The survival of many companies depends on relationships between key customers or vendors (or both). When one of these relationships is disrupted, for whatever the reason, one party may incur financial damage — perhaps even leading to its demise. And business valuation professionals often evaluate this lost value as a source of economic damages. Going, going, gone . . . In many cases, valuators will present a company’s alleged damages as lost past and/or future profits. For instance, if a vendor breaches a contract to sell materials at a contracted price, the business may be forced to pay a higher price to the vendor, assuming no immediate alternatives are available. If it takes six months to secure a new vendor at the originally contracted price, the company will...

Do you use an automobile in your trade or business? If so, you may question how depreciation tax deductions are determined. The rules are complicated, and special limitations that apply to vehicles classified as passenger autos (which include many pickups and SUVs) can result in it taking longer than expected to fully depreciate a vehicle. Depreciation is built into the cents-per-mile rate First, be aware that separate depreciation calculations for a passenger auto only come into play if you choose to use the actual expense method to calculate deductions. If, instead, you use the standard mileage rate (65.5 cents per business mile driven for 2023), a depreciation allowance is built into the rate. If you use the actual expense method to determine your allowable deductions for a passenger...

Many Americans own a vacation home or aspire to purchase one. If you own a second home in a waterfront community, in the mountains or in a resort area, you may want to rent it out for part of the year. The tax implications of these transactions can be complicated. It depends on how many days the home is rented and your level of personal use. Personal use includes vacation use by you, your family members (even if you charge them market rent) and use by non-relatives if a market rent isn’t charged. Short-term rentals If you rent the property out for less than 15 days during the year, it’s not treated as “rental property” at all. In the right circumstances, this can produce revenue and significant tax...

Ever wonder how IRS examiners know about different industries so they can audit various businesses? They generally do research about specific industries and issues on tax returns by using IRS Audit Techniques Guides (ATGs). A little-known fact is that these guides are available to the public on the IRS website. In other words, your business can use the same guides to gain insight into what the IRS is looking for in terms of compliance with tax laws and regulations. Many ATGs target specific industries, such as construction, aerospace, art galleries, architecture and veterinary medicine. Other guides address issues that frequently arise in audits, such as executive compensation, passive activity losses and capitalization of tangible property. Issues unique to certain taxpayers IRS auditors need to examine all different types...

Although some businesses now require employees to work full-time in the office, many others allow employees to work remotely one or more days a week. The popularity of remote positions can make attracting and retaining employees easier. However, some workers may be tempted to take on multiple remote jobs without informing their employers. In addition to affecting employee productivity, this can lead to leaks of intellectual property (IP) and proprietary knowledge to competitors. Or employees may use what they’ve learned working for you to run side businesses that directly compete with yours. Here’s how to minimize such risks. Provide solid oversight The same technology that makes it easy for companies to offer remote positions can also enable workers to juggle multiple jobs simultaneously. Some employees may feel they...

This year, many Americans have been victimized by wildfires, severe storms, flooding, tornadoes and other disasters. No matter where you live, unexpected disasters may cause damage to your home or personal property. Before the Tax Cuts and Jobs Act (TCJA), eligible casualty loss victims could claim a deduction on their tax returns. But currently, there are restrictions that make these deductions harder to take. What’s considered a casualty for tax purposes? It’s a sudden, unexpected or unusual event, such as a hurricane, tornado, flood, earthquake, fire, act of vandalism or a terrorist attack. Many unable to claim a tax break For losses incurred from 2018 through 2025, the TCJA generally eliminates deductions for personal casualty losses, except for losses due to federally declared disasters. Note: There’s an exception to...

An employee stock ownership plan (ESOP) can facilitate the transfer of a business to the owner’s children or employees over a period of years in a tax-advantaged way. However, the IRS recently issued a statement warning businesses about a range of compliance issues related to ESOPs and announcing plans to ramp up compliance enforcement. The IRS has identified numerous issues, such as improper valuation of employer stock, prohibited allocation of shares to disqualified persons and failure to follow tax law requirements for ESOP loans, causing the loans to be prohibited transactions. In light of this warning, business owners who are interested in pursuing an ESOP should seek the advice of business valuators and other professional advisors to ensure compliance with the rules. Here’s some critical information...

If you read the Internal Revenue Code (and you probably don’t want to!), you may be surprised to find that most business deductions aren’t specifically listed. For example, the tax law doesn’t explicitly state that you can deduct office supplies and certain other expenses. Some expenses are detailed in the tax code, but the general rule is contained in the first sentence of §162, which states you can write off “all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business.” Basic definitions In general, an expense is ordinary if it’s considered common or customary in the particular trade or business. For example, insurance premiums to protect a store would be an ordinary business expense in the retail...

If you gamble or buy lottery tickets and you’re lucky enough to win, congratulations! After you celebrate, be aware that there are tax consequences attached to your good fortune. Winning at gambling For tax purposes, it doesn’t matter if you win at the casino, a bingo hall or elsewhere. You must report 100% of your winnings as taxable income. They’re reported on an “Other income” line of your 1040 tax return. To measure your winnings on a particular wager, use the net gain. For example, if a $40 bet at the racetrack turns into a $130 win, you’ve won $90, not $130. You must separately keep track of losses. They’re deductible, but only as itemized deductions. Therefore, if you don’t itemize and instead take the standard deduction, you...

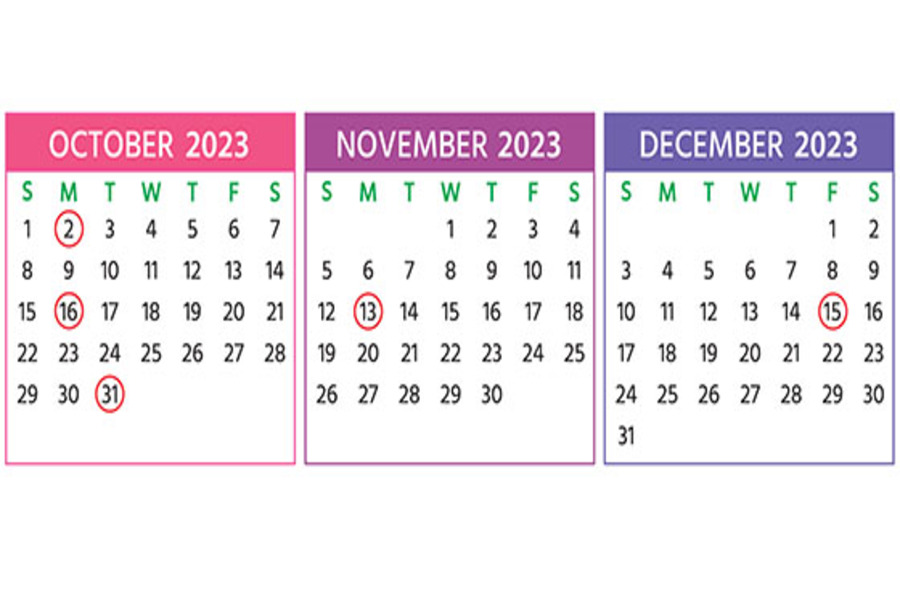

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: Certain tax-filing and tax-payment deadlines may be postponed for taxpayers who reside in or have businesses in federally declared disaster areas. Monday, October 2 The last day you can initially set up a SIMPLE IRA plan, provided you (or any predecessor employer) didn’t previously maintain a SIMPLE IRA plan. If you’re a new employer that comes into existence after October 1 of the year, you can establish a SIMPLE IRA plan as...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150