k), 403(b) or government 457(b) plan to offer emergency savings accounts that are connected to the plan. Basic distribution rules If a retirement plan participant withdraws money from an employer plan before reaching age 59½, a 10% additional tax or penalty generally applies unless an exception exists. This is on top of the ordinary tax that may be due. The goal of...

The federal student loan “pause” came to an end on August 31 after more than three years. If you have student loan debt, you may wonder whether you can deduct the interest you pay on your tax return. The answer may be yes, subject to certain limits. The deduction is phased out if your adjusted gross income exceeds certain levels — and they aren’t as high as the income levels for many other deductions. Deduction basics If you’re eligible, the maximum amount of student loan interest you can deduct each year is $2,500. The interest must be for a “qualified education loan,” which means a debt incurred to pay tuition, room and board, and related expenses to attend a post-high school educational institution, including certain vocational schools....

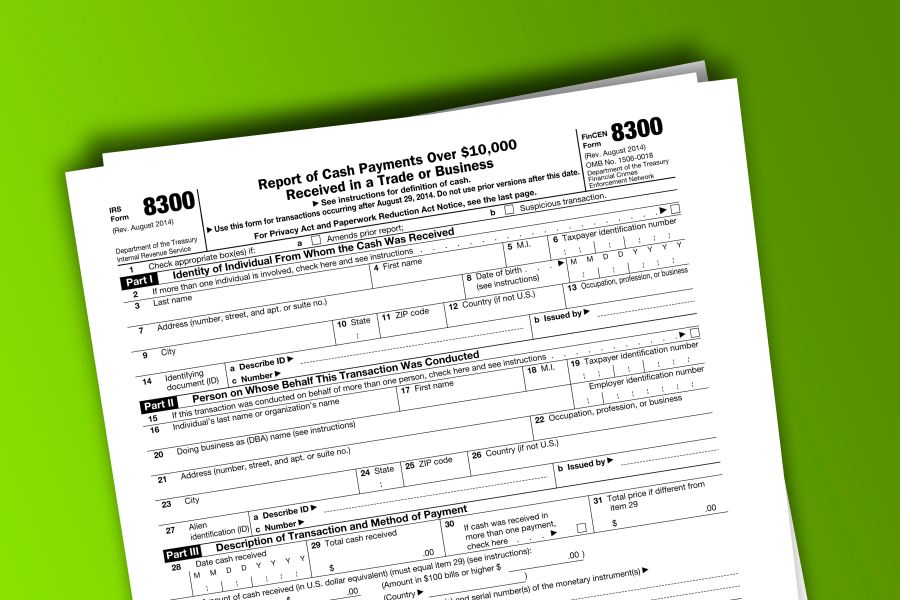

Does your business receive large amounts of cash or cash equivalents? If so, you’re generally required to report these transactions to the IRS — and not just on your tax return. The requirements Each person who, in the course of operating a trade or business, receives more than $10,000 in cash in one transaction (or two or more related transactions), must file Form 8300. Who is a “person”? It can be an individual, company, corporation, partnership, association, trust or estate. What are considered “related transactions”? Any transactions conducted in a 24-hour period. Transactions can also be considered related even if they occur over a period of more than 24 hours if the recipient knows, or has reason to know, that each transaction is one of a series...

Most people equate business bankruptcy with liquidating a company’s assets and using the proceeds to repay creditors. That’s a Chapter 7 filing under the U.S. Bankruptcy Code, but closing shop isn’t a foregone conclusion in bankruptcy. Many companies instead file for Chapter 11 (reorganization) bankruptcy. This option allows a company to continue to operate, with the hope of turning things around. In the first half of 2023, both types of business bankruptcy filings surged in the United States. In particular, Chapter 11 filings were up 68% from the same period last year, according to Epiq Bankruptcy, a provider of bankruptcy statistics. This figure reflects only businesses involved in formal bankruptcy proceedings; many others are involved in informal, out-of-court reorganizations. Here are ways business valuation professionals can...

As appearing in IRS IR-2023-169 To protect taxpayers from scams, IRS orders immediate stop to new Employee Retention Tax Credit (ERTC) processing amid surge of questionable claims Concerns from tax pros, aggressive marketing to ineligible applicants highlights unacceptable risk to businesses and the tax system Moratorium on processing of new claims through year’s end will allow IRS to add more safeguards to prevent future abuse, protect businesses from predatory tactics; IRS working with Justice Department to pursue fraud fueled by aggressive marketing WASHINGTON – Amid rising concerns about a flood of improper Employee Retention Credit claims, the Internal Revenue Service today announced an immediate moratorium through at least the end of the year on processing new claims for the pandemic-era relief program to protect honest small business owners from...

As reported in IRS News Release IR-2023-157 The Internal Revenue Service announced that starting 1/1/2024, businesses are required to electronically file (e-file) Form 8300, Report of Cash Payments Over $10,000, instead of filing a paper return. This new requirement follows final regulations amending e-filing rules for information returns, including Forms 8300. Businesses that receive more than $10,000 in cash must report transactions to the U.S. government. Although many cash transactions are legitimate, information reported on Forms 8300 can help combat those who evade taxes, profit from the drug trade, engage in terrorist financing or conduct other criminal activities. The government can often trace money from these illegal activities through payments reported on Forms 8300 that are timely filed, complete and accurate. The new requirement for e-filing Forms 8300...

An estimated 190 million Americans have recently been under heat advisory alerts, according to the National Weather Service. That may have spurred you to think about making your home more energy efficient — and there’s a cool tax break that may apply. Thanks to the Inflation Reduction Act of 2022, you may be able to benefit from an enhanced residential energy tax credit to help defray the cost. Eligibility rules If you make eligible energy-efficient improvements to your home on or after January 1, 2023, you may qualify for a tax credit up to $3,200. You can claim the credit for improvements made through 2032. The credit equals 30% of certain qualified expenses for energy improvements to a home located in the United States, including: Qualified energy-efficient improvements...

If you operate your small business as a sole proprietorship, you may have thought about forming a limited liability company (LLC) to protect your assets. Or maybe you’re launching a new business and want to know your options for setting it up. Here are the basics of operating as an LLC and why it might be a good choice for your business. An LLC is a bit of a hybrid entity because it can be structured to resemble a corporation for owner liability purposes and a partnership for federal tax purposes. This duality may provide the owners with the best of both worlds. Protecting your personal assets Like the shareholders of a corporation, the owners of an LLC (called “members” rather than shareholders or partners) generally aren’t liable...

Have you ever wondered whether the photo or video you’re viewing, the audio you’re listening to or the article you’re reading is real? Artificial intelligence (AI) can make the line between authentic and inauthentic hard to determine. For fraud perpetrators, the ability to create deepfakes, voice clones or machine-generated communications can make their scams far more compelling — and effective. Although using AI for criminal purposes is a clear-cut abuse of the technology, it’s possible for well-intentioned businesses to violate the Federal Trade Commission (FTC) Act. Sec. 5 of the FTC Act, “Unfair or Deceptive Acts or Practices” prohibits any material representation, omission or practice that’s likely to mislead consumers under ordinary circumstances. Here’s how to reduce the risk of violations. Limiting the technology’s risk Using AI can...

More than a million Americans live in nursing homes, according to various reports. If you have a parent entering one, you’re probably not thinking about taxes. But there may be tax consequences. Let’s take a look at five possible tax breaks. 1. Long-term medical care The costs of qualified long-term care, including nursing home care, are deductible as medical expenses to the extent they, along with other medical expenses, exceed 7.5% of adjusted gross income (AGI). Qualified long-term care services are necessary diagnostic, preventive, therapeutic, curing, treating, mitigating and rehabilitative services, and maintenance or personal-care services required by a chronically ill individual that are provided under care administered by a licensed healthcare practitioner. To qualify as chronically ill, a physician or other licensed healthcare practitioner must certify an individual...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150