(This is Blog Post #753)...

This year, the optional 2020 business mileage rates used to calculate the deductible costs of operating an automobile for business decreased by one-half cent, to 57.5¢ per mile. As a result, you might claim a lower deduction for vehicle-related expense for 2020 than you could for 2019. Calculating your deduction Businesses can generally deduct the actual expenses attributable to business use of vehicles. This includes gas, oil, tires, insurance, repairs, licenses and vehicle registration fees. In addition, you can claim a depreciation allowance for the vehicle. However, in many cases depreciation write-offs on vehicles are subject to certain limits that don’t apply to other types of business assets. The cents-per-mile rate comes into play if you don’t want to keep track of actual vehicle-related expenses. With this approach,...

As posted to the Peak Prosperity YouTube Channel on February 19, 2020 (Run time: 35 min 32 sec) In Update #26, on the Wuhan New Coronavirus (now officially "Covid-19"), Chris Martenson reports: "The world is now watching closely to see if the Coronavirus is indeed poised to accelerate outside of China. In yesterday's video, we warned that the coming two weeks will be crucial in determining how bad the pandemic will be. The early results are not encouraging. New cases continue to climb in the rest of Asia -- Japan, Korea and Singapore are being hit hardest. And now we have the first two cases (and two deaths!) reported in Iran. That's on top of last week's confirmed case in Africa. So now the virus is on every continent...

A Small Business Administration (SBA) loan can make big things happen for your small company. But the agency’s loan program is sometimes abused by con artists who know that many small business owners have little experience applying for financing and are, therefore, vulnerable to scams. Here’s what you should know when applying for an SBA Loan. Applying for an SBA loan: Background on SBA products The SBA provides various financing options with favorable terms and greater flexibility to small businesses and start-ups. It doesn’t disburse loans directly but gives lenders federal guarantees and backing to reduce lending risk. Individual businesses must themselves make arrangements with financial institutions that make loans. Three key SBA programs are: 1. SBA 7(a) loans. This is the flagship product. It typically frees up working...

As posted to the Peak Prosperity YouTube Channel on February 18, 2020 (Run time 25 min 53 sec) In Update #25, on the Wuhan New Coronavirus (now officially "Covid-19"), Chris Martenson reports: "While China remains largely in lock down, Covid-19 cases in the rest of the world are at a key juncture. To-date, confirmed cases have been lower than feared. Though increasingly, we're suspecting that's due to inadequate testing & reporting. And the cases we *do* know of (now at ~1,000) appear to be growing at an exponential rate. So the next two weeks will be critical in telling the tale. We'll soon know whether the spread is indeed slower than initially feared, or we'll start to see huge increases in the number of infected ex-China. Meanwhile, the authorities around...

As posted to the Peak Prosperity YouTube Channel on February 17, 2020 (Run time 39 min 33 sec) In Update #24, on the Wuhan New Coronavirus (now officially "Covid-19"), Chris Martenson reports: "Good updates on the Wuhan Coronavirus pandemic (aka Covid-19) are becoming harder to obtain as governments tighten their grip on news sources. The data being shared, particularly by the Chinese are increasingly hard to believe, as they don't match the massive response the government is undertaking. Likewise, outside of China, reported cases remain lower than we would expect given the powerful R0 (i.e., infectiousness) of the virus, as well as its long asymptomatic incubation period. Are we being intentionally kept in the dark? Quite possibly. Chris walks through the possible reasons why, and points to the stock markets...

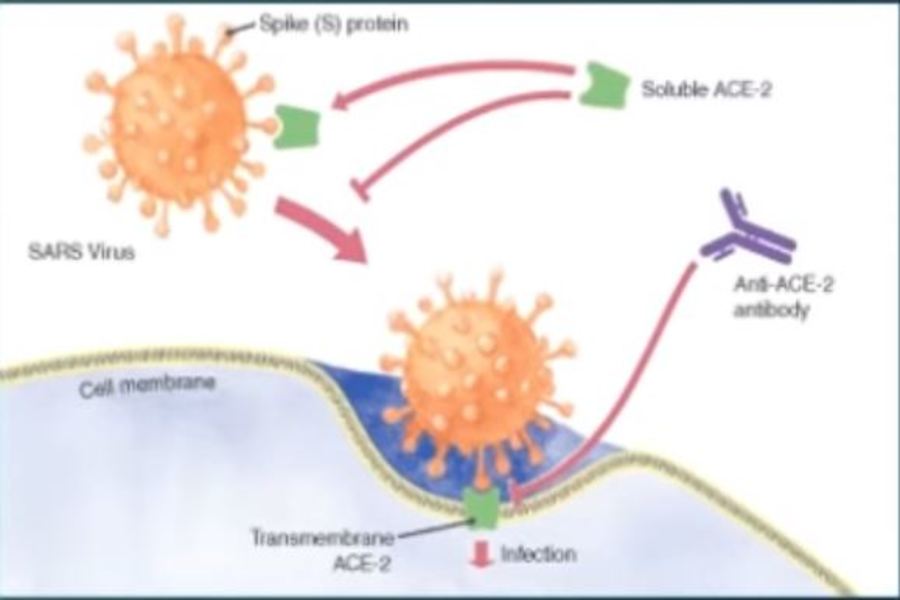

As posted to the Peak Prosperity YouTube Channel on February 15, 2020 (Run time 19 min 39 sec) In Update #23, on the Wuhan New Coronavirus (now officially "Covid-19"), Chris Martenson reports: "Finally, some good news? While the Coronavirus continues its spread throughout China and elsewhere in the world (we now have the first confirmed case in Africa), we are hearing about an encouraging development on the treatment front. Chinese hospitals are reporting success treating severely sick patients with the blood plasma of those who have recently recovered. At least 11 patients treated this way went from 'critically ill' to much improved in just 24 hours. This is not an uncommon form of treatment, so it's a process the medical establishment knows how to successfully replicate. The big questions now...

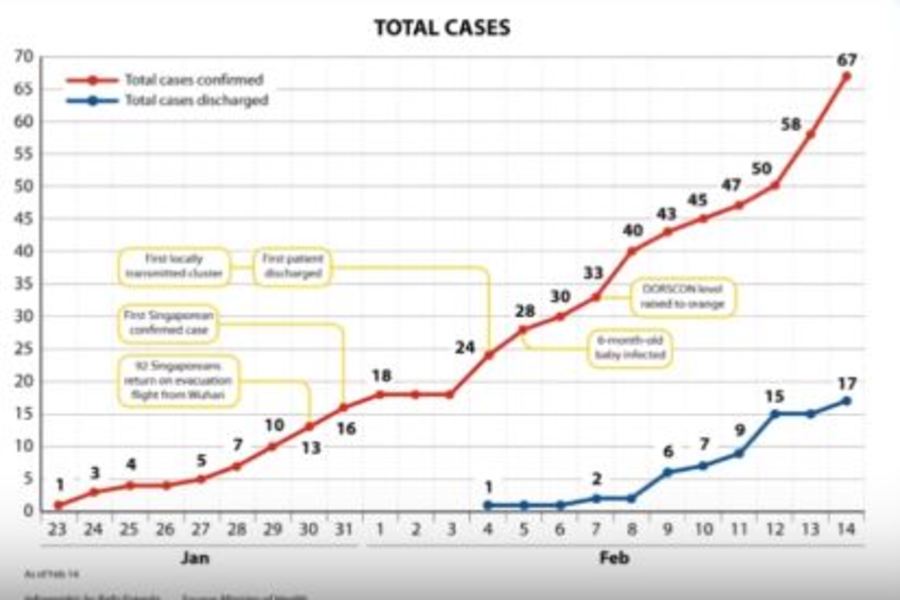

As posted to the Peak Prosperity YouTube Channel on February 14, 2020 (Run time 35 min 05 sec) In Update #22, on the Wuhan New Coronavirus (now officially "Covid-19"), Chris Martenson reports: "While China is ground zero for this epidemic, Japan is now experiencing a bloom of coronavirus cases. With nearly 40 known people now infected, Japanese officials fear that a 'silent outbreak' is underway and that many more people are catching and spreading the disease. Most of the new cases are of people with no connection to China, signaling that the virus has now gained a foothold in the local population. In other breaking news, not only does it seem that it's possible to contract the virus more than once, but if you do, the second time can be...

The IRS opened the 2019 individual income tax return filing season on January 27. Even if you typically don’t file until much closer to the April 15 deadline (or you file for an extension), consider filing your taxes early this year. The reason: You can potentially protect yourself from tax identity theft — and you may obtain other benefits, too. Tax identity theft explained and how filing your taxes early can help In a tax identity theft scam, a thief uses another individual’s personal information to file a fraudulent tax return early in the filing season and claim a bogus refund. The legitimate taxpayer discovers the fraud when he or she files a return and is informed by the IRS that the return has been rejected because one...

As posted to the Peak Prosperity YouTube Channel on February 13, 2020 (Run time 19 min 26 sec) In Update #21, on the Wuhan New Coronavirus (now officially "Covid-19"), Chris Martenson reports: ". . . the scientific research on covid-19 (the new name of the Wuhan Coronavirus) continues to reveal what a huge challenge containing this virus is. A new report from Los Alamos Labs calculates its R0 at between 4.7 to 6.6. That is massively contagious! It's little wonder then why we're seeing more and more reports of doctors and health workers falling sick, despite using proper PPE and contamination protocol. China, which bumped up the number of total infected within the country by 33% last night, is clearly facing a public health nightmare of epic proportion. As...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153