In its 2018 decision in South Dakota v. Wayfair, the U.S. Supreme Court upheld South Dakota’s “economic nexus” statute, expanding the power of states to collect sales tax from remote sellers. Today, nearly every state with a sales tax has enacted a similar law, so if your company does business across state lines, it’s a good idea to reexamine your post-Wayfair sales tax obligations. What’s nexus? A state is constitutionally prohibited from taxing business activities unless those activities have a substantial “nexus,” or connection, with the state. Before Wayfair, simply selling to customers in a state wasn’t enough to establish nexus. The business also had to have a physical presence in the state, such as offices, retail stores, manufacturing or distribution facilities, or sales reps. In Wayfair, the...

As posted to the Peak Prosperity YouTube Channel on February 1, 2020 (Run time 11 min 31 sec) In Update #10, on the Wuhan New Coronavirus (officially "2019-ncov"), Chris Martenson reports: "Late on January 31, 2020, the US officially declared coronavirus a "national health emergency". So they are starting to claim that it's "too late" to do anything to stop the spread of coronavirus. Is it? Even if it's too late to stop it, we may still be able to slow the spread substantially. The latest numbers from China may be offering our first hope of that. At ~12,000 cases, they are our first sign the virus may no longer be spreading at a geometric rate. China's quarantine efforts may be starting to pay off. (Or, we may just...

(This is Blog Post #718)...

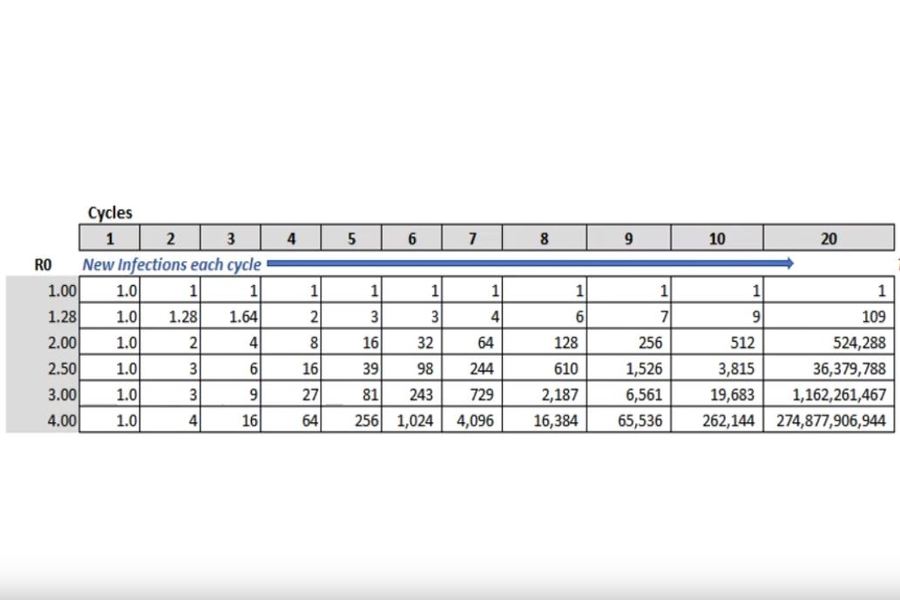

As posted to the Peak Prosperity YouTube Channel on January 31, 2020 (Run time 19 min 27 sec) In Update #9, on the Wuhan New Coronavirus (officially "2019-ncov"), Chris Martenson issues the following alert that he'd hoped not to have to deliver: A new study coming out of China reports that the Wuhan Coronavirus has an Ro of 4.1. That means it's much more contagious than previously feared. If indeed the case, an Ro of 4.1 means there is NO way of stopping this virus from becoming a full-blown global pandemic. This study has not yet had time to be peer-reviewed, so the data may change. But going with the data available *right now* in this fast-developing situation, it is time to start preparing yourself and your loved ones....

(This is Blog Post #716)...

As posted to the Peak Prosperity YouTube Channel on January 30, 2020 (Run time 5 min 33 sec) In Update #8, on the Wuhan New Coronavirus (officially "2019-ncov"), Chris Martenson reports that science journal "The Lancet" just released a study that finds initial evidence that men are substantially more vulnerable to Coronaviruses than women. Chris walks through the science behind the findings, explaining it in simple layman terms. (This is Blog Post #715) Chris Martenson, is a former American biochemical scientist and Vice President of Science Applications International Corporation. Currently he is an author and trend forecaster interested in macro trends regarding the economy, energy composition and the environment at his site, www.peakprosperity.com....

The IRS has issued final regulations that should provide comfort to taxpayers interested in making large gifts under the current gift and estate tax regime. The final regs generally adopt, with some revisions, proposed regs that the IRS released in November 2018 meaning that large gifts now won't hurt post-2025 estates. The need for clarification The Tax Cuts and Jobs Act (TCJA) temporarily doubled the gift and estate tax exemption from $5 million to $10 million for gifts made or estates of decedents dying after 12/31/17, and before 1/1/26. The exemption is adjusted annually for inflation ($11.40 million for 2019 and $11.58 million for 2020). After 2025, though, the exemption is scheduled to drop back to pre-2018 levels. With the estate tax a flat 40%, the higher threshold...

As posted to the Peak Prosperity YouTube Channel on January 30, 2020 (Run time 15 min 23 sec) In Update #7, on the Wuhan New Coronavirus (officially "2019-ncov"), Chris Martenson reports that on 1/30/2020 the World Health Organization (WHO) declared that the Wuhan Coronavirus is indeed now a pandemic. If that's not scary enough, the WHO then proceeded to downplay the risk to public health and went to great lengths to make it clear it doesn't recommend placing restrictions on global trade & travel at this time . . . when we may be in dealing with a viral outbreak as (or more) virulent than the Spanish Flu (aka The Great Influenza). "This is nothing less than a political decision to keep business/commerce flowing without regard to public health....

The number of people engaged in the “gig” or sharing economy has grown in recent years, according to a 2019 IRS report. But what are the tax implications of your side gig? I'm talking about people who perform these jobs, such as providing car rides, renting spare bedrooms, delivering food, walking dogs or providing other services. Basically, if you receive income from one of the online platforms offering goods and services, it’s generally taxable. That’s true even if the income comes from a side job and even if you don’t receive an income statement reporting the amount of money you made. IRS report details The IRS recently released a report examining two decades of tax returns and titled “Is Gig Work Replacing Traditional Employment?” It found that “alternative,...

As posted to the Peak Prosperity YouTube Channel on January 29, 2020 (Run time 10 min 48 sec) In Update #6, on the Wuhan New Coronavirus (officially "2019-ncov"), Chris Martenson reports that the sudden lack of new information coming out of China is suspect. In this update, Chris walks us through the math here, showing how if the Coronavirus follows its current geometric growth, over 100 million people could be infected by the end of February. Don't take today's lack of 'news' as meaning the threat from this virus is dying down. This is very likely just the calm before the storm. (This is Blog Post #711) Chris Martenson, is a former American biochemical scientist and Vice President of Science Applications International Corporation. Currently he is an author and trend...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151