The Tax Cuts and Jobs Act (TCJA) created a new program to encourage investment in economically distressed areas through generous tax incentives. The Qualified Opportunity Zone (QOZ) program relies on investments in Qualified Opportunity Funds (QOFs) — funds that can provide wealthy taxpayers with some new avenues for estate planning. 3 big tax benefits Investors in QOFs stand to reap three significant tax breaks: They can defer capital gains on the disposition of appreciated property by reinvesting the gains in a QOF within 180 days of disposition. The tax is deferred until the QOF investment is sold or Dec. 31, 2026, whichever is earlier. Depending on how long they hold their QOF investment, they can eliminate 10% to 15% of the tax. After 10 years, post-acquisition appreciation...

As posted to the Peak Prosperity YouTube Channel on February 2, 2020 (Run time 16 min 00 sec) In Update #11, on the Wuhan New Coronavirus (officially "2019-ncov"), Chris Martenson reports: "The official data on the spread of the Wuhan coronavirus continues to suggest a geometric growth rate. Which explains why more and more infectious disease experts are now openly calling the virus a full-blown global pandemic. It's worth noting at this point that the data we do have, mostly from the Chinese government, is still scant and suspect. Many think the situation is China is worse than is being reported -- potentially much worse. Frustratingly, the Western press seems bent on downplaying the coronavirus threat, many trying to convince us that the standard flu is more dangerous. Which is...

Some fraud schemes refuse to die. Jury duty fraud schemes existed long before phishing, malware and other cybercrime methods became synonymous with identity theft. Yet just this month, the U.S. Marshals Service issued a fraud advisory about this old-school con that’s enjoying a resurgence. Common methods Here’s how jury duty scams work: Perpetrators posing as court officers, U.S. Marshals and other members of law enforcement call unsuspecting victims, warning them that they’re about to be arrested because they haven’t reported for jury duty. When the targets assert they haven’t been notified that they’ve been selected, the scammers ask for information to “verify their records.” The information the scammers want, of course, is a victim’s Social Security number and date of birth. Some go a step further and...

In its 2018 decision in South Dakota v. Wayfair, the U.S. Supreme Court upheld South Dakota’s “economic nexus” statute, expanding the power of states to collect sales tax from remote sellers. Today, nearly every state with a sales tax has enacted a similar law, so if your company does business across state lines, it’s a good idea to reexamine your post-Wayfair sales tax obligations. What’s nexus? A state is constitutionally prohibited from taxing business activities unless those activities have a substantial “nexus,” or connection, with the state. Before Wayfair, simply selling to customers in a state wasn’t enough to establish nexus. The business also had to have a physical presence in the state, such as offices, retail stores, manufacturing or distribution facilities, or sales reps. In Wayfair, the...

As posted to the Peak Prosperity YouTube Channel on February 1, 2020 (Run time 11 min 31 sec) In Update #10, on the Wuhan New Coronavirus (officially "2019-ncov"), Chris Martenson reports: "Late on January 31, 2020, the US officially declared coronavirus a "national health emergency". So they are starting to claim that it's "too late" to do anything to stop the spread of coronavirus. Is it? Even if it's too late to stop it, we may still be able to slow the spread substantially. The latest numbers from China may be offering our first hope of that. At ~12,000 cases, they are our first sign the virus may no longer be spreading at a geometric rate. China's quarantine efforts may be starting to pay off. (Or, we may just...

(This is Blog Post #718)...

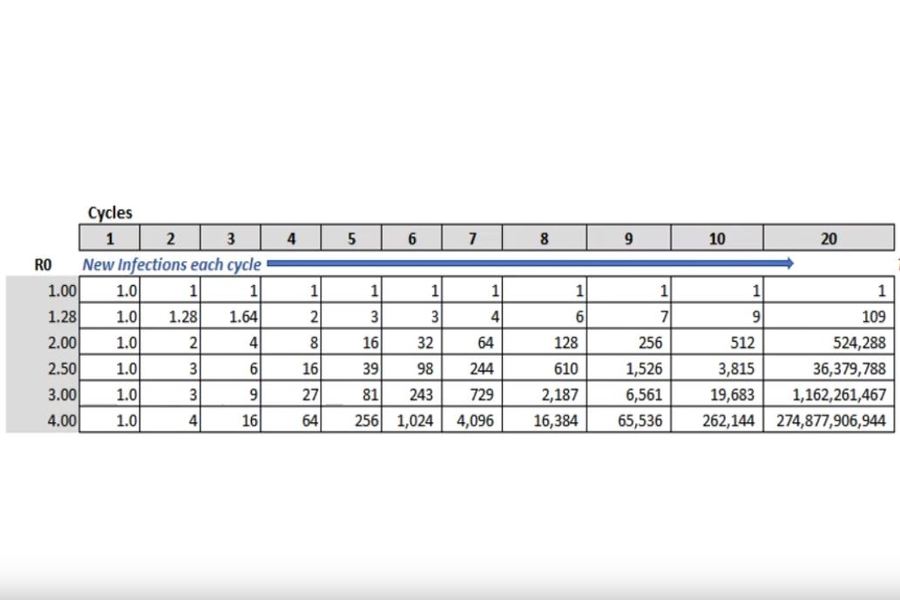

As posted to the Peak Prosperity YouTube Channel on January 31, 2020 (Run time 19 min 27 sec) In Update #9, on the Wuhan New Coronavirus (officially "2019-ncov"), Chris Martenson issues the following alert that he'd hoped not to have to deliver: A new study coming out of China reports that the Wuhan Coronavirus has an Ro of 4.1. That means it's much more contagious than previously feared. If indeed the case, an Ro of 4.1 means there is NO way of stopping this virus from becoming a full-blown global pandemic. This study has not yet had time to be peer-reviewed, so the data may change. But going with the data available *right now* in this fast-developing situation, it is time to start preparing yourself and your loved ones....

(This is Blog Post #716)...

As posted to the Peak Prosperity YouTube Channel on January 30, 2020 (Run time 5 min 33 sec) In Update #8, on the Wuhan New Coronavirus (officially "2019-ncov"), Chris Martenson reports that science journal "The Lancet" just released a study that finds initial evidence that men are substantially more vulnerable to Coronaviruses than women. Chris walks through the science behind the findings, explaining it in simple layman terms. (This is Blog Post #715) Chris Martenson, is a former American biochemical scientist and Vice President of Science Applications International Corporation. Currently he is an author and trend forecaster interested in macro trends regarding the economy, energy composition and the environment at his site, www.peakprosperity.com....

The IRS has issued final regulations that should provide comfort to taxpayers interested in making large gifts under the current gift and estate tax regime. The final regs generally adopt, with some revisions, proposed regs that the IRS released in November 2018 meaning that large gifts now won't hurt post-2025 estates. The need for clarification The Tax Cuts and Jobs Act (TCJA) temporarily doubled the gift and estate tax exemption from $5 million to $10 million for gifts made or estates of decedents dying after 12/31/17, and before 1/1/26. The exemption is adjusted annually for inflation ($11.40 million for 2019 and $11.58 million for 2020). After 2025, though, the exemption is scheduled to drop back to pre-2018 levels. With the estate tax a flat 40%, the higher threshold...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153