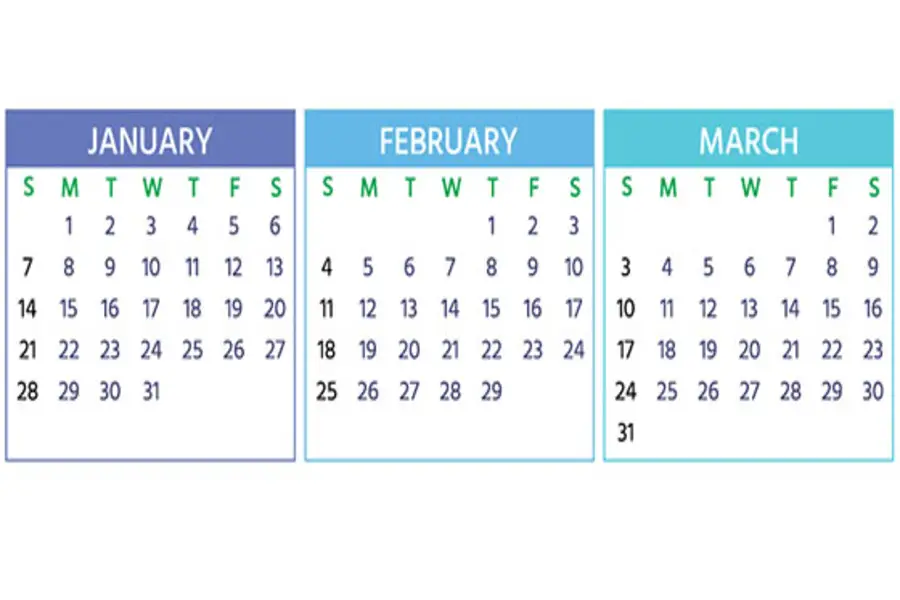

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have questions about filing requirements, contact us. We can ensure you’re meeting all applicable deadlines. January 16 (The usual deadline of January 15 is a federal holiday) Pay the final installment of 2023 estimated tax. Farmers and fishermen: Pay estimated tax for 2023. If you don’t pay your estimated tax by January 16, you must file your 2023 return and pay all tax due by March 1, 2024, to avoid an estimated tax penalty. January 31 File 2023 Forms W-2, “Wage and Tax Statement,” with the Social Security...

You may have heard of the “nanny tax.” But if you don’t employ a nanny, you may think it doesn’t apply to you. Check again. Hiring a housekeeper, gardener or other household employee (who isn’t an independent contractor) may make you liable for federal income and other taxes. You may also have state tax obligations. If you employ a household worker, you aren’t required to withhold federal income taxes from pay. However, you may choose to withhold if the worker requests it. In that case, ask the worker to fill out a Form W-4. However, you may be required to withhold Social Security and Medicare (FICA) taxes and to pay federal unemployment (FUTA) tax. Threshold increasing in 2024 In 2023, you must withhold and pay FICA taxes if...

U.S. commercial bankruptcies surged in 2023, as businesses across many industries struggle with rising costs, a tight labor market, lackluster demand, economic uncertainty and geopolitical risks. When valuing a distressed business, its value as a going concern might not necessarily be appropriate. Some situations call for liquidation value. Here’s how these premises of value differ and how valuators estimate liquidation value. The key differences The International Valuation Glossary — Business Valuation defines going-concern value as “a premise of value that assumes the business is an ongoing commercial enterprise with a reasonable expectation of future earning power.” Most business valuations focus on a business’s going-concern value. However, for businesses contemplating bankruptcy, liquidation value is another important benchmark. The glossary identifies two types of liquidation value: 1. In an orderly liquidation,...

During this holiday seasons, your business may want to show its gratitude to employees and customers by giving them gifts or hosting holiday parties. It’s a good time to review the tax rules associated with these expenses. Are they tax deductible by your business and is the value taxable to the recipients? Employee gifts Many businesses want to show their employees appreciation during the holiday time. In general, anything of value that you transfer to an employee is included in his or her taxable income (and, therefore, subject to income and payroll taxes) and deductible by your business. But there’s an exception for non-cash gifts that constitute a “de minimis” fringe benefit. These are items small in value and given so infrequently that they are administratively impracticable to...

One of the most appreciated fringe benefits for owners and employees of small businesses is the use of a company car. This perk results in tax deductions for the employer as well as tax breaks for the owners and employees driving the cars. (And of course, they enjoy the non-tax benefit of using a company car.) Even better, current federal tax rules make the benefit more valuable than it was in the past. Rolling out the rules Let’s take a look at how the rules work in a typical situation. For example, a corporation decides to supply the owner-employee with a company car. The owner-employee needs the car to visit customers and satellite offices, check on suppliers and meet with vendors. He or she expects to drive...

Every year, U.S. companies lose millions of dollars to vendor fraud. These schemes can be complex and usually involve collusion of multiple suppliers or suppliers and employees of the defrauded business. Small businesses that don’t use sophisticated vendor software or don’t have other anti-fraud resources are particularly vulnerable. But knowledge is power. Learn what vendor fraud is and the simple steps you can take to prevent it. Predetermined outcomes Vendor fraud can take one of several forms. Price fixing, for example, is a common scheme in which competitors agree to set the same price for goods or services or jointly establish a price range or minimum price. Bid rigging is similar. It involves two or more suppliers agreeing to steer a company’s purchase of goods or services. Potential...

If you have a tax-saving flexible spending account (FSA) with your employer to help pay for health or dependent care expenses, there’s an important date coming up. You may have to use the money in the account by year-end or you’ll lose it (unless your employer has a grace period). As the end of 2023 gets closer, here are some rules and reminders to keep in mind. Health FSA A pre-tax contribution of $3,050 to a health FSA is permitted in 2023. This amount will be increasing to $3,200 in 2024. You save taxes in these accounts because you use pre-tax dollars to pay for medical expenses that might not be deductible. For example, expenses won’t be deductible if you don’t itemize deductions on your tax return. Even...

In the midst of holiday parties and shopping for gifts, don’t forget to consider steps to cut the 2023 tax liability for your business. You still have time to take advantage of a few opportunities. Time deductions and income If your business operates on a cash basis, you can significantly affect your amount of taxable income by accelerating your deductions into 2023 and deferring income into 2024 (assuming you expect to be taxed at the same or a lower rate next year). For example, you could put recurring expenses normally paid early in the year on your credit card before January 1 — that way, you can claim the deduction for 2023 even though you don’t pay the credit card bill until 2024. In certain circumstances, you also can...

A business may have more than one value, depending on the purpose of the business valuation and the characteristics of the ownership interest. Before an expert starts working on a business valuation, it’s important to discuss the appropriate level of value. Otherwise, confusion over levels of value may lead to miscommunication and misinformed business decisions. Moreover, when multiple experts calculate different levels of value, discrepancies and disputes abound. Here’s an overview of the three main levels of value. 1. Controlling interests Control value is one level. The ability to control a business’s decisions has impact on value, especially on the value of a closely held business. Potential buyers often may be willing to pay a premium for the ability to control business decisions. The key to arriving...

California AB 2280 established a new Unclaimed Property Voluntary Compliance Program that waives interest for taxpayers who voluntarily come into compliance with unclaimed property reporting requirements. The State Controller’s Office (SCO) has now opened the sign up process for businesses to apply for the program. Unclaimed Property Reporting Explained California businesses holding property belonging to others must file with the SCO to report unclaimed financial assets held by the entity for longer than the dormancy period applicable to the property in question (see “Unclaimed Property Explained” below). Failure to comply without reasonable cause Businesses that fail to comply with the unclaimed property reporting requirements, and do not have reasonable cause, are subject to interest assessed at the rate of 12% on the value of the unclaimed property. There exists...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151