Like many sectors of the economy, the healthcare industry regularly suffers data breaches. Healthcare data breaches can threaten your financial well-being. Healthcare analytics company Protenus has found that nearly 32 million patient records were breached between January and June 2019 alone. Alarmed? You should be. However, there are steps you can take to reduce the risk that thieves will get a hold of your medical records and use them for nefarious purposes. Why they’re valuable Unlike other types of personal data, healthcare records command a hefty premium on the black market. That’s at least partly because criminals can potentially use information about an individual’s health to blackmail him or her. Also, stolen medical records include valuable details about people’s identities. In fact, there’s usually enough information in medical files...

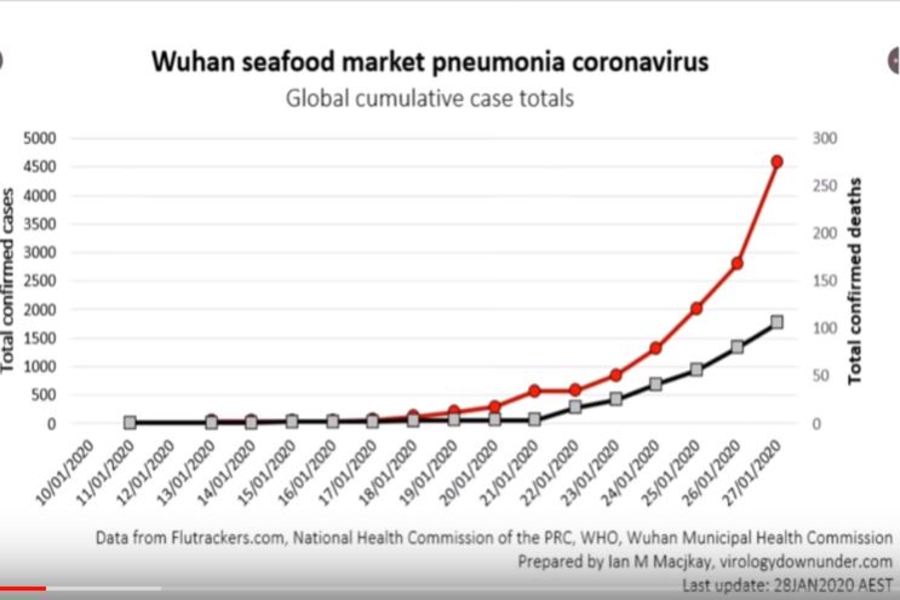

As posted to the Peak Prosperity YouTube Channel on January 28, 2020 (Run time 8 min 30 sec) In Update #5, with regards to the Wuhan New Coronavirus (offially "2019-ncov"), Chris Martenson suggests that the Coronavirus has all the hallmarks of a true Black Swan event. In addition to presenting a major public health risk, the Coronavirus is already doing serious economic damage. China, the world's second-largest economy, is essentially "closed for business" right now. The disruption to global trade the Coronavirus is likely to cause is going to be material, perhaps severe. And that will have serious negative consequences for the financial markets, which have been (and is still!) trading at the highest valuations in history. (This is Blog Post #709) Chris Martenson, is a former American biochemical scientist and...

As posted to the GoldSilver.com YouTube Channel on January 27, 2020 (Run Time: 12 min, 32 sec) On the Coronavirus, Dr. Chris Martenson says, "This is the most serious pandemic risk that we've seen, not since SARS . . . but I think since the Spanish Flu outbreak in 1919.". Join Mike Maloney as he investigates the potential for the Coronavirus outbreak to become a full-blown pandemic. Mike and Chris will discuss the genesis and spread of the Coronavirus and how to prepare yourself. They will also examine how China is reacting to the Coronavirus with lockdowns and quarantines, and how this pandemic may be an economic black swan event. (This is Blog Post #708) Chris Martenson, is a former American biochemical scientist and Vice President of Science Applications International Corporation. ...

As posted to the Peak Prosperity YouTube Channel on January 27, 2020 (Run time 11 min 58 sec) In Update #4, with regards to the Wuhan New Coronavirus (officially "2019-ncov"), Chris Martenson reports that pretty much the entire country of China is in lockdown at this moment which is unbelievable. In addition to the restriction of travel within and across its borders, the Chinese government has begun heavily censoring the data its sharing with the world. Chris calls into question the few statistics they're currently reporting, suspecting the situation is devolving into something much worse than admitted to. (This is Blog Post #707) Chris Martenson, is a former American biochemical scientist and Vice President of Science Applications International Corporation. Currently he is an author and trend forecaster interested in macro trends...

As posted to the Peak Prosperity YouTube Channel on January 26, 2020 (Run time 11 min 45 sec) In Update #3, with regards to the Wuhan New Coronavirus (officially "2019-ncov"), Chris Martenson reports that there are already 2,070 reported cases in China, 37 abroad Deaths: 56 Cured: 49 Human-to-human transmission confirmed Health experts say the virus has the potential to mutate 30 cities and provinces have launched Level 1 emergency response, while Hong Kong declared its "highest" emergency response There is much more important information in this extended video. Please watch and pass along. (This is Blog Post #706) Chris Martenson, is a former American biochemical scientist and Vice President of Science Applications International Corporation. Currently he is an author and trend forecaster interested in macro trends regarding the economy, energy...

Life insurance is an important asset (in the case of whole life policies) that should not overlooked by families. It can also be a powerful financial and estate planning tool, but its benefits can be reduced or even eliminated if you designate the wrong beneficiary or fail to change beneficiaries when your life circumstances change. Common life insurance beneficiary pitfalls to avoid include: (1) Naming your estate as beneficiary Doing so can subject life insurance proceeds to unnecessary state inheritance taxes (in many states), expose the proceeds to your estate’s creditors and ensure that the proceeds will go through probate, which may delay payment to your loved ones. (2) Naming minor children as beneficiaries Insurance companies won’t pay life insurance proceeds directly to minors, which means a court-appointed guardian...

If you’re adopting a child, or you adopted one this year, there may be adoption related tax savings available to offset the expenses. For 2019, adoptive parents may be able to claim a nonrefundable credit against their federal tax for up to $14,080 of “qualified adoption expenses” for each adopted child. (This amount is increasing to $14,300 for 2020.) That’s a dollar-for-dollar reduction of tax — the equivalent, for someone in the 24% marginal tax bracket, of a deduction of over $50,000. Adoptive parents may also be able to exclude from their gross income up to $14,080 for 2019 ($14,300 for 2020) of qualified adoption expenses paid by an employer under an adoption assistance program. Both the credit and the exclusion are phased out if the...

You may suspect that an employee has stolen from your company. But without evidence of a crime, you’ll have a hard time pursuing prosecution. So if you discover a fraud, first call your attorney. Then take immediate steps to preserve the evidence. Safeguard paper documents Place any hard documents related to the possible fraud in a safe location that’s accessible only to key people. The fewer who handle it, the better. Don’t make notes on any paper documents and, unless necessary, don’t let them be handled. Instead, make separate notations about when and where they were found and how you preserved them. A court case can be derailed if you don’t preserve the chain of evidence and can’t prove to a judge’s satisfaction that the documents haven’t...

With the lifetime gift and estate tax exemption at $11.40 million for 2019 ($11.58 million for 2020), you may think you don’t have to worry about gift and estate taxes. However, there are no guarantees that estate tax law won’t be revised in the future or that your accumulated assets won’t eventually exceed the available exemption (which is scheduled to drop significantly in 2026). Thus, there’s a need to investigate other tax-saving possibilities. Beyond annual exclusion gifts Under the annual gift tax exclusion, you can reduce your taxable estate without using up any of your lifetime exemption by giving each recipient gifts valued up to $15,000 a year. For example, if you have three children and seven grandchildren, you can give each one $15,000 tax free, for a...

Preventing fraud from costing your company can sometimes seem like a game of whack-a-mole: Squash one scheme and another one pops up. Business service scams are particularly abundant. Fraud perpetrators know that business owners don’t always have time to verify the identities of salespeople or service reps and the legitimacy of their claims. Your best defense is to refuse to pay anyone anything until you’ve ascertained the facts. It also helps to know what schemes are popular with criminals. Here are 5 business service scams to watch out for. (1) Utility Bill Fraudsters Someone claiming to be from your gas, electric or water company may call and say services are about to be cut off for non-payment. However, you can stop the discontinuation if you immediately pay the...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151