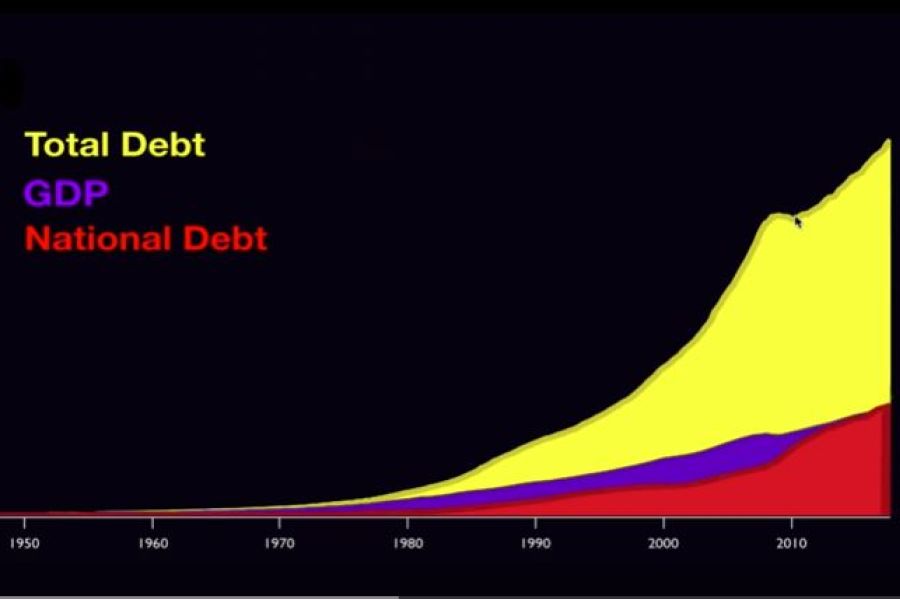

As posted to the GoldSilver YouTube Channel on 03/12/19 (transcript of documentary as appears on YouTube) Today (3/12/19) brings news of the latest federal budget proposal, a $4.75T presidential wishlist doomed to defeat in the House that spends money we don’t have. Perhaps most striking is that we are on pace to shatter the all-time debt-to-GDP record established in 1946 — when the country was in the midst of the life-or-death crisis of World War II — for no other reason than politicians lying to us about what the country can afford. One unrealistic promise after another campaign exaggeration from Democrat and Republican alike, one after the next, has gotten us here. Interest rates are still near historic lows. As the US economy begins to slow, the Fed knows that...

If you’re the parent of a child who is age 17 to 23, and you pay all (or most) of his or her expenses, you may be surprised to learn you’re not eligible for the child tax credit. But there’s a dependent tax credit that may be available to you. It’s not as valuable as the child tax credit, but when you’re saving for college or paying tuition, every dollar counts! Background of the credits The Tax Cuts and Jobs Act (TCJA) increased the child credit to $2,000 per qualifying child under the age of 17. The law also substantially increased the phaseout income thresholds for the credit so more people qualify for it. Unfortunately, the TCJA eliminated dependency exemptions for older children for 2018 through 2025....

Buying a home is stressful enough without also having to worry about potential fraud. Unfortunately, real estate fraud is surging. According to Realtor magazine, scams targeting the industry rose 1,100% from 2015 to 2017, resulting in losses of more than $1.6 billion. Home closing wire fraud should be of particular concern for prospective homebuyers. When schemes are successful, criminals can make off with buyers’ hard-earned down payments — several hundred thousand dollars’ worth in some cases. Here’s how to avoid losing the home of your dreams and the money with which to buy it. The scoop Home closing wire fraud involves hackers who typically use real estate agents’ email accounts to trick homebuyers into wiring money. Perpetrators send phishing messages containing links that, if clicked on, install malware....

In this installment of Millennial Money, Robert Kiyosaki explains that, because the government has mismanaged our economy, millennials will have to be 10 times smarter than him to achieve the same result today that he achieved decades earlier. Being an Business Owner or Investor rather than being an Employee or Self-Employed is now more important than ever. With perspectives on money and investing that often contradict conventional wisdom, Robert has earned an international reputation for straight talk, irreverence, and courage and has become a passionate and outspoken advocate for financial education. The "Millennial Money" series of videos seeks to provide young people with some important economic concepts that they didn't learn in school. Previous episodes of "Millennial Money" Blog #446 - How Debt Can Generate Income Blog #451 -...

The Tax Cuts and Jobs Act created a new federal tax credit for employers that provide qualified paid family and medical leave to their employees. It’s subject to numerous rules and restrictions and the credit is only available for two tax years — those beginning between January 1, 2018, and December 31, 2019. However, it may be worthwhile for some businesses. The value of the credit An eligible employer can claim a credit equal to 12.5% of wages paid to qualifying employees who are on family and medical leave, if the leave payments are at least 50% of the normal wages paid to them. For each 1% increase over 50%, the credit rate increases by 0.25%, up to a maximum credit rate of 25%. An eligible employee is...

No matter how much effort you’ve invested in designing your estate plan . . . your will, trusts and other official documents may not be enough. Consider creating a “road map” — an informal letter or other document that guides your family in understanding and executing your plan and ensuring that your wishes are carried out. Navigating your world Your road map should include, among other things: A list of important contacts, including your estate planning attorney, accountant, insurance agent and financial advisors, The location of your will, living and other trusts, tax returns and records, powers of attorney, insurance policies, deeds, stock certificates, automobile titles, and other important documents, A personal financial statement that lists stocks, bonds, real estate, bank accounts, retirement plans, vehicles and other...

Did you make large gifts to your children, grandchildren or other heirs last year? If so, it’s important to determine whether you’re required to file a 2018 gift tax return — or whether filing one would be beneficial even if it isn’t required. Filing requirements Generally, you must file a gift tax return for 2018 if, during the tax year, you made gifts: That exceeded the $15,000-per-recipient gift tax annual exclusion (other than to your U.S. citizen spouse), That you wish to split with your spouse to take advantage of your combined $30,000 annual exclusion, That exceeded the $152,000 annual exclusion for gifts to a non-citizen spouse, To a §529 college savings plan and wish to accelerate up to five years’ worth of annual exclusions ($75,000) into...

If you own a business and don’t have a tax-advantaged retirement plan, it’s not too late to establish one and reduce your 2018 tax bill. A Simplified Employee Pension (SEP) can still be set up for 2018, and you can make contributions to it that you can deduct on your 2018 income tax return. Contribution deadlines A SEP can be set up as late as the due date (including extensions) of your income tax return for the tax year for which the SEP is to first apply. That means you can establish a SEP for 2018 in 2019 as long as you do it before your 2018 return filing deadline. You have until the same deadline to make 2018 contributions and still claim a potentially substantial deduction...

For brick-and-mortar retailers, return fraud can be a serious financial threat. There are several types of schemes. But when they’re successful, they all end the same way: Stores issue refunds that they shouldn’t have. Here’s what to look for and how to limit losses. Myriad schemes Return fraud perpetrators could be customers, employees or even a criminal gang working with employee accomplices. In perhaps the most common scheme, an individual steals merchandise, and then returns it and insists on a cash refund, despite the lack of a receipt. Or a criminal steals merchandise from one retailer and then returns it to another for a cash refund. Some thieves do supply receipts — but they’re fake. The “customer” hands over an altered or completely counterfeit receipt that the original...

People who live in states with high income taxes sometimes relocate to a state with a more favorable tax climate. A similar strategy can be available for trusts. If a trust is subject to high state income taxes, you may be able to change its residence — or “situs” — to a state with low or no income taxes. What can a “trust-friendly” state offer? In addition to offering low (or no) tax on trust income, some states: Authorize domestic asset protection trusts, which provide added protection against creditors’ claims, Permit silent trusts, under which beneficiaries need not be notified of their interests, Allow perpetual trusts, enabling grantors to establish “dynasty” trusts that benefit many generations to come, Have directed trust statutes, which make it possible to...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150